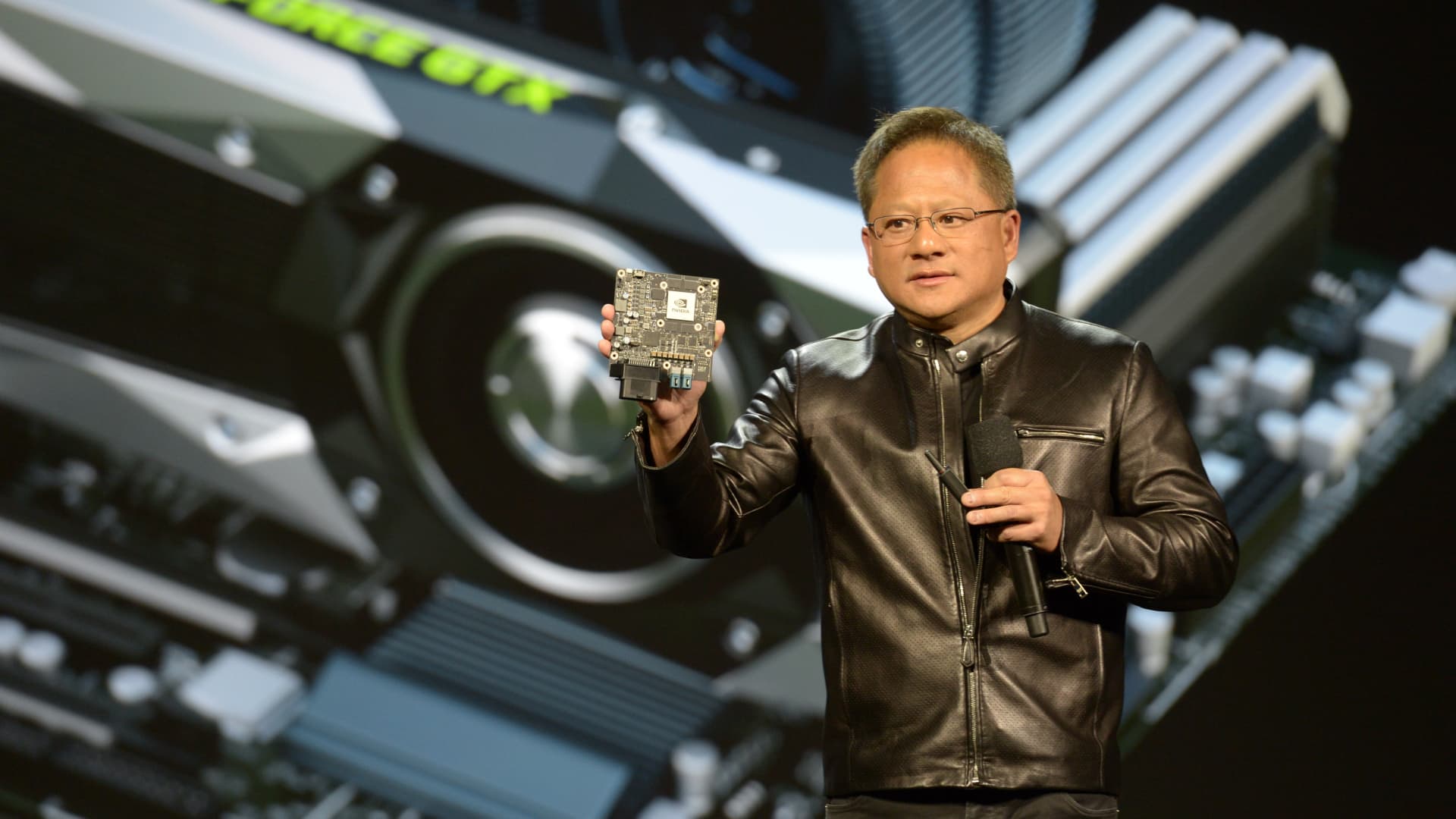

Nvidia has been awarded the flagship status of companies leading the artificial intelligence revolution, and all eyes turn to fourth-quarter earnings after the bell Wednesday. This is arguably the most important earnings report for technology stocks this quarter. The expectations are massive compared to the same quarter last year — and even compared to last quarter’s earnings. The massive gains in price reflect this historic growth and the question is will the chart continue its rally following earnings? The stock is reaching technical overbought status, and as a NVDA shareholder I do have concerns and will outline a level that should hold during this pullback — or I will look to protect or reduce our holdings. On Jan. 9 , I wrote about NVDA breaking through the 2023 resistance zone of $500 with targets of $650 in the first half of this year, and $775 in all of 2024. The recent highs of $746 surprised even this bull, falling just short of our target in just over six weeks. Are we moving into an environment where the expectations are fully baked into the cake? Expectations are for earnings of $4.59 per share vs 88 cents in Q4 of ’23 and $4.02 in Q3 of ’24. It’s simply amazing. Looking at analyst expectations for 2025 of $21.36 per share and with a current price of $690 that equates to a forward multiple of 32 times. For comparison, Eli Lilly is trading at 42 times 2025 earnings. It’s not egregiously valued, but there are some concerns going forward. Specifically, UBS put out a research note that wait times for GPU orders have come in significantly from eight-to-11 months to three-to-four months indicating that insatiable demand is starting to be satisfied. Another fundamental factor I’m watching is margins have expanded rapidly to 54.8% this year, but expectations are for that to level off to 50.50% in 2025 and 49.00% in 2026. Turning to the technicals, the weekly chart shows a convergence of 3 technical factors producing a resistance zone of $680-$750 that may suggest the boat is crowded too far to the bullish side, despite the strong underlying fundamental picture. Here are the factors: Parallel channel resistance . Connecting an uptrend line from the lows of May 2019 and Oct 2022 and projecting the angle of ascent from the Nov ’21 highs, that intersects price in the zone. Elliott Wave trend possibly complete . As covered in this column before, we track the Elliott Wave model that suggests trends unfold in a series of three rallies with two intervening corrections. That has occurred. Fibonacci projections . These ratios are used to study the expected starting and stopping points of the trend and corrective waves mentioned above. They intersect with the current price. There was some pre-earnings profit taking happening Tuesday, which is not surprising. Drilling down to the daily chart, I would like to see the depth of the prior November-December 2023 correction of 11% serve as a support level for this current pullback at $664. If this level is broken after the earnings report, especially on the back of a strong report, I am looking to reduce my 8% weighting in NVDA in our Tactical Alpha Growth portfolio at Inside Edge Capital and hedge my personal holdings with an April option collar. DISCLOSURES: Gordon owns NVDA personally and in his wealth management business Inside Edge Capital. Charts shown are MotiveWave. DISCLOSURES: THE ABOVE CONTENT IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY . THIS CONTENT IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSITUTE FINANCIAL, INVESTMENT, TAX OR LEGAL ADVICE OR A RECOMMENDATION TO BUY ANY SECURITY OR OTHER FINANCIAL ASSET. THE CONTENT IS GENERAL IN NATURE AND DOES NOT REFLECT ANY INDIVIDUAL’S UNIQUE PERSONAL CIRCUMSTANCES. THE ABOVE CONTENT MIGHT NOT BE SUITABLE FOR YOUR PARTICULAR CIRCUMSTANCES. BEFORE MAKING ANY FINANCIAL DECISIONS, YOU SHOULD STRONGLY CONSIDER SEEKING ADVICE FROM YOUR OWN FINANCIAL OR INVESTMENT ADVISOR. Click here for the full disclaimer.

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Discussion about this post