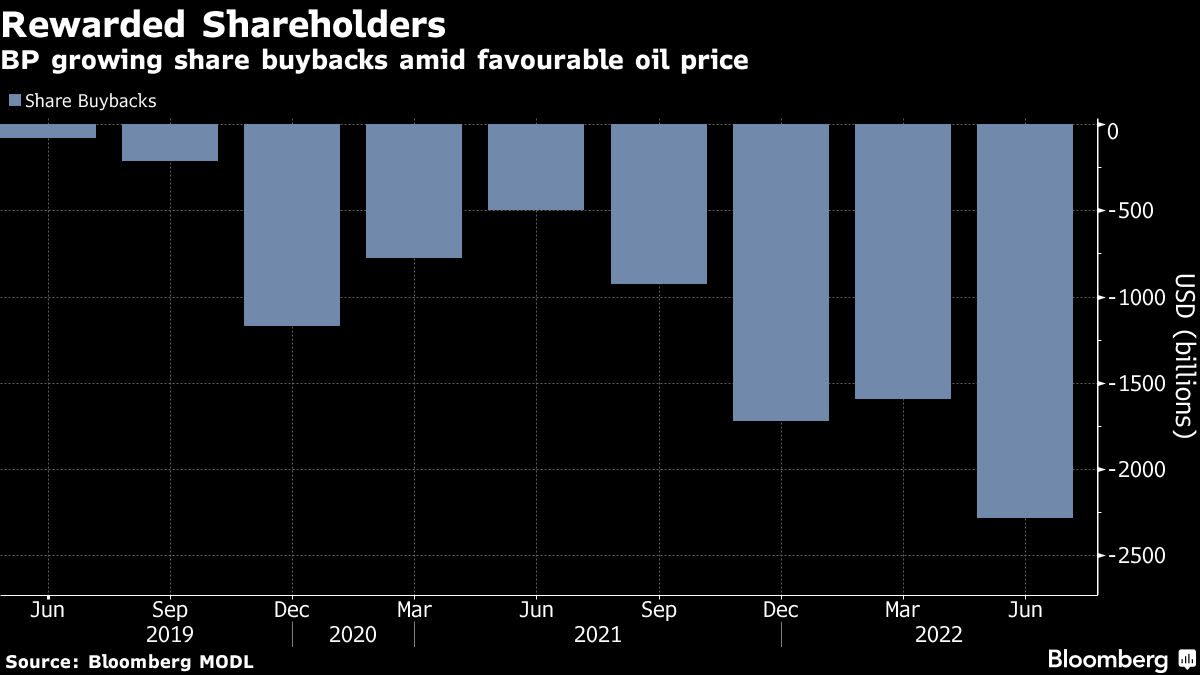

(Bloomberg) — BP Plc hiked its dividend and accelerated share buybacks to the fastest pace yet after profits surged.

Most Read from Bloomberg

The oil and gas industry is boosting returns to shareholders as the cash rolls in, even while the energy crisis triggered by Russia’s invasion of Ukraine threatens the global economy. BP said it expects prices to remain high and highlighted its investments in additional supplies.

“Today’s results show that BP continues to perform while transforming,” Chief Executive Officer Bernard Looney said in a statement on Tuesday. The company is “providing the oil and gas the world needs today — while at the same time investing to accelerate the energy transition.”

Following in the footsteps of most of its peers, the London-based company said it will repurchase $3.5 billion of shares over the next three months, adding to the $3.8 billion it already bought back in the first half. It also increased its dividend by 10%.

Shares of the company rose 4.1% to 408.6 pence as of 8:01 a.m. in London.

BP’s second-quarter adjusted net income was $8.45 billion, the highest since 2008 and comfortably beating even the highest analyst estimate. This wasn’t just driven by high crude and natural gas prices — the company’s refineries earned strong margins and its oil traders delivered an “exceptional” performance.

The dividend was increased to 6 cents a share, an improvement from a previous commitment to raise the payout by around 4% annually through to 2025. Net debt fell to $22.82 billion at the end of the period, down from $32.7 billion a year ago.

The oil sector’s sky-high profits come at a politically tricky time for an industry accused of profiteering from the fallout from Russian President Vladimir Putin’s aggression, while also failing to invest enough in new drilling. Alongside its earnings statement, BP published an extensive list of investments it is making in the UK, where the rising cost of energy has become a hot political issue and the North Sea oil and gas industry has already been hit by a windfall tax.

With recession fears gathering pace, there has been speculation that the second quarter could end up marking the high point for Big Oil this year. BP said it expects oil and natural gas prices, and refining margins, to stay high in the third quarter because of disruptions in Russian supply, relatively low inventories and reduced spare capacity.

(Updates with share price in fifth paragraph.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Discussion about this post