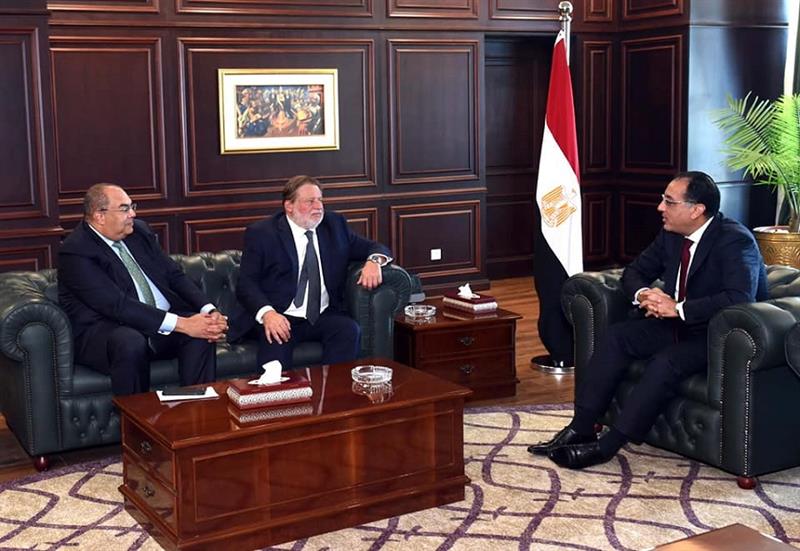

Egypt s Prime Minister Mostafa Madbouly meets with Executive Director at the International Monetary Fund (IMF) Mahmoud Mohieldin and newly-appoint acting governor of the Central Bank of Egypt Hassan Abdallah. Cabinet

In a meeting at the cabinet headquarters in New Alamein, Madbouly asserted that the government is working to strengthen efforts to implement the necessary economic and structural reforms, Cabinet spokesperson Nader Saad said.

This came hours after President Abdel-Fattah El-Sisi issued a presidential decree appointing the Chairman of the Board of Members of the United Media Services Group (UMS) and veteran banker Hassan Abdallah as the acting governor of the Central Bank of Egypt (CBE).

The meeting tackled the latest developments in the current global situation in light of the continuing repercussions of the Russian-Ukrainian crisis and the challenges faced by the countries of the world as a result.

The meeting also reviewed the developments of the ongoing consultations between Egypt and the IMF to reach an expert-level agreement between the two sides, and thus allow support for the Egyptian state’s economic plans in the medium term and contribute to limiting the negative consequences of the global economic conditions on the Egyptian economy.

In March, Egypt submitted a request to the IMF for a new loan in order to keep the gains of the first wave of the country’s economic reforms and to meet the country’s financial needs in response to the global economic challenges amid the ongoing Russia-Ukraine war.

In an earlier meeting on Thursday with the PM, Abdallah asserted that there will be full cooperation and coordination with the government on several issues.

Abdallah added that the relationship between the two sides will be characterised by harmony to achieve the Egyptian state’s goals and plans for sustainable development.

Earlier Thursday in Cairo, the CBE’s Monetary Policy Committee kept the current key interest rates unchanged in its meeting on Thursday.

Accordingly, the CBE’s overnight deposit rate, overnight lending rate, and the rate of the main operation remain unchanged at 11.25 percent, 12.25 percent, and 11.75 percent, respectively.

Short link:

Discussion about this post