Technology is central to the country’s sustainability agenda. Malaysia’s commercial hub, Kuala Lumpur, has rolled out a smart city plan, which includes accelerating digital transformation by focusing on education and promoting cloud technologies and artificial intelligence (AI), among other areas. The Malaysian government has also emphasized technology investment in its Budget 2022, with up to MYR 100 million (US$ 23.7 million) in grants for areas such as smart automation and at least MYR 30 billion (US$ 7 billion) for government-linked companies investing in renewable energy, supply-chain modernization, and 5G infrastructure.

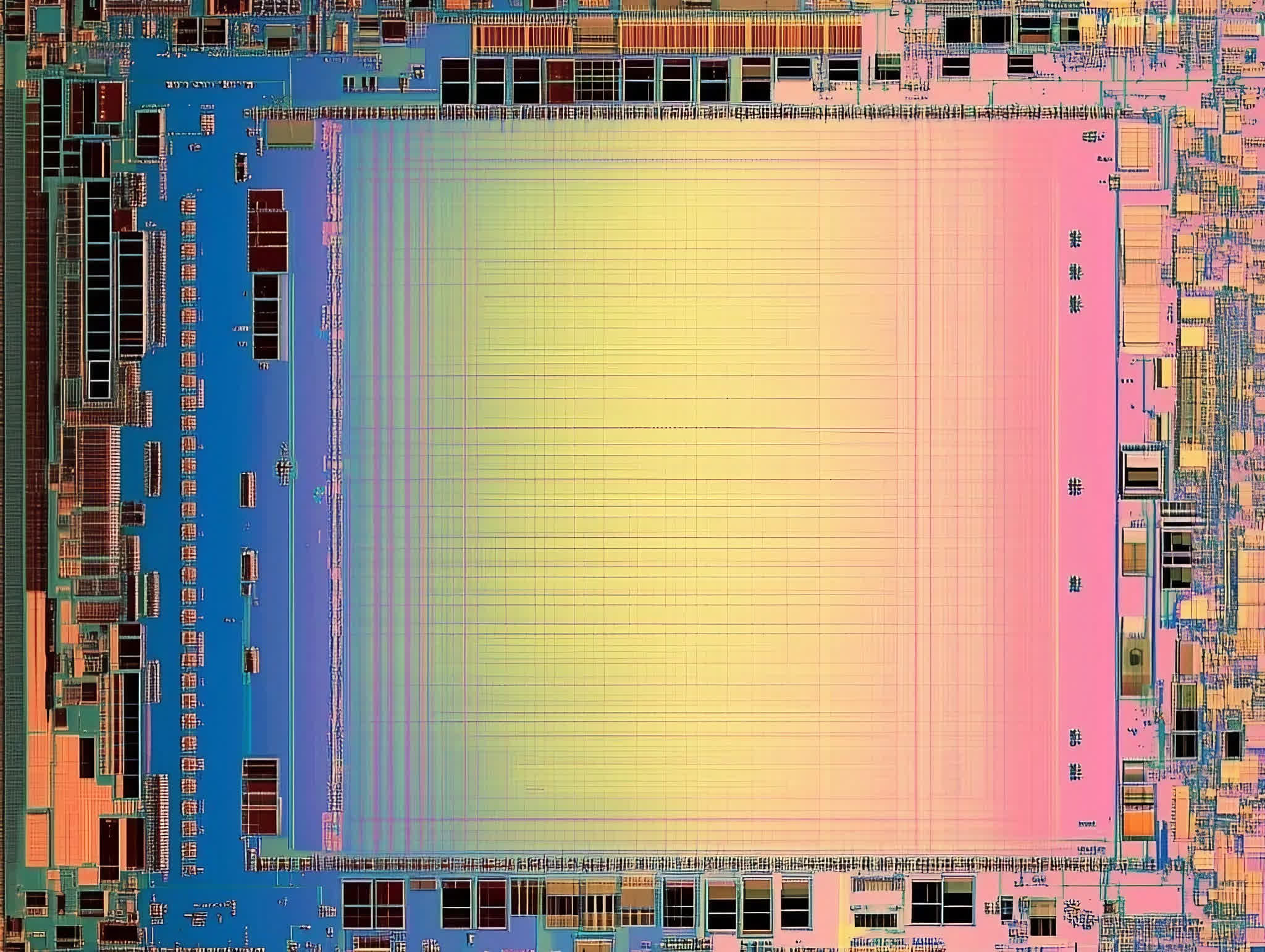

In recent years, Kuala Lumpur has also seen an increasing number of “greening” opportunities. For instance, the city governance has employed a smart “City Brain”, which uses Alibaba Cloud’s computing systems to optimize services like traffic control and even calculate the best routes for emergency services. International technology and mobility companies such as Microsoft and Korea-based Socar, which are eyeing green innovation and business opportunities, have also invested and expanded their operations in Kuala Lumpur. At the same time, traditional industries, in particular energy and electronics, have been trying to reinvent themselves.

In light of this shifting environment, this report explores what global companies in Greater Kuala Lumpur are doing to achieve their ESG targets, the opportunities the location has to offer, and how their local experiences could be applied globally.

The key findings of this report are:

Malaysia is committed to becoming a regional decarbonization leader. The country’s current master plan that charts its economic development through 2025 includes numerous programs aimed at advancing sustainability by increasing renewable energy-generation capabilities, developing green mobility solutions, and building sustainable and resilient cities. This sustainability commitment comes even as the country continues to derive economic growth from traditionally carbon-intensive industries, such as oil and gas development, energy production, and agriculture. Yet, while some countries’ reliance on fossil fuels and other traditional industries weighs on their decarbonization commitments, Malaysia uses its deep, globally integrated industry clusters and supply chains to develop new, greener business processes and less carbon-intensive manufacturing and logistics processes.

Greater Kuala Lumpur has seen an increasing number of “greening” opportunities for some of the country’s traditional innovation clusters, in particular energy, electronics manufacturing, IT outsourcing, and other digital economy sectors. Asia’s fast-growing digital economies have also created unique synergies for digitally “native” firms that are looking to use Kuala Lumpur as a hub from which they can tap green business opportunities in the region. These include Korean green mobility firm Socar, which is expanding its “people-to-people” ridesharing model across Southeast Asia from its Kuala Lumpur base. And Schlumberger, which has one of seven global “Innovation Factori” centers in Kuala Lumpur. The center works to accelerate the adoption of its AI for boosting energy transition efforts in East Asia.

Malaysia’s maturing sustainability stance is creating a culture of monitoring, measurement and, ultimately, accountability. This can serve as a framework for ESG-minded firms to chart their own journeys. Such efforts are far from cosmetic, they are essential to a market’s economic prospects. Global, sustainability-oriented firms can both achieve their ESG targets through their Greater Kuala Lumpur operations and use their Malaysian experience as a template for sustainable innovation in their global operations. Malaysia’s role as a global sustainability hub is critical, as its economy uniquely straddles many industry sectors, including high technology and energy production, which are pivotal in shifting the world’s development toward a low-carbon future. Collaboration and communication are essential to these efforts.

This content was produced by Insights, the custom content arm of MIT Technology Review. It was not written by MIT Technology Review’s editorial staff.

Discussion about this post