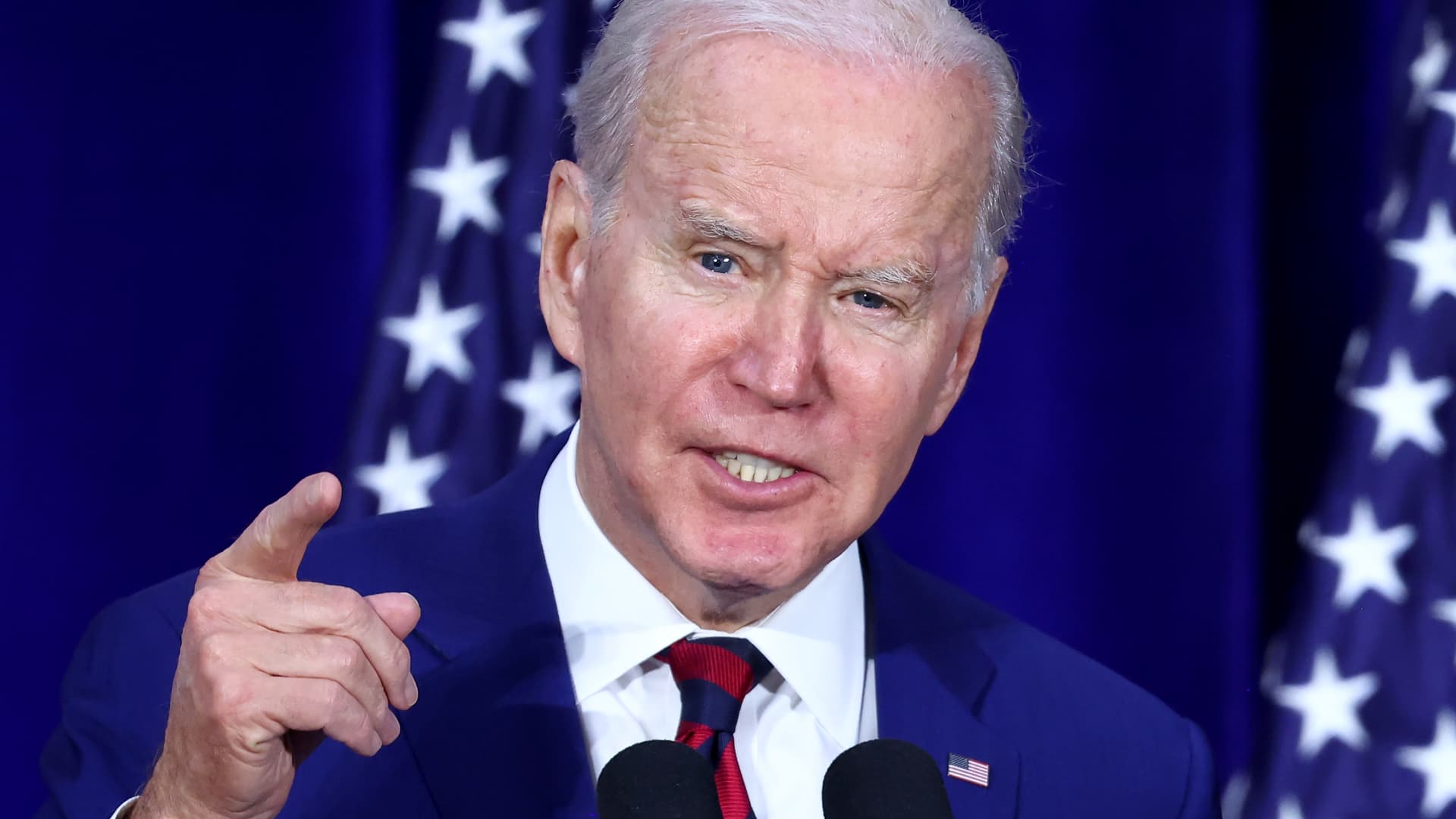

President Joe Biden called on Congress to give regulators more authority to claw back pay and penalize executives at distressed banks “whose mismanagement contributed to their institutions failing.”

