What’s your financial independence number (FI/FIRE number)? Are you being too conservative, or are you cutting things close? Do you even have one? Today, we’re taking a deep dive into this hotly debated topic to help you build a nest egg that will support your early retirement!

Welcome back to the BiggerPockets Money podcast! How much money do you actually need to retire? For years, the four-percent rule has been the “official” stance of the FI community. But why is it, then, that so many people continue saving and investing when they can comfortably retire? In this episode, Scott and Mindy talk about their own FI numbers, how they calculated them, and how their financial positions have evolved over time. You’ll learn whether the four-percent rule still works today or if you need a larger buffer!

If you’re worried about inflation, one of the best things you can do is keep your living expenses in check. This might seem out of your control, but there are several ways to either lock in certain costs or eliminate them entirely. We’ll discuss the many advantages of a paid-off house, self-managing your rental properties in retirement, and a one-time investment that could help you save thousands of dollars over your lifetime!

Mindy:

In the fire community, one of the most frequently asked questions is, what is your fine number? I’ve asked this a ton of times. It’s one of my go-tos. It’s a great icebreaker. Everyone wants to know if their fine number is too low, too high, too conservative, or hopefully just right. More often than not, people are too conservative. Have you inflated your fine number just to be a little too high and could this be impacting your retirement today? We’re going to talk about that in just a few minutes. Hello, hello, hello and welcome to the BiggerPockets Money podcast. My name is Mindy Jensen and with me as always is my nose, his own risk tolerance. Co-host Scott Trench.

Scott:

I don’t think you could have come up with a beta introduction for me if you tried. Mindy BiggerPockets has a goal of creating 1 million millionaires. You are in the right place if you want to get your financial house in order because we truly believe financial freedom is attainable for everyone, no matter when or where you’re starting, as long as you actually know what your number is. Today we are going to discuss how to calculate your FI number and what you may be doing wrong. We’re going to talk about why your FI number may be too high, too conservative, and why that may be costing you a number of years and why the traditional ways of calculating your fine number, the 4% rule, are already baking in the most conservative assumptions that you probably need to plan out for your portfolio. Excited to get into this today.

Mindy:

I am too, Scott. Let’s jump right in. I’m going to put you on the hot seat. Can you give us a refresher for our audience how you calculate your fine number?

Scott:

First of all, this is such an issue because it’s the whole game, right? The question is how much do I need to retire? Everyone who is ever exploring the concept of financial independence retire early. The fire movement has to have an opinion on this number. The official stance of the fire community, I say that a little bit in jest, is the concept of the 4% rule. There is a large body of research starting with the Trinity Study and work developed by William Bangin, who we’ve had here on BiggerPockets money and followed up and expanded on by Michael Kitsis, who we’ve also had here on BiggerPockets. Money supports generally the conclusion that the 4% rule is the answer to how much do you need in order to retire la the 4% rule states that if you have a portfolio and withdraw of a 60 40 stock bond portfolio and you withdraw 4% of that portfolio or less, you never in history would run out of money over a 30 year period and it goes further than that and explains that in most cases, you end up with more money at the end of 30 years than in retirement.

Then you began your retirement with. Now this sparks the debate in the fire community. Well, if I’m retiring at 30 and I want to live to be a hundred, that 30 year component of the Trinity study and all this work really gives me the heebie GBS here. And as a result, while we generally all agree on the math and that the 4% rule is a great answer to the question, how much do you need to retire? We never, never find anybody in this entire industry doing this for years who has actually retired permanently on the 4% rule in a 60 40 stock bond portfolio in an early capacity with no other side bets, cash position, pension jobs, whatever. So how did I do it there? Is that answering the question? Framing it right?

Mindy:

I think you are correct with, I have two little changes. You said never has anybody run out of money in history retiring on the 60 40 with a 30 year horizon, and it’s actually 96% success rates. So there are a couple of times when you retire into a period of high inflation, prolonged high inflation, so you’re retiring in the sixties into the seventies hyperinflation. That was a time where when you ran out the money year 30, you know what? You might’ve actually been correct. Year 31 I think is when the bank account dipped below zero. So you said 30 years, you’re correct, but I know somebody’s going to send it out there. Send us a note. So I jumped there in advance.

