Absa Bank Kenya is targeting at least 600 women entrepreneurs with free investment readiness training in partnership with Melanin Kapital and the African Guarantee Fund (AGF).

The programme, dubbed Tuungane 2x na Absa, comes amid numerous challenges faced by women entrepreneurs including limited funding, balancing responsibilities, inadequate support systems, and limited business knowledge, among others.

Painting a picture of the local scene, the International Finance Corporation (IFC) recently noted that despite women in Kenya having the potential to become equal contributors to the country’s GDP (gross domestic product) and economic growth in general, they only form 33 per cent of the total SMEs.

Absa Kenya Director for Business Banking Elizabeth Wasunna said the long-term capacity building programme has come at a time when women SMEs also contend with unique financial constraints such as inflation, rising dollar rates and various global shocks that are affecting their operations and services.

“As a partner for their growth, we have maintained focus on addressing the systemic barriers that stunt their growth through different channels, including strategic pacts that bring their possibilities to life,” she said.

Risk-sharing mechanisms

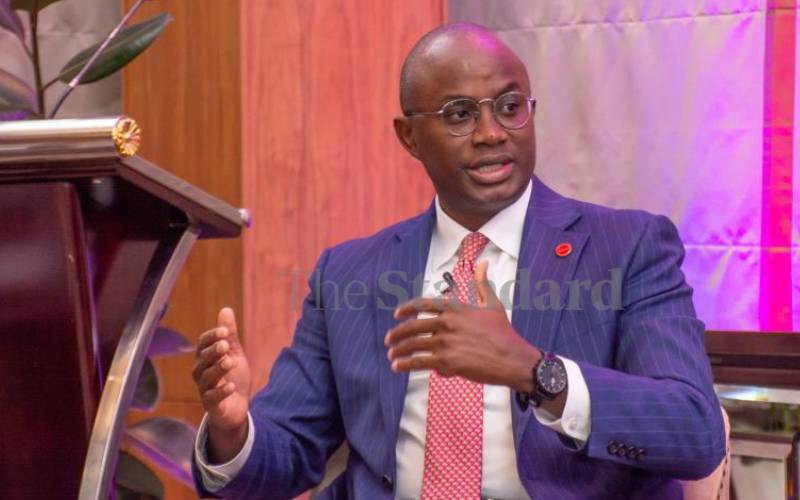

AGF Director for Structured Finance Nishdeep Sethi said the fund will provide financial institutions such as Absa with risk-sharing mechanisms that enable the same to increase their lending to women-owned SMEs across the continent.

“With a presence in 40 African countries, AGF has unlocked more than Sh300 billion ($3 billion) in financing for small and medium-sized enterprises (SMEs). Cumulatively, about 30,000 SMEs have gained access to income-enhancing loans which are estimated to have generated nearly Sh600 billion ($5 billion) in incremental income,” she added.

Melanin Kapital Chief Executive Melanie Keïta noted that the firm seeks to leverage its growing women empowerment platform to make a difference in the lives of the small businesses seeking to come on board.

Discussion about this post