Today’s Animal Spirits is brought to you by Future Proof:

See here to register for Future Proof in September 2024!

We are hiring!

- See here for opportunities

On today’s show, we discuss:

Listen here:

Recommendations:

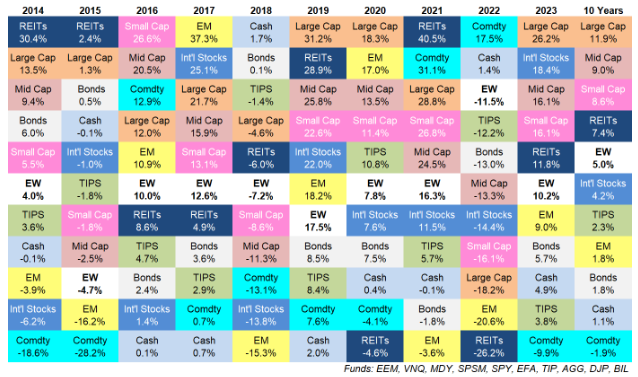

Charts:

Tweets:

1/3 – Brief ETF trading volume thread

There are ETFs that “T” a LOT and those that don’t.

Here’s a look at the Top 20 U.S.-listed ETFs ranked by average daily ’23 AUM showing total value traded in ’23, turnover (avg. daily AUM/total value traded), and avg. “holding” period. pic.twitter.com/o0iiAUyR4L

— Ben Johnson, CFA (@MstarBenJohnson) January 8, 2024

The correct answer is $120,000. Thanks for all your guesses, and congrats to a few of you (@upzone_CA @mmoooose @idobadtakes @WilliamRFuqua @CatgirlCrude) that got it correct

Census ACS puts it at $120,704, while Census CPS ASEC says $122,400.

— Jeremy Horpedahl 🤷♂️ (@jmhorp) January 8, 2024

“63% of Americans do not have $500 in the bank to pay for an emergency healthcare bill.”

This is inaccurate.

Median household net worth is $192k, including $8k in checking accounts. https://t.co/DSrqyhig8K

— Matt Darling 🌐🏗️ (@besttrousers) January 6, 2024

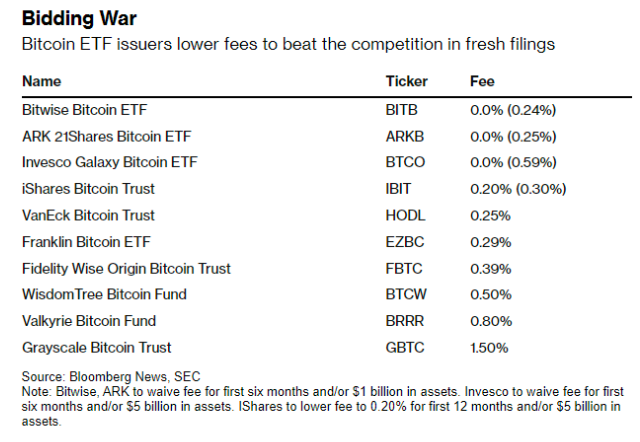

WOW: This morning was wild for #Bitcoin ETF filers. Here’s the state of play on the fee war front. Lowest long term fee is @BitwiseInvest at 0.24% followed closely by @vaneck_us at 0.25%. But we also have fee waivers on 3 for 6 months down to 0.0%. Plus BlackRock waiver to 0.20% pic.twitter.com/8bfhtFHOfH

— James Seyffart (@JSeyff) January 8, 2024

It costs less to hold a Bitcoin ETF for a year than a single trade on Coinbase. (~40-60bps vs ~25bps for a retail size trade)

The “ETF terrordome” has arrived, as @EricBalchunas would say.

— Gabor Gurbacs (@gaborgurbacs) January 8, 2024

not predicting how this is going to play out and NFA

but below is the Gold chart post-ETF launch

*If* TradFi is interested in buying $BTC – they will now have a friendly vehicle to do so starting next week pic.twitter.com/N1y4WeX7pi

— Matias | AssetDash 🏁 (@mattdorta) January 6, 2024

Percent of Americans who owned a home in 1950: 40%.

Percent who own a home now: 66%.Percent who owned a car in 1950: 50%.

Percent who own a car now: 91%.Percent who had a college degree in 1950: 5%.

Percent who have a college degree now: 44%. https://t.co/N3jE5XhL5L— Matthew Chapman (@fawfulfan) January 9, 2024

Contact us at animalspirits@thecompoundnews.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.

Discussion about this post