Scott:

Ending 30 years with next to nothing is not an acceptable fire plan. So the point either way is the same when it comes to thinking about the 4% rule as the iron law of can you retire early?

Mindy:

Yes. However, I will argue back against people who are like, well, we’re in a period of high inflation now. First of all, inflation is already coming down. It wasn’t a prolonged period in the seventies. And second of all, if you got yourself to the position of being financially independent, chances are really good. You’re checking in on your finances at least somewhat. I don’t personally do it, but my husband does it every single day, which is way too much for me, but I know that I don’t have to because he’s doing it every single day. He’s keeping an eye on it. If there was a downturn, if there was a prolonged downturn, we would do something to right the ship. We wouldn’t just be like, well, it says we’re going to have to be withdrawing 4% every year. So that’s what we’re going to do. And even if we run out of money, there’s no way to change it. I mean, just a little bit of difference will change your whole financial outlook. You could stop spending money for a year, go get a job or a part-time job or something for a year. So I think that not only is this the most common question, what’s your fine number, but this is also a really big source of debate between people who say 4% isn’t conservative enough. So I hope to dive into that a little bit with you today, Scott. Have you calculated your FI number based on your spending? And the 4% rule

Scott:

I have, and I’m way past it at this point, frankly, which is a really interesting position to be in because I’m in the same bucket as essentially every other person who, well, I haven’t left my job, but every person who has actually left their job and retired early finds themselves in my experience in this position of having well beyond that number from a fire planning perspective.

Mindy:

Yes, and I think that our current timeline is part of the reason for it. We started, my husband and I started pursuing financial independence about 11 years ago. We reached it fairly quickly, although we were halfway there. I continued to work. He continued to work. Our nest egg has grown and doubled and doubled again, and then a little bit more. So we are not in a position to worry about our finances, but I can see how somebody who is listening to this in 25 years is like, oh, well, she did it with a huge stock market tailwind. We’ve had a crazy market for the last, what, 20 years? 15 years, 20 years? Oh, I’m sorry, I’m forgetting about 2008. How can I forget? About 2008 for the last 10 or 15 years, we have had a crazy market. So I think that there’s a lot of things to consider, but also overwhelmingly people are too conservative with their original FI number.

Scott:

