Canva

Lifestyle creep, also known as lifestyle inflation, is a sneaky phenomenon where your spending increases as your income grows. It’s an issue many people face, often without realizing it. In this article, we’ll explore ten signs that you’re falling victim to lifestyle creep and provide practical tips on how to curb it. Recognizing these signs early can help you maintain financial stability and avoid unnecessary debt.

1. You’re Constantly Upgrading Your Gadgets

One clear sign of lifestyle creep is the constant need to upgrade your gadgets. Whether it’s the latest smartphone, tablet, or laptop, you find yourself regularly buying new technology. While it’s tempting to have the newest features, these upgrades can quickly add up. This habit not only strains your budget but also fuels a cycle of ever-increasing spending. To counteract this, focus on using your current devices for longer and only replace them when absolutely necessary.

2. Dining Out Becomes a Regular Habit

If dining out is becoming a frequent occurrence, you might be experiencing lifestyle creep. Eating at restaurants or ordering takeout more often than before can signal an increase in discretionary spending. This habit can significantly impact your monthly budget and contribute to financial strain. To combat this, try setting a dining-out limit each month and prioritize cooking at home. This approach not only saves money but also promotes healthier eating habits.

3. You’re Accumulating Unnecessary Subscriptions

Another sign of lifestyle creep is the accumulation of unnecessary subscriptions. From streaming services to premium memberships, these recurring expenses can easily go unnoticed. Over time, they can add up and impact your financial health. Review your subscriptions regularly and cancel those you no longer use or need. By keeping only essential services, you can better manage your budget and avoid wasted spending.

4. You’re Living Paycheck to Paycheck

Canva

Living paycheck to paycheck, despite a higher income, is a significant indicator of lifestyle creep. If you find yourself struggling to save or manage your finances even with a decent salary, it’s a red flag. This situation often results from increased spending on non-essential items. Create a detailed budget to track your expenses and prioritize saving. Building an emergency fund and automating savings can also help you regain control of your finances.

5. You’re Increasingly Indulging in Luxuries

Indulging in luxuries like designer clothes, high-end accessories, or extravagant vacations is another sign of lifestyle creep. While occasional treats are fine, frequent indulgences can lead to financial instability. It’s important to differentiate between wants and needs and set limits on luxury spending. Establishing financial goals and sticking to a budget can help curb unnecessary luxury expenses. Remember, financial security should take precedence over fleeting pleasures.

6. Your Housing Expenses Have Increased

A common manifestation of lifestyle creep is an increase in housing expenses. If you’ve recently moved into a larger home or upgraded to a more expensive apartment, your housing costs may be eating up a larger portion of your income. Evaluate whether the increase in housing expenses is necessary or if you’re stretching your budget too thin. Consider downsizing or finding more cost-effective housing options if needed. Maintaining a manageable housing budget is crucial for long-term financial health.

7. You’re Frequently Taking On New Debts

Frequent new debts, such as credit card balances or loans, can signal lifestyle creep. If you’re regularly using credit to finance lifestyle upgrades, it’s a warning sign of unsustainable spending. High-interest debt can quickly become overwhelming and impede your financial goals. Focus on paying off existing debts and avoid taking on new ones for non-essential items. Budgeting and financial planning can help you stay debt-free and achieve financial stability.

8. You’re Overlooking Your Savings Goals

Canva

If you’re neglecting your savings goals in favor of spending, you might be experiencing lifestyle creep. Prioritizing immediate gratification over long-term financial goals can hinder your progress. Ensure that saving for retirement, emergencies, and other financial goals remains a priority. Automate your savings contributions to make it easier to stick to your goals. Regularly review your financial plan to stay on track and avoid compromising your future financial security.

