Today’s Animal Spirits is brought to you by YCharts:

See here to get 20% off your initial YCharts subscription for new customers.

See here to register for the Future Proof Retreat in March!

On today’s show, we discuss:

Listen here:

Recommendations:

Charts:

Tweets:

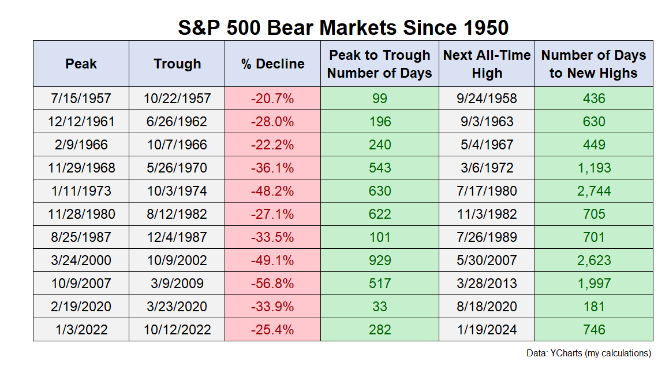

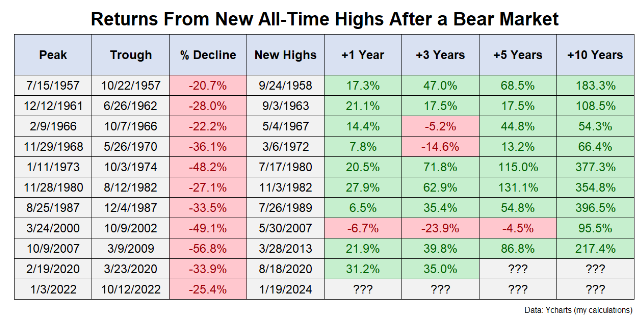

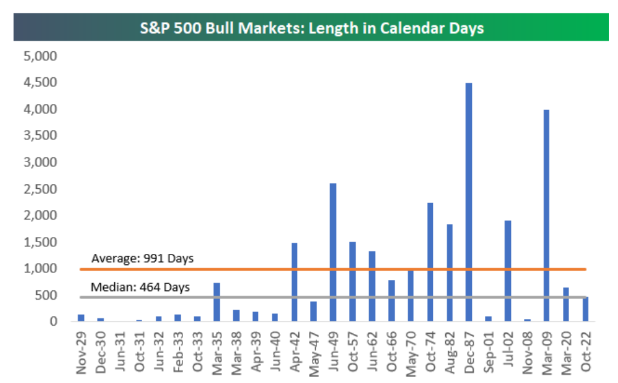

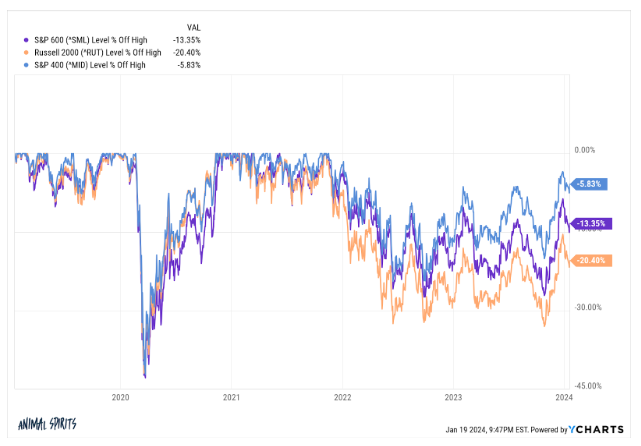

The S&P 500 closed at an all-time high.

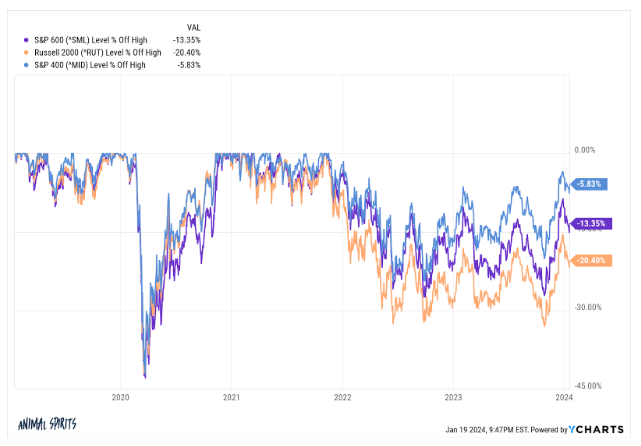

The Russell 2000 is still in a bear market*, down more than 20% from its high.

That’s never happened before. pic.twitter.com/ZB5vUAhHMe

— Jason Goepfert (@jasongoepfert) January 19, 2024

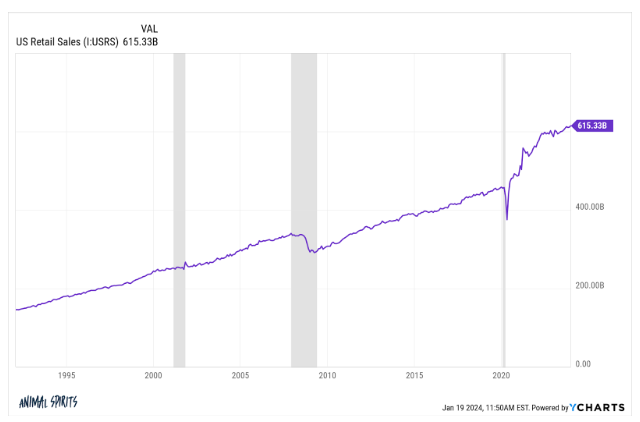

THE STOCK MARKET IS NOT THE ECONOMY

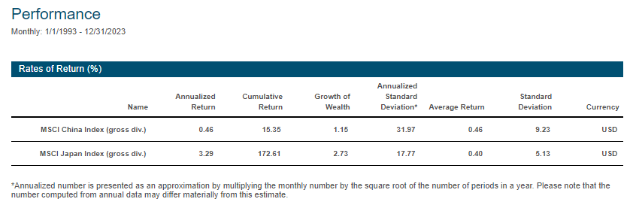

Chart of the year so far… the MSCI China Index is about to go NEGATIVE since its 1992 inception