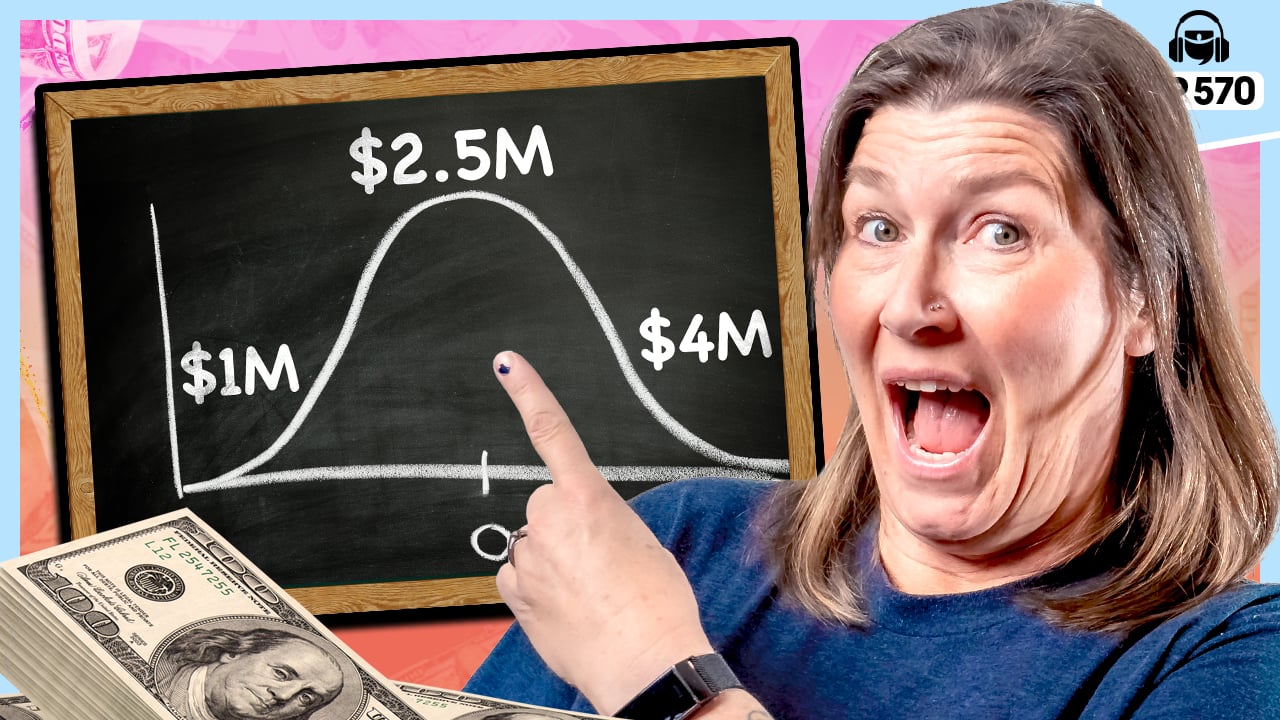

Let’s put ourselves in the shoes of someone listening, and if you’re listening, let us know in the comments or on Facebook if you disagree. But if I’m going back 5, 6, 7, 8 years ago and I’m thinking about the journey to financial independence, the target is a net worth of between one and a half and two and a half million dollars inflation adjusted for the vast majority of people listening to this podcast. That will be the target. And when you’re on the journey there, that backs into a 4% number. I think that most people who are on the journey to fire back into a 4% rule number, and what we see is when people approach or even surpass that number, they’re not actually able then to retire. And that’s where the conservativeness comes in, right? Because people listening to the podcast who are on that journey are like, I’m totally fine with the 4% rule.

I get the math and I’m still shooting for it. But what we’re I think addressing here is that the reality of once you get there is that most people tend to go way beyond it or have backup plan after backup plan after backup plan for it. And so that brings up the two I think conflicting problems or the big argument in the fire community about this. Number one is, hey, there are a number of cases in history where you will end up with less money at the end of 30 years than you started with on a nominal basis, which is an unacceptable outcome for a lot of people in the fire community because they plan to live more than the 30 years of traditional retirement planning. And the second is that the 4% rule assumes and Mr. Money mustache put this beautifully in a 2012 article called How Much Do I Need for Retirement?

It assumes that the retiree will never earn any more money through any part-time work or self-employment projects for the rest of their lives. It assumes that they’ll never collect a single dollar from Social Security or any other pension plan. It assumes that they’ll never adjust their spending to account for any economic reality like a huge recession. It assumes that they will never substitute goods to compensate for inflation or price fluctuations like taking a vacation in a cheaper area one year versus doing something different in another year. It assumes that they’ll never collect any inheritance. It includes that they will never spend less as they age, which is a typical pattern that we see in a lot of retirees. So those assumptions are also not baked in to this 4% rule analysis. And so those are the two tug and poles on there, but I think that it doesn’t change the reality that every case of fire that I have come across to this point has involved someone starting with this goal of the 4% rule and going beyond it before actually pulling the trigger and quitting.

Mindy:

While we are away on a quick break, we want to hear from you, do you know what your fine number is? Submit your answer in the Spotify or YouTube app. Okay, we’ll be back right after these quick few ads.

Scott:

Alright, let’s Phi Noli jump back in

Mindy:

And I think you’re correct, Scott. We haven’t found anybody who is solely living off of their 4% rule withdrawals and not having any other side businesses. However, I do want to call out millennial revolution. They have their portfolio that they retired on and all of their additional income that is coming in now is going into a different bucket. They are pulling out of this main bucket, their 4% rule retirement bucket. They are only spending the money that they’re pulling out of there and they are living well within their means off of this money. They said that they have been doing this for 10 years and they have more money now than they did 10 years ago while continuing to withdraw 4% every year.

