Investors looking for the next way to play the artificial intelligence boom should consider some of the basic building blocks of the economy, according to Bank of America. Investment and ETF strategist Jared Woodard said in a note to clients last week that the market is underestimating the changes brought about by the energy demand of AI programs. “‘Round one’ winners from new tech demand like data centers, hyperscalers, and chip makers are well-owned already,” Woodard said. “Further investments in those beneficiaries should be made contingent on a realistic path to expand the power supply. In other words, the big new digital darlings can still win, but the ruddy old real world may have to win first.” The shift toward the next round may have already started. Utility stocks have started to rally in May, with the Utilities Select Sector SPDR Fund (XLU) up 8% month to date. The fact that utility stocks are cheaper than the rest of the market and have long underperformed helped fuel the move, but the prospect of increasing energy demand also appears to have been a factor. XLU 1M mountain Utilities stocks have risen sharply in May. Woodard identified other ETFs and stocks that could benefit from increased energy consumption and investment in the electric grid. One is the Direxion Auspice Broad Commodity Strategy ETF (COM) . This fund is pricier than many equity-focused ETFs, with a net expense ratio of 0.70%, but offers actively- managed exposure to 12 different commodities, from soybeans to oil to copper. It is up about 8% this year. Bank of America also has a buy rating on mining stock Freeport-McMoRan , which is already up more than 27% year to date. “Progress is not possible without real assets. Our strategists expect metals like copper to fall into massive deficits through 2026. Miners should retain pricing power given constrained capacity after a decade of underinvestment,” the Bank of America note said. Companies that help produce sources of energy could be another area in which to find winners. The VanEck Oil Services ETF (OIH) is a fund that Woodard highlighted. Its top holdings include SLB and Halliburton . Uranium could become more important as a fuel source in the years ahead. Bank of America is positive on the Global X Uranium ETF (URA) , which offers exposure to both physical uranium and miners. “Uranium is in its third secular bull market as global supply cannot keep up with growing demand. A 10% nuclear ‘uprate’ could add 10GW of energy supply without any new building,” the note said. The URA has a net expense ratio of 0.69% and is up about 18% year to date. The OIH is cheaper at 0.35% and is up roughly 6% on the year. Bank of America did not include a utilities ETF in the note, but the firm has a buy rating on Xcel Energy, among such stocks. — CNBC’s Michael Bloom contributed reporting.

