The Covid-19 pandemic allowed us to imagine the future while experiencing it. This is the case with blockchain technology, virtual reality and non-fungible tokens (NFTs). The convergence of reality and the future has offered opportunities to continue disrupting specific industries, including the cultural and creative sector.

NFTs are unique digital assets in the form of photography, music, sports memorabilia, collectable items, virtual land and digital art. This form of ownership is underpinned by a decentralised digital ledger of recorded transactions that takes place across a business network known as blockchain technology.

A buyer will receive a verified digital token indicating the artwork’s authenticity. The Ethereum blockchain protocol remains popular because of its sophisticated capabilities, but other protocols are used to mint NFTs, including Polygon, which offers lower transaction costs and considers its effect on the environment by being carbon neutral.

There are various marketplaces where artists can sell, auction and trade their NFT. These include Momint, Magic Eden, Rarible, SuperRare and The Tree, with the most popular being OpenSea.

Founded by Dan Jordan and Trevor Stuurman, the South African-based marketplace The Tree provides artists with a curated entry into NFTs.

Jordan said it is a “digital storytelling platform for African storytellers to make use of the power of blockchain technology to tell and transform their stories into a digital future with a digital legacy behind them”.

The marketplace is also looking into creating mixed reality galley experiences for various audiences.

Stuurman that although sales measures success for an artist, this experience has also “been about pioneering a new space and creating new pathways for the consumption and creation of art”.

NFTs have exploded globally, with the market value standing at more than $3-billion. The Merge, by digital artist Pak, was auctioned off for $91.8-million in December last year, beating the digital artwork Everydays: The First 5 000 Days by Mike Winkelmann, which was sold for $69.3-million in March 2021.

International corporations are also offering NFT experiences. Visa Inc established an NFT creator programme that helps artists to promote their NFTs. Instagram is creating a gallery experience for NFT owners to exhibit their artworks on their profiles, and jewellery company Tiffany’s has created a limited edition of 250 “NFTiffs” for sale.

How do NFTs fare in South Africa?

The recent Finder online survey estimates that NFT adoption could soon reach 17.8% as individuals and organisations participate in immersive technologies such as Web3.

Jordan said: “There isn’t a barrier to entry for Africa to compete on a technological level with the rest of the world because now all I need is a cell phone and a relatively strong internet connection, and I can take part in this NFT conversation with world-renowned digital artists.”