Scott:

Think about that example though. That’s the fun part about this, right? B Bryce and Christie, right? We had them on the show here at BiggerPockets Money too, right when they were starting this journey and they’re like, they’re geniuses. They get all this, they know all the math behind this. They wrote a book called Quit Like a Millionaire in the Space that’s really popular. You should go check it out. If you haven’t read it yet. They know what they’re talking about and they can’t even do it. They have to have the side income stream just in case their experiment doesn’t work out of traditional financial independence. And that’s the conundrum. That’s the topic today is yes, that number that is too conservative, it’s too much. They didn’t need the other side of things there because the math generally works. It’s got a real high enough hit rate that if people did it, they would retire on time and spend the minimum amount of time working and the maximum amount of time in retirement on that. But nobody can actually mentally do that without some sort of side bet.

Mindy:

Well, I don’t know that they have a side bet on purpose. I think their blog just started generating income and they wrote a book and that generated income and little other things generated income. I don’t think they set out to say we don’t believe in the 4% rule, so we’re going to make extra money. I think it just happens that they’re making extra money. The same has happened for my husband who has been retired for seven or eight years. I can’t remember now. It has happened for I am making more money now than I have ever done before. Although I do have a job, which is one source of income. I have a real estate agent license that’s another source of income. We have dividends from index funds. We have dividends from stocks that weren’t started out as dividends. There’s all these little buckets that start coming in and it feels like, so your

Scott:

Plan is too conservative.

Mindy:

It almost feels like you can’t stop it. Our original number was $1 million and I think that that might have been a little aggressive for us because we have started spending more money, but also we have started spending more money because our nest egg has grown so much. So it’s kind of a chicken and an egg thing.

Scott:

Well, look, we have this dynamic and we have wonderful math and we’ve had the people who do this research on the show and one other call out about Bill Bangin is Bill Bangin did this research and then maybe a month or two after he was on the show, maybe even a month or two before he was on BiggerPockets money, he went 70% to cash with his own personal position because he feared market correction and he didn’t use his rule to do that and he was totally fine with that. And that’s a psychological and personal preference for all of this. It’s not necessarily good retirement planning or a way to maximize wealth necessarily, but this is the guy who did the original study, couldn’t even adhere to it or didn’t adhere to it maybe is the different word. Chose not to adhere to it for what I’m sure are great reasons for him, but that’s the conundrum. So we have great math and we have no literally zero examples in six years and 550 plus episodes here of people who have actually done this.

Mindy:

And if you have, email [email protected], [email protected] and let’s tell your story because we do truly want to tell your story. We just haven’t found you yet.

Scott:

Let’s take that and say how does this factor into the plan here? Well, the plan should be amass 25 times your annual spending. That’s where we things start and know just that you are going to want to go beyond that unless you are the person who we’ve been looking for for years who will actually pull the trigger at the 4% rule with nothing else on top of that. And again, we would love to have you on the BiggerPockets Money podcast when you do that at that point or within a percentage, 1% or so of that inflection point. So that’s the plan. The plan is get there and know that that’s the beginning of the end and you’re going to move on to other parts of the process here. Then we can get into talking about more nuances from fire. And what’s kind of been interesting to me is these concepts of lean fire, regular fire, chubby fire, fat, fire and all of the things in between. And one of the things, Mindy, that I have been thinking about is inflation and protecting against this desire to maybe so kind of want to spend more as life progresses rather than keep spending flat and how to plan for that. Right? And so do you have any ideas around how someone who’s preparing for fire can lock in core expenses so that they’re protected from rising costs and inflation as much as possible?

Mindy:

Well, there’s always going to be things that you cannot control. The cost of food is going to continue to go up. The cost of gasoline is going to continue to go up. You can hedge your bet by having an electric vehicle and solar panels on your house and then you’ve mitigated your gasoline cost. You’ve mitigated some of your heating costs, some of your working around your house costs, assuming that the sun doesn’t go out. Of course you can buy a car with cash so you don’t have a car payment. You will have some repairs and you’ll need to be saving for those. But that’s not the overwhelming majority of your vehicle expenses. It’s the payment itself, the gasoline and a little bit of upkeep. You can buy a house and not be tempted to move and move and move again. Get a fixed rate mortgage, pay it off completely either way, your annual expenditures are going to be far less with a fixed rate.