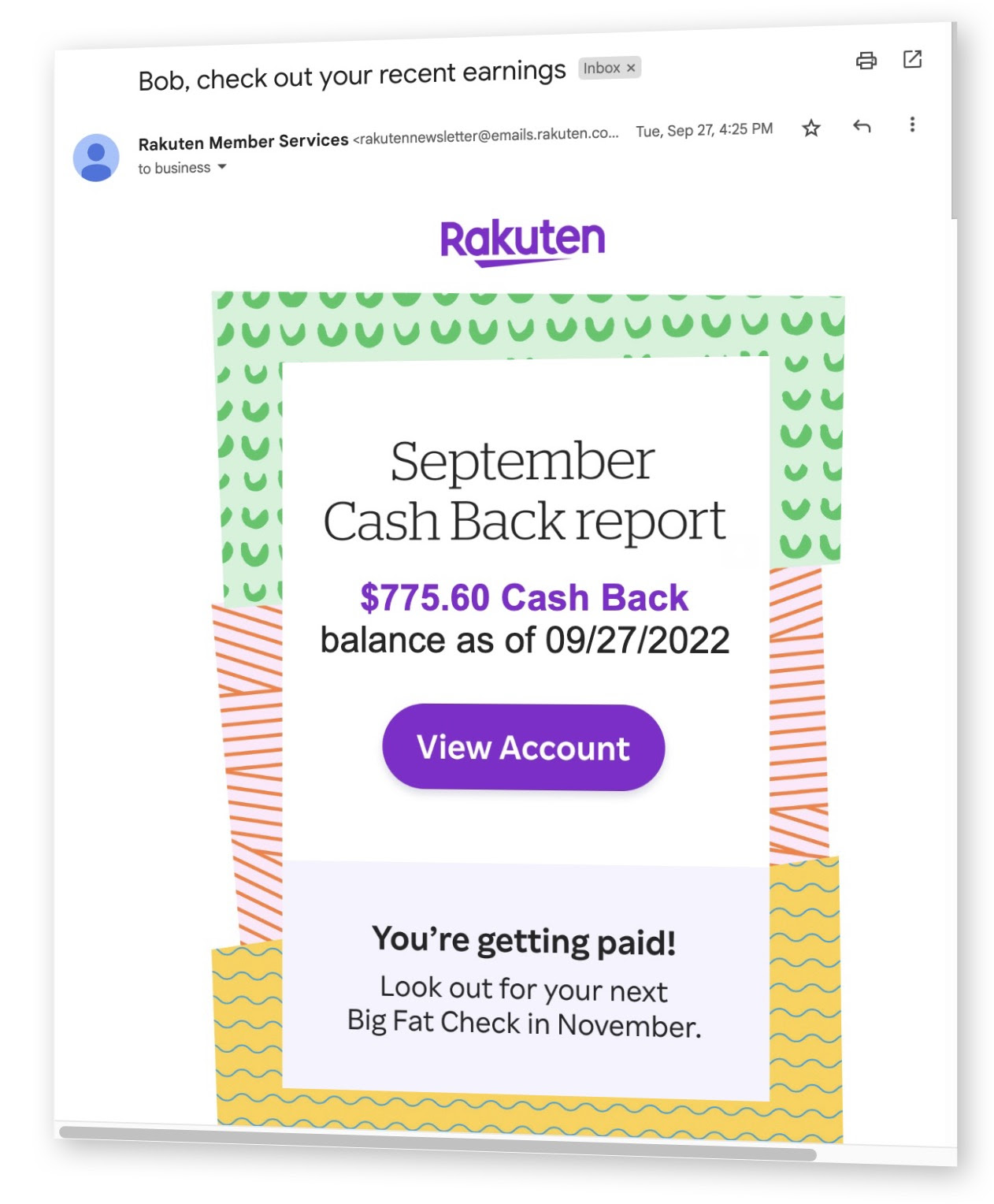

9. Your Spending Is Outpacing Your Income

When your spending starts to outpace your income, it’s a clear sign of lifestyle creep. If you’re consistently spending more than you earn, even with a higher salary, it indicates unsustainable financial behavior. Track your income and expenses to identify areas where you’re overspending. Adjust your budget to ensure that spending aligns with your income. Developing disciplined financial habits can help prevent overspending and maintain financial health.

10. You’re Neglecting Budgeting and Financial Planning

Finally, neglecting budgeting and financial planning is a major indicator of lifestyle creep. If you’re no longer tracking your expenses or creating a budget, it’s easy to fall into the trap of increased spending. Establish a regular budgeting routine and set financial goals to keep your spending in check. Use financial planning tools or apps to monitor your progress and make informed decisions. Staying organized and proactive with your finances can prevent lifestyle creep and promote long-term financial success.

Take Control and Curb Lifestyle Creep

Recognizing the signs of lifestyle creep is the first step toward regaining control of your finances. By being aware of these indicators and implementing practical solutions, you can stop lifestyle creep in its tracks. Focus on maintaining a balanced budget, prioritizing savings, and making mindful spending choices. Taking proactive steps to manage your finances will help you achieve long-term financial stability and avoid the pitfalls of lifestyle inflation.

The post 10 Signs You’re Falling Victim to Lifestyle Creep And How to Stop It! appeared first on The Free Financial Advisor.

Discussion about this post