Rep. Lloyd Doggett (D-TX) of the House Ways and Means Committee said that Trump’s tax returns suggest that he had tens of millions of dollars in unsubstantiated claims.

Video:

Rep. Doggett said on CNN, “I think you will see tens of millions of dollars in these returns that were claimed without adequate substantiation. The extent to which the IRS made an effort to get that substantiation, I invite you to look at the reports. But I think you’ll be surprised by how little there is, and I have my doubts that another taxpayer could go into audit and provide as little as was provided here and expect to have a completed audit. “

Doggett was suggesting that Trump claimed tens of millions of dollars in losses that were not real, which is a form of tax fraud. Trump has a documented history of inflating his assets to get loans and deflating those same assets to avoid paying taxes.

If Trump was lying to the IRS and taking losses that were not real to avoid payment or get a refund, that is tax fraud.

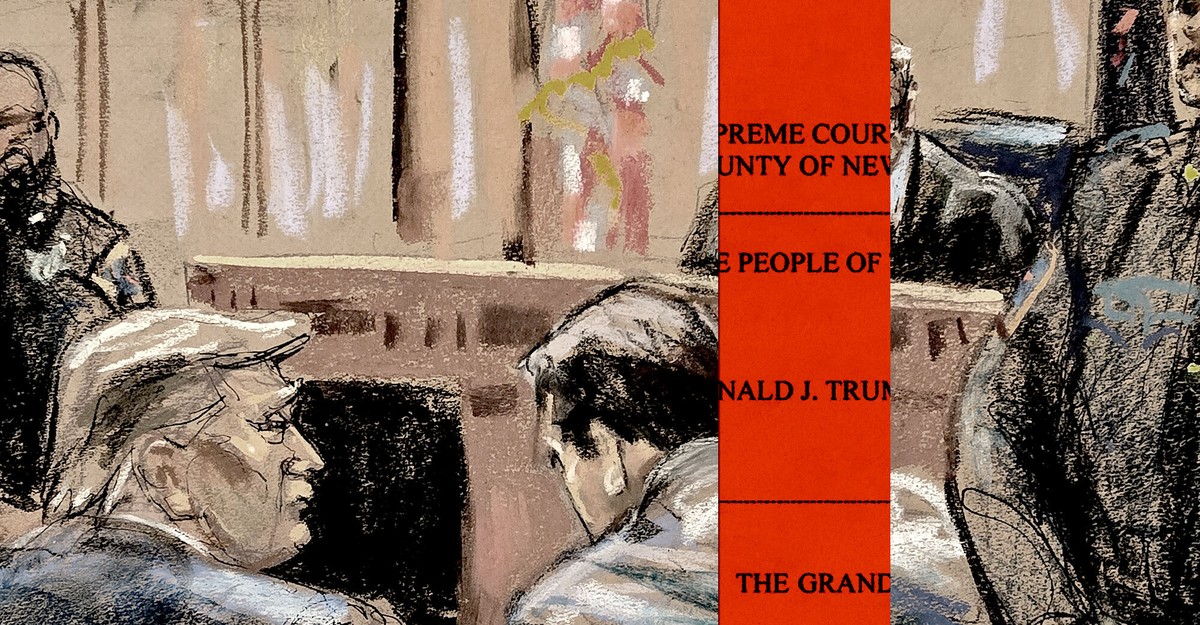

The state of New York appears to have Trump’s business dead to rights to tax fraud, but the tax returns may find that Donald Trump committed federal tax fraud.

Trump may have been hiding his tax returns because they contained evidence of illegal activity, and there will be intense pressure on the IRS to investigate and potentially have Trump prosecuted if he committed tax fraud.

Jason is the managing editor. He is also a White House Press Pool and a Congressional correspondent for PoliticusUSA. Jason has a Bachelor’s Degree in Political Science. His graduate work focused on public policy, with a specialization in social reform movements.

Awards and Professional Memberships

Member of the Society of Professional Journalists and The American Political Science Association

Discussion about this post