Stock Market This Week

Stock Market This Week – 03/23/24

I love dividends, which is probably obvious because I write a blog about them. I spend time each week following and analyzing dividend stocks. They are a main component of investor returns. Consequently, it was nice to read that global dividend payments reached $1.66 trillion in 2023. This is a large number and more than the Gross Domestic Product (GDP) of many companies. It is also larger than the whole market capitalization of many stock exchanges.

Here are some additional interesting statistics. According to the Janus Henderson Global Dividend Index, 86% of companies increased or maintained their dividends in 2023. Banks contributed half of the growth. Twenty-two countries, including the United States, Canada, Germany, France, Italy, Mexico, and Indonesia, experienced record payouts.

The same dataset shows that Microsoft Corporation (MSFT) is the largest dividend payer. Microsoft, Apple (AAPL), Exxon Mobil Corp (XOM), and the China Construction Bank have been in the top ten since at least 2017.

The top 20 companies paid $236.1 billion in dividends. The value is down compared to 2021 and 2022 because many international firms pay variable and special dividends.

If you are interested in dividend stocks, try the Sure Dividend Newsletter. They provide ten picks each month with easy-to-follow analysis and commentary. Click here to try the Sure Dividend Newsletter* (7-day free trial with credit card information).

Stock Market Overview

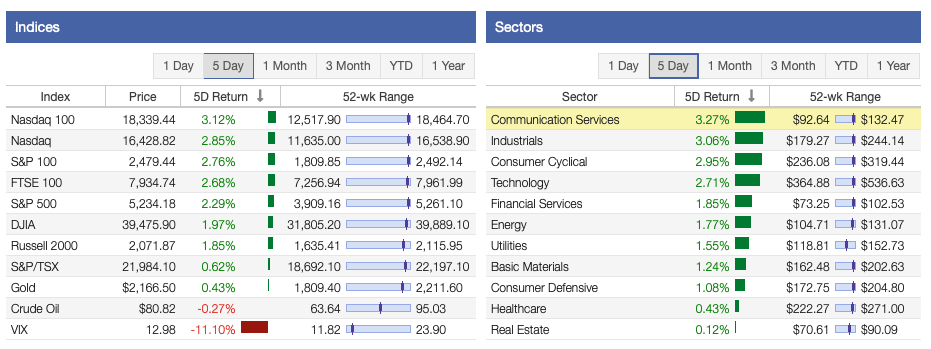

Data from Stock Rover* showed an excellent week for the stock market. The Nasdaq Composite led the way, followed by the S&P 500 Index, the Dow Jones Industrial Average (DJIA), and the Russell 2000. All four had positive returns.

All 11 sectors had positive returns this week. The Communication Services, Industrials, and Consumer Cyclical sectors were top performers. However, the Consumer Defensive, Healthcare, and Real Estate sectors were the worst performers.

Oil prices were flat at $81. The VIX plunged 11%+ to 12.98, well below its long-term average. Gold ended the week at ~$2,167 per ounce.

Affiliate

The Sure Dividend Newsletter for high-quality dividend growth stocks.

- The monthly newsletter includes stock analyses, portfolio ideas, dividend risk scores, real money portfolio, etc.

- Risk free 7-day free trial and $41 off only through Dividend Power for $158 per year.

- Sure Dividend Coupon Code – DP41

Click here to try the Sure Dividend Newsletter (7-day free trial).

The markets continue to move upward due to the American economy’s strength and continuation of the bull market. The S&P 500 leads the way, followed by the Nasdaq, the DJIA, and the Russell 2000. Ten of the 11 sectors have positive returns. The top performers in 2024 have been Communication Services, Energy, and Industrials, while the Consumer Cyclical, Utilities, and Real Estate sectors are trailing. Only the Real Estate sector has a negative return because of high-interest rates.

The dividend growth investing strategy started the year down. Larger market capitalization stocks are performing better than smaller ones. The table below shows their performance by category. However, dividends and passive income streams continue to grow.

Affiliate

Subscribe to one of the Sure Dividend newsletters. They analyze 850+ income securities every quarter to find the best income securities for members. This is real research, not a quick computer screen.

- The Sure Dividend Newsletter focuses on investing in high-quality dividend growth stocks with a focus on expected total returns. It is Sure Dividend’s flagship newsletter.

- The Sure Retirement Newsletter focuses on investing in high yielding stocks, REITs, and MLPs. All recommendations must have a dividend yield of at least 4%.

- The Sure Passive Income Newsletter focuses on investing in high-quality dividend growth stocks with a buy and hold forever approach.

Dividend Power readers can use the Sure Dividend coupon code DP41 for $41 off any newsletter, reducing your price from $199/year to just $158/year (7-day free trial).

Stock Market Valuation This Week

The S&P 500 Index trades at a price-to-earnings ratio of 28.41X, and the Schiller P/E Ratio is about 35.0X. These multiples are based on trailing twelve months (TTM) earnings.

The long-term means of these two ratios are approximately 16X and 17X, respectively.

Despite the recent correction, bear market, and rebound, the market is still overvalued. Based on historical data, earnings multiples of more than 30X are overvalued.

Resources

Curated Weekend Reading From Around The Web

Portfolio Management and Investing

Retirement

Financial Independence

Here are my recommendations:

Affiliates

- Simply Investing Report & Analysis Platform or the Course can teach you how to invest in stocks. Try it free for 14 days.

- Sure Dividend Newsletter is an excellent resource for DIY dividend growth investors and retirees. Try it free for 7 days.

- Stock Rover is the leading investment research platform with all the fundamental metrics, screens, and analysis tools you need. Try it free for 14 days.

- Portfolio Insight is the newest and most complete portfolio management tool with built-in stock screeners. Try it free for 14 days.

Receive a free e-book, “Become a Better Investor: 5 Fundamental Metrics to Know!” Join thousands of other readers !

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Prakash Kolli is the founder of the Dividend Power site. He is a self-taught investor, analyst, and writer on dividend growth stocks and financial independence. His writings can be found on Seeking Alpha, InvestorPlace, Business Insider, Nasdaq, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, and leading financial sites. In addition, he is part of the Portfolio Insight and Sure Dividend teams. He was recently in the top 1.0% and 100 (73 out of over 13,450) financial bloggers, as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.

Discussion about this post