Stocks and ETFs that could benefit from AI’s insatiable need for energy

Related News

Subscribe To Our Newsletters

Customer Support

1251 Wilcrest Drive

Houston, Texas

77042 USA

Call-832.795.1420

e-mail – news@theinsightpost.com

Subscribe To Our Newsletters

Categories

- Africa

- Africa-East

- African Sports

- American Sports

- Arts

- Asia

- Australia

- Business

- Business Asia

- Business- Africa

- Canada

- Defense

- Education

- Egypt

- Energy

- Entertainment

- Europe

- European Soccer

- Finance

- Germany

- Ghana

- Health

- Insight

- International

- Investing

- Japan

- Latest Headlines

- Life & Living

- Markets

- Mobile

- Movies

- New Zealand

- Nigeria

- Politics

- Scholarships

- Science

- South Africa

- South America

- Sports

- Tech

- Travel

- Travel-Africa

- UK

- USA

- Weather

- World

No Result

View All Result

Recent News

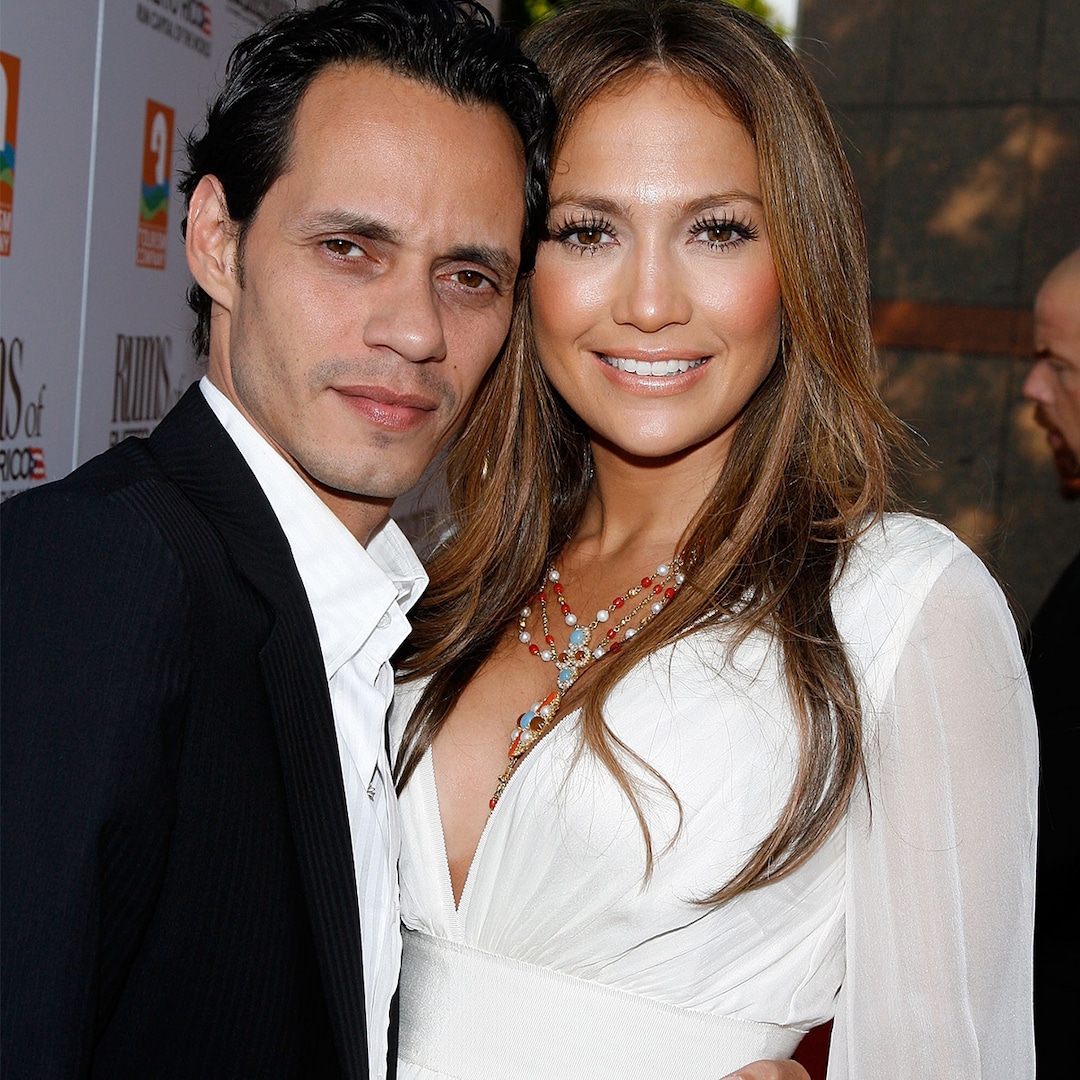

Jennifer Lopez on Marc Anthony Divorce

March 7, 2026

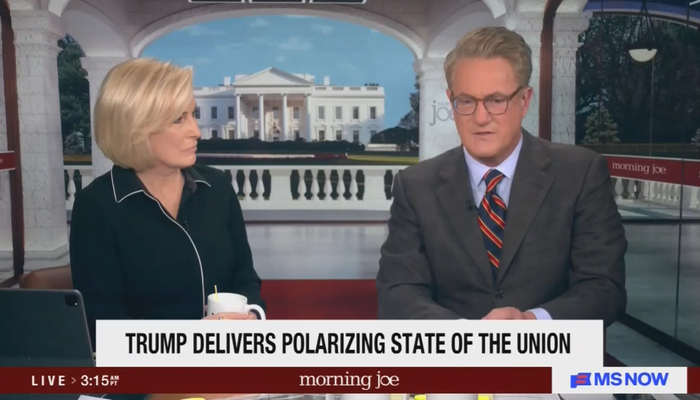

Media Elitists Trash Trump’s SOTU, Fearmonger Over Iran

March 7, 2026

Theinsightpost ©2026 | All Rights Reserved. Theinsightpost is an Elnegy LLC company, registered in Texas, USA

Discussion about this post