Tax experts in the country have been asked to bring their expertise to bear on sustainable voluntary tax compliance among Ghanaian taxpayers.

Dr Yaw Osei Adutwum, the Minister for Education, who made the call explained that there was the need for all Ghanaians and other sector players in the country to support the Ghana Revenue Authority (GRA) and the State to achieve improved and sustainable revenue mobilization to support the nation’s collective socio-economic development.

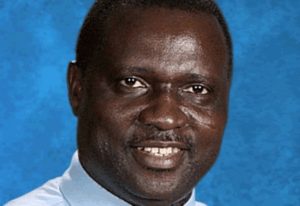

Dr Adutwum made the call in an address read for him by Dr Eric Nkansah, Director in charge of Tertiary Education at the 2022 Chartered Institute of Taxation Ghana graduation, orientation and induction ceremony in Accra.

The event saw 83 graduating after completing the Institute’s qualifying examinations in February 2022 while 72 newly qualified chartered tax practitioners who have already completed the mandatory post-qualifying working experience were inducted into membership of the Chartered Institute of Taxation, Ghana.

He said, “the Government has intensified efforts to transform the face of education right from the basic level through to tertiary, and in the last five years, it has vigorously implemented bold reforms and policies aimed at improving education standards and widening skills acquisition in Ghana.”

The Minister stated that the collaboration and support from various stakeholders including the CITG to date played a crucial role in human capital development and to a large extent provided technical assistance on various policy issues and reforms within the taxation sector and had quickened achievements in the sector.

“With the world transitioning to a digital economy, and with digitalization at the forefront of the Nana Addo Dankwa Akufo Addo-led government’s transformation agenda, we need to intensify partnerships to step up efforts in offering digital skills training and capacity building for human talent across various sectors of the Ghanaian economy,” he said.

A speech read on behalf of Dr Anthony Oteng Gyasi, the Board Chairman, GRA ,commended the Vice President, Dr Mahamudu Bawumia, for his effort toward digitalizing the nation’s economy.

He said the GRA had embarked on several policy initiatives to improve its processes and procedures to facilitate revenue mobilization.

The Board Chairman mentioned the introduction of the innovative Cashless policy which ensured that taxpayers pay taxes either through the banks or online as one of such initiatives which would not only create convenience for taxpayers but also positively affected efficiencies at the Authority.

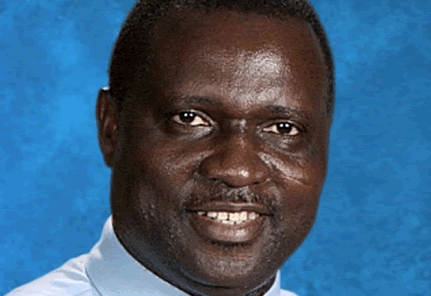

Mr George Ohene-Kwatia, the President of the CITG, said, “we take great pride in developing impactful professionals who care and are passionate about the impact they make in society wherever they are located”.

Mr Ohene-Kwatia indicated that the digitization of economies across the globe required laws and regulations to enhance effective tax administration and called for tax reforms to match the digitized economies.

Source: GNA

Discussion about this post