Mortgage and predictable taxes are always going to go up. Property insurance is always going to go up. So if you have a principal interest, taxes, insurance, mortgage, then your mortgage is never going to be a fixed cost. But the principal and interest part will be a fixed cost. And that doesn’t change if you’re all paid off. You still have to pay property taxes. You still don’t have to pay property insurance, but I highly recommend it. Getting your costs fixed with either fixed rate, interest rates, fixed rate loans, or removing that cost altogether while you’re on your FI journey. So you have the paid off everything I think would be the best choice. But there are some things that are not going to be predictable when you are operating under a, I am spending X per year, you still need to pay attention to what you’re spending. It’s so easy for your spending to go up. So if you think you’re spending $50,000 a year, check in on yourself loosely if you’re on track to spend $50,000 a year, but tighten up a little bit if you’re not on track or rethink your fine number. There’s a lot of ways to lock in your expenses on most things so that the fluctuating expenses like food aren’t going to derail your whole budget.

Scott:

Let’s talk about some of these items here because I think that as you think about planning for fire, the expense side is so much more important in a lot of ways than the asset base or even the income on it because if you need to spend a lot, you need to realize a higher income, which puts you in a higher tracks bracket, which puts a pressure that compounds the whole way up the stack. On the net worth side, you need a lot more net worth to spend $300,000 a year comfortably in retirement. Then you do $50,000 a year in retirement and it’s a compounding set. So the difference between 50 and 60 is not that large in terms of tax consequences, but every little bit counts. And so when you think about the way to protect your fire plan from inflation, I think that that’s right, right? You just went down the stack and I just want to repeat some of them here and think through ’em the home, right? What percent of people who actually retire with something closer to the 4% rule, do you think pay off their mortgage? Mindy, if you had to guess

Mindy:

Paying it off before the 30 years is up, wow, I would say that’s pretty low, like 20, 30%.

Scott:

I would bet you that. So I think there’s a carve out here. I think for people like yourself who have much more than you need for a fire and a low interest rate mortgage, they’re not paying that off because it’s an investment decision at that point. But for people who are somewhat close to that bubble, I think that they’re paying it off. I think you’re going to find that paying off the home mortgage is very popular in, I actually retired and left my job before the age of 60 in this country. I wonder how we could pull that, but I’d love to have a discussion, go in there and see how people think about it and who’s fired and is not way beyond the 4% role, but it’s just a little bit behind this 4% rule. And if you did, did you pay off your mortgage first or do you still have it?

Mindy:

Okay, I have to write down these questions because I’m going to pull our audience in the Facebook group, which is facebook.com/groups/bp money

Scott:

If folks are interested in learning more. Mindy and I had a very spirited debate about this on episode 5 54 where we talk about the math of paying off a mortgage early and we really nerd it out on a lot of the pre and post tax consequences of that. But I think that that’s a really good way. Okay, you have a paid off house your rent, you’re not exposed on the rent side to inflation for as long as you live in that property. You are exposed in the costs of home maintenance, you’re exposed in the cost of utilities, you’re exposed in the cost of insurance and property taxes or your HOA if you have one. And so those are things that are in there, but you can control the fact that rent is not going to grow. And I think that despite some folks in the space like Ramit Safety, who very rightfully talk about how a lot of millionaires should rent and that renting is in many cases a better alternative if you’re planning for a 30 year retirement and actually want to pull the trigger. I think a paid off house is a pretty helpful way to think about it for a lot of folks because you just know that expense is not going to grow with inflation on it. So I think that’ll be a popular move and that’s something I chose to do. I like to not have to worry about that expense rising over time except to my real estate portfolio

Mindy:

And I chose to get a mortgage when I bought this house. We actually had to pay cash for it in order to be able to close quickly and then after six months we chose to get a mortgage on it because rates were so low. And because I want to take that money that is, for lack of a better word, sitting in my house and put it to use in the stock market.

Scott:

We should take one fi, no break, but stick around for more on adjusting your FI number when we’re back. Welcome back to the show. Let’s talk about solar panels next. So this is one in there, right? Okay, here’s the thought process that I would go through, right? Okay. My energy bill is 150 bucks a month or whatever it is, and I can get solar panels and that knocks out an $1,800 to $2,000 a year expense on my life that I was just permanently knocked out. What’s that going to cost me? Like 25, 30 grand, something in there much more. Okay, great. What do I have to, so what do you think it will cost me to get solar panels like that?

