In January 2019, a dam holding mine waste in Brazil collapsed into a raging torrent of nine million cubic metres of tailings, killing 270 people in the town of Brumadinho. The dam was part of the operation of the Córrego do Feijão iron ore mine owned by Brazilian mining giant, Vale.

That disaster was a massive wake-up call to an industry that had for decades been under pressure to clean up its environmental and safety act. One of many initiatives to emerge was a Global Standard of Tailings Management (the Standard) developed by the International Council on Mining and Metals (ICMM), the United Nations Environment Programme and the UN-linked Principles for Responsible Investment.

“The Standard has made tailings dams a focus for the entire global industry, rather than just a few companies. This has put responsible management of tailings on the agenda of executives and boards in a way that rarely happened before. This is having an impact,” ICMM CEO Rohitesh Dhawan and COO Aidan Davy recently said on the group’s website.

As of January 2022, 79 companies (including ICMM’s 26 members) have committed to implementing the Standard.

“Although the Standard is voluntary, there are consequences for ignoring it. For example, the Church of England Pension Board, managing about £4-billion in assets, has said it will vote against the Chairs of companies that have not committed to implement the Standard.”

The CoE Pension Board also helped nudge Anglo American to shed its South African coal assets.

All of this is tapping into the current corporate zeitgeist with its focus on ESGs — environmental, social and governance issues.

The upshot is that the construction and maintenance of tailings dams — which store the byproducts of mining operations — are being closely monitored, and any company that has a disaster on its hands will pay a steep price. Vale has paid $7-billion in compensation to the communities affected by the 2019 incident in Brazil and its legal woes are not over.

Jagersfontein Developments

This brings us to the Jagersfontein diamond mine and its tailings dam, which killed at least one person and displaced scores of others when its wall burst.

A few things stand out. For one, the company is unlisted and does not belong to a wider professional association such as the ICMM or the Minerals Council South Africa. Such memberships are not immediate badges of transparency, but signing up to membership compacts and the like — even if they are not zealously enforced or vaguely worded — confers a level of credibility to a company.

Virtually all the companies that have signed up to the Standard will belong to such associations or will be publicly listed. Jagersfontein Developments is neither, and its ownership structure is opaque, with beneficial ownership apparently somewhere in Dubai. This correspondent couldn’t even find a website for it. It is a former Anglo asset.

“If listed companies are bad, then unlisted companies like Jagersfontein Developments are much worse. They are not members of the Minerals Council or listed on a stock exchange. Unlisted mining companies need not disclose anything at all on an ongoing or consistent period to period basis,” Paul Miller, director of consultancy AmaranthCX, told Business Maverick.

‘Information black holes’

Miller said that “both government and business in SA are information and disclosure black holes. The Minerals Council does not enforce its own much vaunted Membership Compact which has, as Guiding Principle 10, that members must ‘implement effective and transparent engagement, communication and independently verified reporting arrangements with their stakeholders’.

“Mining companies very quickly call in the lawyers to defend their information and generally provide the least possible amount of data to the public,” said Miller.

“Listed companies produce meaningless multiple hundred-page books of data, typeset, wordsmithed and designed in London and New York, but local community members don’t get anything useful at the local level. Each mine needs to have full and ongoing disclosure of their licences, environmental reporting and performance and social and labour plans on a mine-by-mine basis… in a digital world, this is not too hard to expect.”

Relief fund

The Minerals Council, to its credit, has launched a Jagersfontein Relief Fund for those affected by the disaster.

“While the owners of the Jagersfontein assets are not Minerals Council members, the Council sent a senior technical team to the site on Monday to assess the damage and establish what the industry could do to assist families and the affected communities,” the council said in a statement on Wednesday.

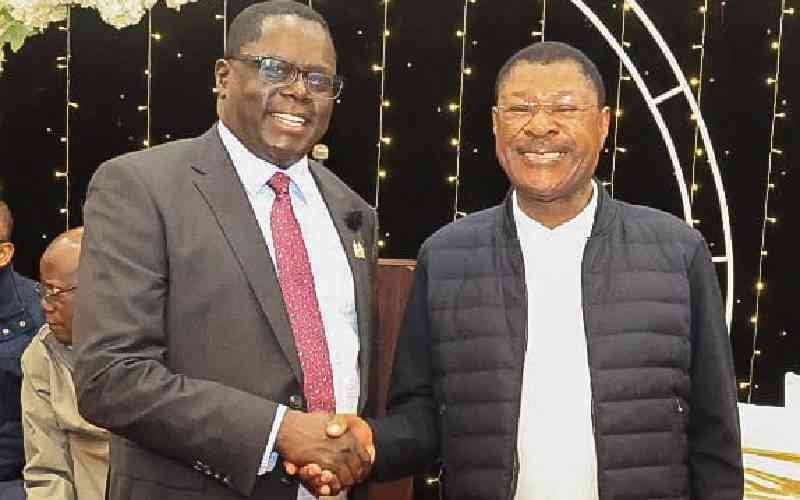

“Council president, Ms Nolitha Fakude, visited the site on Tuesday with [Mineral Resources] Minister Mantashe to gain first-hand insight into the tragedy and to guide the Minerals Council’s relief efforts.”

Visit Daily Maverick’s home page for more news, analysis and investigations

Meanwhile, the blame game is in full swing.

Mantashe says a high court judgment from 2009 that left the Department of Mineral Resources and Energy without jurisdiction over all tailings dams — including the one in Jagersfontein — was a dangerous mistake.

Read more in Daily Maverick: “Mantashe says ‘dangerous’ high court judgment crippled his department’s jurisdiction over all tailings dams”

But the DMRE has its own governance and capacity issues. Over the past few years, it has screwed up everything in its portfolio, resulting in massive bottlenecks for permitting and allowing toxic legacies to remain unaddressed. Its ongoing failure to rehabilitate derelict and ownerless mines is a huge health and safety threat to mine communities.

Read more in Daily Maverick: “DMRE’s failure to rehabilitate abandoned mines poses health risks to communities”

There have been red lights flashing at Jagersfontein before. Reuters reported that the tailings dam was shut down in 2020 because of high water levels, but then allowed to reopen in 2021.

Investigators will hopefully get to the bottom of the technical reasons behind the catastrophe. Perhaps excessive rains linked to La Niña were a factor.

Meanwhile, the global industry is cleaning up its act when it comes to tailings dams, and the hope is that such events will remain rare. DM/BM

Discussion about this post