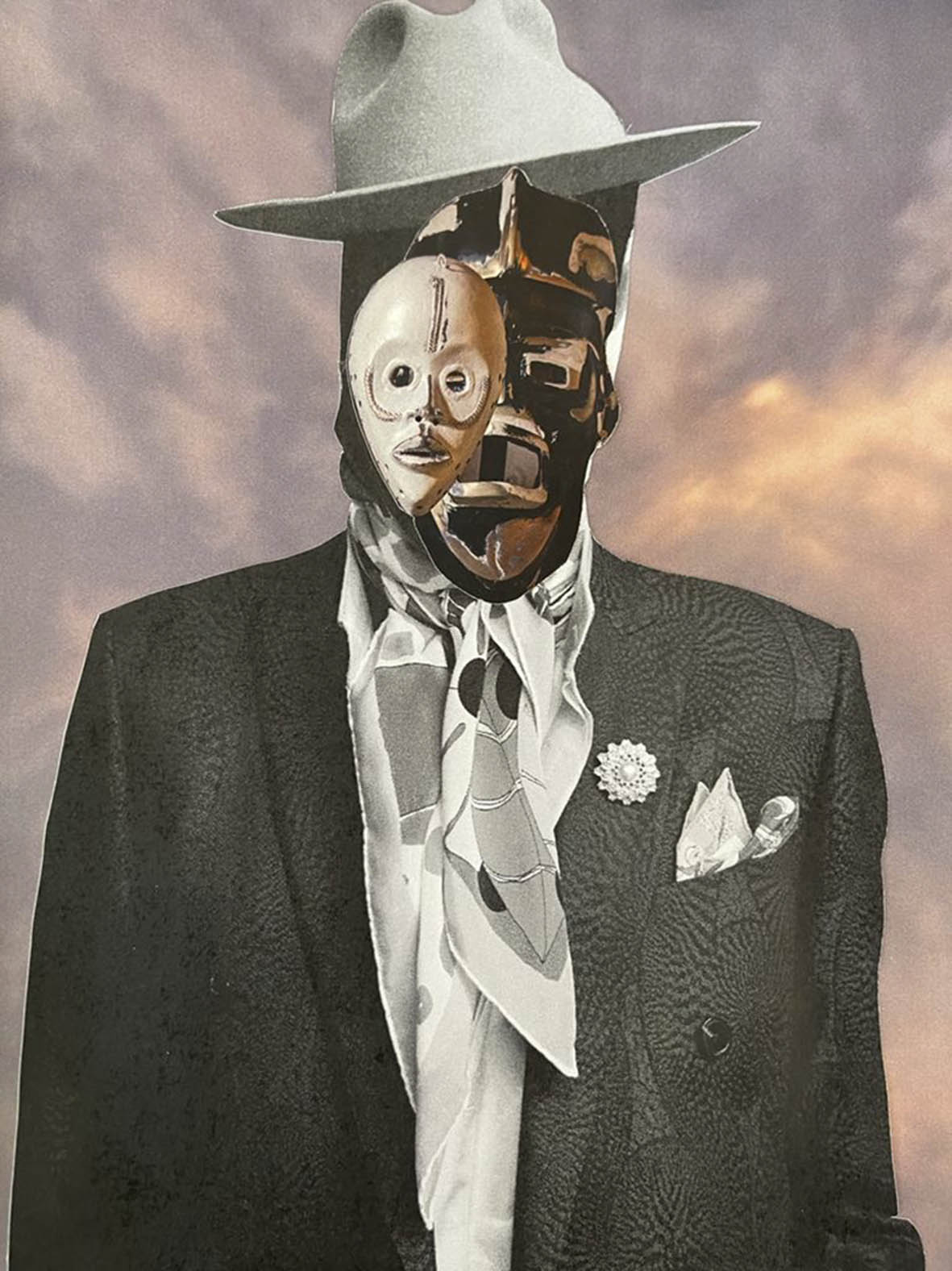

The first NFT sold in South Africa was by Norman O’Flynn and retailed at $35 000 in April last year. Other artists such as Fhatuwani Mukheli, Jan-Hendrik Viljoen, Phumulani Ntuli and JP Meyer have also dabbled in NFTs with varying success.

Through the innovative Out of Africa NFT collection, created by the Invictus NFT Lab, top artists displayed 118 NFT representations of physical artwork to bridge the divide between physical and digital artwork using OpenSea as their NFT marketplace.

While the artists could sell their physical artwork, the innovation stems from the NFT collection built on Ethereum allowing the digital artwork creation and ownership to be verified. The ability for the buyer to purchase both the physical and digital artwork shows the importance of bridging the two worlds.

Printmaker and contemporary artist Lerato Lodi said: “The Out of Africa collection opportunity has opened my realm of possibilities as an artist. Being featured in the collection among other established artists gave me the confidence to know I was engaging in something unique and interesting.”

Photographer and artist Musa N Nxumalo said: “It’s almost like another world and I feel that in time, as it grows and makes more sense to the ordinary guy, then one might think it [purchasing the NFT]. The collection was centred on the artist and what I enjoyed about the process was that the buyer will also get the physical art, which is a plus for me, as it is about what the artist has created physically.”

Although NFTs are sold on auctions, Nxumalo said: “As its prices grow, we signed a thing where artists will be paid royalties as the NFT is re-sold, which, if you think about it, in the normal art world and the secondary market, once I sell my work and if it goes to the secondary market, whatever the art is sold at the artist is out of the picture, which is a problem for artists from a financial sustainability perspective.”

The process of selling art by connecting artists with audiences, instead of working through an art gallery, has its perks. In the case of NFTs, the benefits are through the creation of “smart contracts” with instructions where each time the NFT is sold, a percentage of the sale in the form of royalties goes to the artist who created the work.

The NFT market in South Africa is at an early stage and opportunities to sell NFTs are limited.

Lodi said that although she has not been able to sell her NFT artwork, The Gathering, the experience has shown her the potential of NFTs. Mukheli shared similar sentiments: “It’s a new and exciting platform, and the earlier you start, the better the financial side of it. It’s being able to have my work in a platform that is the future and having it accessible to anyone who understands the NFT space.”

But some caveats exist. Given the lack of interoperability between the different blockchain protocols and NFT marketplaces, the convergence of reality and the future has led to creating physical, legal contracts as a backup if the instructions in the smart contract are not fulfilled.

Furthermore, the current volatility in the NFT space has created opportunistic chances for market manipulation, hence the need for a progressive regulatory framework for the enforcement of smart contracts, establishing standards and norms, upholding the artists’ intellectual property rights and reducing fraud risks.

Lockdown regulations and social distancing have forced artists to become more intentional in curating their artworks using social media platforms such as Instagram, Twitter and Pinterest for audience development and potential business. A lot of potential could be realised in ensuring that artists’ copyright is protected and the means to profit off art is done in a unique manner that once might have never been considered five to 10 years ago.

As the NFT market matures, it is essential to understand that NFT is not art but rather a possible conduit toward democratising the art experience for artists and their audiences. Art reflects the times, and the maturity of NFTs will depend on the adoption of immersive technologies and enhanced social commentary.

Digital art as a form of disruptive innovation and how it’s packaged will fundamentally change how we view and experience the arts sector.

This article was produced as part of a partnership between the Mail & Guardian and the Goethe-Institut, focusing on sustainability and the arts.

Discussion about this post