Mindy:

Okay, so I put solar panels on my house. I say my husband did it, I didn’t do it. He would love to talk to you about it ad nauseum forever. But we put solar panels on the house. We did a DIY installation, we got quotes from other companies. The least expensive quote that we got for half of the amount of panels that we ended up putting on was $7,000. This was unacceptable. So Carl started looking into DIY. We’ve got some friends who are electrical engineers, we’ve got some friends who are electricians, we’ve got some contractor friends and he’s just really handy. So we installed the panels ourselves. We did end up paying an electrician to come and change out the panel, which has to be done and all in it was $13,000 for us to put in twice as many panels as the original $37,000 quote. We got a tax credit, so our net cost was something like $9,000 out of pocket. We live in Colorado where they advertise it’s 330 days of sun every year. That’s not quite accurate, but it’s close enough. We get a lot of sun here. So in a place that doesn’t get a lot of sun like your northern states, I wouldn’t even consider putting on solar panels.

Scott:

Wait, wait, wait, wait though we were so close. What did your energy costs go from until

Mindy:

Well, so we have twice as many panels as we needed at the time. We also now have two electric vehicles that are charging. We have a swimming pool, we have an air conditioner that all run on electric. Our net is about break even like what we are making from the sun and what we are using. But we will have a surplus over the winter months when the air conditioning and the pool aren’t running. And then over the summer we use up that surplus. My electric company pays me the retail rate for my excess electricity, which is not always something that your electricity company will do. Sometimes they will pay you the wholesale rate. So even though you’re paying, I dunno what it is, you’re paying a dollar a kilowatt hour and they are paying 20 cents a kilowatt hour for your extra. So there’s not the same break even.

Scott:

But now let’s take that and move that into the context of fire. So you put $9,000 into this project and your electricity costs went on an annualized basis from what to what

Mindy:

I will say about $200 a month, $20 a month for the connectivity because that charge will never go away.

Scott:

So we went from $2,400 a month to a year to 25, 200 $50 a year in electricity costs. And let’s also call out the fact that this just move also came with two electric cars, which means no gas. I dunno how much you drive, but let’s call that another a hundred dollars a month for two electric cars, at least in cost savings. That is fueled by your solar panels here and decisions to do other things. Do you have a power bank as well that stores electricity as part of this? Okay, so that would another potential one that would, I think those are pretty expensive from Tesla or whatever that can bank power for the home. But for this $9,000 investment, you reduced your cash outlays and electricity by $2,000 and maybe by another 1200 bucks. That’s $3,200 a year for when you think about gas savings with the two electric vehicles that you now have.

So that break even is closer to three years. And let’s also talk about how now you don’t need to generate, you don’t pay tax on that $3,000 on that return. That is all post tax that just stays in your account. You don’t have to realize income to do that. And I know, or I bet you guys are in a pretty high income tax bracket between all your investments and the things that are going on. So that’s a major savings. So you’d have to generate, that’s like a 33% return post tax per year when you factor in all the other decisions that came from it. And so that is what’s really interesting to me. Now, if it’s $67,000 to get the solar panels in there, you have a major problem. But that I think is part of the analysis of PHI that people should be thinking about here is, okay, and think about all the things that go together home. You’re not going to do that on a place you rent. So there’s a home factor in here. I think that there’s a connection here that can be explored when you think about how do I protect my life from inflation? Well, it’s thinking like that. What else can you do along those lines to set up your living environment so that you can make those kinds of decisions. So I think Carl’s math on this and yours here, I think it’s a home run, this investment.

Mindy:

Yes, for sure. We are not at all sad that we have gotten these Originally when we put them on, we were going to stay here for another four years and now we may move in a year or so, we’re just moving around the corner, but then we would sell this house and we wouldn’t have the solar panels anymore. It has been a good choice for us. But again, if you don’t have all of these other factors, it might not be a good choice for you If you can’t, DIY it 37,000 versus 9,000. That’s a big difference. And that 37,000 was taking into account the credit that we would be getting from I think the state or the federal. I can’t remember who gives the credit,

Scott:

But this is a perfect, this is a perfect example, right? So you’re fired, you’re close, you’re worried about being conservative, right? Go a little bit beyond and consider how do I create a life situation that costs as little as possible with my new found time in retirement, right? I am not going to run BiggerPockets during the day and then get on my roof, DIY, installing solar panels in the evenings and weekends At this point, if I was fire, I might and that was my day or that my plan that might actually happen on there. And so those are the types of things that you can think about when you’re starting to say, how do I protect my portfolio from inflation? Well, it’s this concept of you’re retired and you’re not at traditional retirement age. You can develop a lot of skills that can then drive these costs down.