The Chinese economy is ~13x larger and an investment in it has gotten you the same return as if you put your cash under your mattress pic.twitter.com/4yqeYQRTRp

— Jake (@EconomPic) January 19, 2024

Probably no better chart to illustrate the fact that differences in GDP growth have nothing to do with differences in equity returns.

From ’03 China’s nominal GDP up 1000%, Japan’s up 12%. pic.twitter.com/UTYfBeL5fD

— Bob Elliott (@BobEUnlimited) January 21, 2024

By one measure, borrowing costs for S&P 500 companies are hovering around the lowest levels in **48 years** –Goldman pic.twitter.com/yTegeaZ4kg

— Gunjan Banerji (@GunjanJS) January 20, 2024

The Spot Bitcoin ETFs started on January 11, when the price was $49,021, 10 minutes after ETF trading began. Two weeks later, the “sell the news” correction is now 21% and not yet showing signs of bottoming.

This may not sound like much to experienced Degens, but to normies… pic.twitter.com/vFLPhb2sal

— Jim Bianco (@biancoresearch) January 23, 2024

LATEST: The Great GBTC Gouge hit record -$640m on Monday, the Nine did their best to offset but fell short w/ a $553m haul. ROLLING NET FLOWS still healthy at +$1b but ongoing battle. The Nine now have a 20% share vs GBTC. Volume also remains very high for new launches in 2nd wk pic.twitter.com/ng0BU8mi6L

— Eric Balchunas (@EricBalchunas) January 23, 2024

Digital asset investment products saw a near-record $1.18bn in inflows last week.@CoinSharesCo pic.twitter.com/CVGHJ0bvh6

— Daily Chartbook (@dailychartbook) January 18, 2024

BlackRock’s $IBIT is the first US spot Bitcoin ETF to cross the $1 billion inflow threshold w/ yesterday’s $371m

Fidelity’s $FBTC in second place w/ $881 million overall pic.twitter.com/6svFXnHcGR

— Katie Greifeld (@kgreifeld) January 18, 2024

Faces melted. pic.twitter.com/eqvksuOTiw

— NFTstats.eth (@punk9059) January 18, 2024

BofA Small Business Checkpoint

In good shape and handling hurdles pic.twitter.com/f4870grExY— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) January 21, 2024

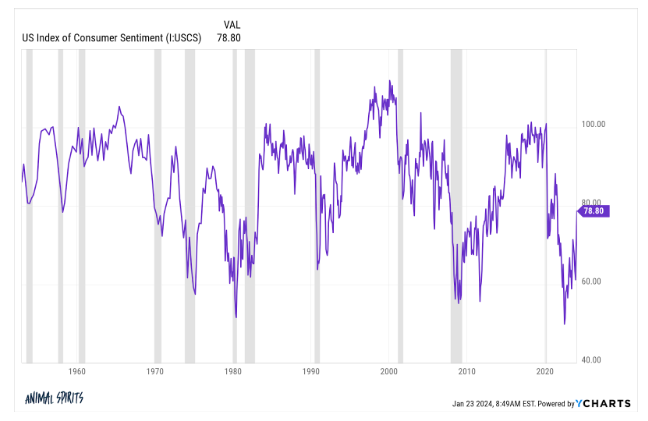

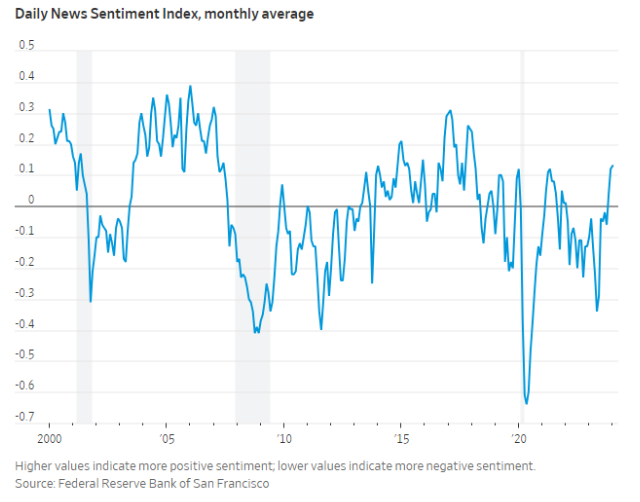

The Democrat / Republican gap in the view of the current economy is the widest in history https://t.co/7RkLCVO5Is pic.twitter.com/M6W4qwPZgH

— Jake (@EconomPic) January 19, 2024

Every time a publication folds the public and the employees have some story to tell about its mismanagement, and how if they had just x they would have survived, but the trend is inescapable and they’re all doomed. pic.twitter.com/RH3sKVe5GO

— Ryan Moulton (@moultano) January 21, 2024

Contact us at animalspirits@thecompoundnews.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

Wealthcast Media, an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.

Discussion about this post