“No one is above the law – and strengthening accountability is an important deterrent to prevent mismanagement in the future,” Biden said in a statement Friday, days after federal bank regulators stepped in to guarantee deposits at two banks that failed over the weekend. “When banks fail due to mismanagement and excessive risk taking, it should be easier for regulators to claw back compensation from executives, to impose civil penalties, and to ban executives from working in the banking industry again.”

Biden noted his powers to hold executives accountable were constrained by the law and asked Congress step in.

“Congress must act to impose tougher penalties for senior bank executives whose mismanagement contributed to their institutions failing,” Biden said.

The president is asking Congress to broaden the Federal Deposit Insurance Corporation’s ability to claw back compensation, including from the sale of stocks, from executives at failed banks. The White House said SVB’s CEO reportedly sold more than $3 million in shares mere days before the FDIC took it over. Under current Dodd-Frank legislation, the FDIC only has the ability to recoup these funds at the nation’s largest financial institutions, not large and medium sized banks like the ones that failed over the weekend.

Biden also called on Congress to expand the FDIC’s authority to bar executives whose banks are under receivership from working in the banking sector and bring fines against executives of failed banks. All three of the White House’s proposals seek to penalize banking executives for the risky behaviors leading up to the bank failures.

The nation’s top bank regulators on Sunday announced the FDIC and Federal Reserve would fully cover deposits, including those above the $250,000 limit covered by traditional FDIC insurance, at both failed banks: Silicon Valley Bank and Signature Bank. The agencies noted that Wall Street and large financial institutions — not taxpayers — to foot the bill through a special fee assessed against federally insured lenders.

A majority of SVB’s customers were small tech companies, venture capital firms and entrepreneurs who used the bank for day-to-day cash management to run their businesses. Those customers had $175 billion on deposit with tens of millions in individual accounts. That left SVB with one of the highest share of uninsured deposits in the country when it collapsed, with 94% of its deposits landing above the FDIC’s $250,000 insurance limit, according to S&P Global Market Intelligence data from 2022.

The SVB failure was the nation’s largest collapse of a financial institution since Washington Mutual went under in 2008. Signature Bank in New York, which was shuttered Sunday over similar fears its failure could pull other institutions down with it, had been a popular funding source for cryptocurrency companies.

The Federal Reserve also loosened its borrowing guidelines for banks seeking short-term funding through its so-called discount window. It also set up a separate unlimited facility to offer one-year loans under looser terms than usual to shore up troubled banks facing a surge in cash withdrawals. Both programs are being paid for through industry fees, not by taxpayers.

The president stressed the actions taken over the weekend were necessary to prevent further economic fallout but did not use taxpayer funds.

“Our banking system is more resilient and stable today because of the actions we took,” Biden said. “On Monday morning, I told the American people and American businesses that they should feel confident that their deposits will be there if and when they need them. That continues to be the case.”

Treasury Secretary Janet Yellen took questions from members of the Senate Banking Committee on Thursday about the moves taken to date to contain the damage. She stated not all depositors will be protected over the FDIC insurance limits of $250,000 per account as they did for customers of the two failed banks.

Members of Congress are currently weighing a number of legislative proposals intended to prevent the next Silicon Valley Bank-type failure.

One of these is an increase in the $250,000 FDIC insurance limit, which several senior Democratic lawmakers have called for in the wake of SVB’s collapse. Following the 2008 financial crisis, Congress raised the FDIC limit from $100,000 to $250,000, and approved a plan under which big banks contribute more to the insurance fund than smaller lenders.

Like the White House, Congress has limited power as to what it can do to punish individual executives of failing banks, because courts are the venue where the law imposes penalties on those found guilty of wrongdoing.

A bill has already been introduced in the Senate, in response to the SVB collapse, that seeks to claw back two forms of compensation from top executives at failed banks: Bonuses and profits from stock sales.

On Tuesday, Sen. Richard Blumenthal, D-Conn. introduced a bill, S. 800, that would amend the IRS rules to impose a higher tax rate on bonuses and profits from selling stock options for executives at banks that have been taken over by the FDIC.

By Friday morning, the bill had picked up one influential co-sponsor: Sen. Kyrsten Sinema, I-Ariz. As a swing vote within the Democratic caucus, Sinema’s support is seen as important in getting any bill in the Senate passed if Republicans oppose it.

Discussion about this post