Those skills can include solar panels. They can include getting really skilled at shopping and preparing meals for much lower costs. What might be practical or reasonable during your working career. For example, it can include operating parts of your investment portfolio or whatever that can save cost. If I was fire, my rental property portfolio for example, might not have a property manager or might not have a property manager for all of the portfolio, which generates an increase of 10%, I’m now not spending 10% of those rents on property management. And so those are the ways or those are the starter ideas I think to protect against inflation. And then there are certain things you just can’t protect against the fact that groceries will spend more or if you like to eat out food costs will rise. I was going to say gas, but we’ve covered gas actually.

Other things like insurance. So insurance, having a paid off house, you can have different deductibles for example that maybe your lender wouldn’t accept, which allows you to have cheaper insurance rates not moving when your house is sold. The tax appraiser has a very clear idea of what that house is worth at that point and could reassess the tax basis on it. If you live in the place for 20 years and the place doesn’t sell and it’s not a direct comp with all the neighbor homes, maybe your tax bill is going to lag behind other things. So we can’t control those directly, but we can influence them when we’re thinking about retirement and those things add up. When you take all of those ideas, all of these concepts around solar panels around paid off home that is not going to inflate over a dozen or a decade or two into retirement, that will make a major dent in protecting your spending from inflation are huge chunks of it. While your portfolio is very likely outpacing or at least staying in line with inflation, how are we thinking?

Mindy:

I’m wondering how I should be looking at the fine number if I’m not 60 40 stocks bonds, but instead a hundred percent stocks.

Scott:

I’ll tell you this, a nobody, if we might meet somebody, if retires on a 4% rule with 60 40, we will never meet someone who will retire on a 4% rule portfolio with just stocks. You’re pointing at yourself, but you may be a hundred percent stocks, but it’s because you’re well past the FI number. Nobody is, we’re never going to meet the person. Mindy, I’ll tell us right now and I will eat my words if it ever comes to pass, but we’ll never meet the person who will actually retire with no backup plan, with no other items in place at a 4% rule, a hundred percent stock portfolio, it will happen.

Mindy:

Okay? And his name is Scott. His email [email protected]. If you did in fact retire on a hundred percent stocks and are withdrawing from your 4% rule

Scott:

And have no emergency reserve and no pension and no side projects and are not close to attritional retirement age and going to withdraw social security and have no other gotchas or gimmicks in your portfolio that are side bets. Besides that true reliance on the 4% withdrawal rate from a hundred percent stock portfolio, I’ll eat my words.

Mindy:

I’ll put these on a cookie and have you eat that.

Scott:

Sounds good,

Mindy:

Scott. I thought this was a very fun conversation. Thank you so much for your points of view. I always learn something when I’m talking to you and now I have to go back and revisit my solar plan, my solar panel plan, maybe even revisit that video because I told people that it was not a break even and I think at the time we didn’t have the electric vehicles, but with the electric vehicle, I think that that’s a much more viable solution.

Scott:

Andy, I always learn from you and feel like your bets are though I couldn’t make solar panels work. I didn’t consider DIY installing solar panels. There’s no reason not to consider that. As I think about that project, I’ll just do that at some other future point, what I have a few weeks off on there, but that’s a home run. That’s one of the best investments that someone I think could make in that situation. Although I do have questions about whether rock sized hail will wipe out that investment.

Mindy:

Well, we did have those hailstorms last year and they’re still standing. Scott, when we move into the new house, we will be putting on solar panels. So come on up for a day and you can learn how to do it yourself. Alright Scott, should we get out of here?

Scott:

Let’s do it.

Mindy:

That wraps up this episode of the BiggerPockets Money Podcast. He is the Scot Trench. I am Mindy Jensen saying Tooles noodles.

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds. Thanks! We really appreciate it!

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Check out our sponsor page!

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

Discussion about this post