KCB has made entry into the Democratic Republic (DRC) ending many years of search for an entry point into the lucrative market.

This is after it acquired DRC-based lender Trust Merchant Bank (TMB), in a deal that will see it expand its asset base to Sh1.26 trillion, just Sh10 billion shy of Equity Bank’s Sh1.27 trillion by end of March.

Completion of the deal opens up yet another battlefield between KCB and its main competitor Equity Bank which made forays into the Central African country in 2020.

KCB announced on Tuesday that it had 85 per cent of TMB, gaining a foothold into the 90-million market.

This is after it entered an agreement with the shareholders of TMB to acquire a majority stake in the bank.

Once completed, this acquisition will complement KCB Group’s regional footprint with an asset base of Sh1.5 Trillion (USD 12.6 billion) and is expected to strengthen the Group’s Retail and Corporate banking franchises.

“This is part of our ongoing strategy to tap into opportunities for new growth while investing in and maximizing returns from the Group’s existing businesses.

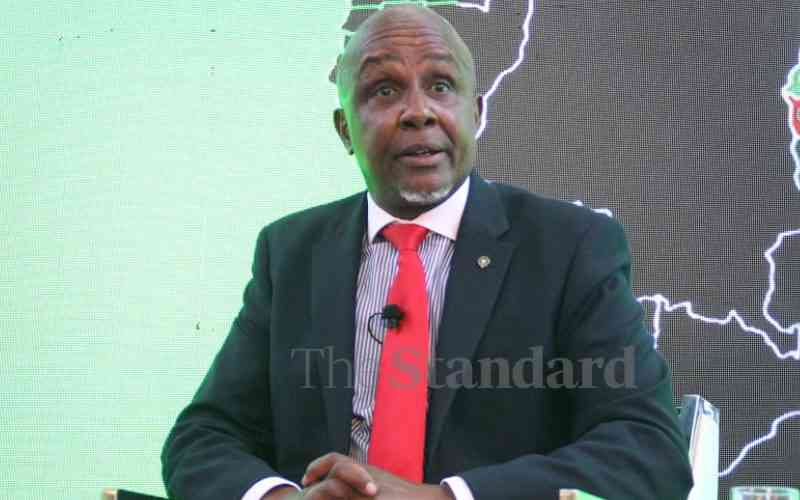

Andrew Wambari Kairu, KCB Group Chairman, said the acquisition is aligned with the bank’s strategic focus of scaling its regional presence.

“It gives us strong headroom to accelerate our growth ambitions to deliver better value for our shareholders and to bolster the push for deeper financial inclusion and social and economic transformation in Africa and beyond,” said Kairu.

“We are very excited about the opportunities KCB offers in this transaction and we are proud to bring our unique DRC insights and experience to the KCB Group. We believe that by combining our local knowledge and standing with the size and expertise of KCB Group, we should be able to increase market share and shareholder value through unlocking our synergies and business opportunities,” said Robert Levy, TMB Chairman.

Earlier, KCB had completed the acquisition of another of Atlas Mara’s lenders in Rwanda – Banque Populaire du Rwanda – which saw its assets grow by 15 per cent, or Sh1.12 trillion, in September 2021 compared to Sh972 billion in the same period last year

However, the bank’s intention of acquiring African Banking Corporation Tanzania (BancABC Tanzania), also majority owned by Atlas Mara, did not bear fruits after Tanzanian authorities threw KCB’s bid into disarray.

KCB has also acquired National Bank of Kenya in an expansion spree that has characterised competition among Kenya’s top lenders.

The transaction of TMB is expected to close by the end of the third quarter of 2022, subject to regulatory, shareholders and other approvals.

This will see KCB acquire 85 per cent of the shares in TMB while the existing shareholders will continue to hold the balance for a period of not less than 2 years after which, KCB will acquire their shares.

KCB will pay a cash consideration for the shares determined based on the net asset value of TMB at completion of the proposed transaction, and using a price to book multiple of 1.49.

TMB, a public company limited by shares, is one of DRC’s largest banks with $1.5 (Sh178.2) billion in total assets. TMB has a strong offering in Retail, SME, Corporate and Digital banking channels.

It has over 110 branches and numerous agency banking outlets spread across DRC.

Discussion about this post