Searching for travel insurance? If you’re traveling long-term, you might have come across Genki travel insurance.

This insurer offers comprehensive coverage for travelers who are away from home for extended periods of time, so let’s take a closer look at what Genki has to offer.

In this Genki review, we’ll look at their policies to help you decide if it’s the right travel insurance for you.

We’ll provide information about Genki, how it works, who it is for, and more.

By the end of our review, you’ll know everything you need to know about Genki insurance.

What Is Genki?

Genki provides health insurance for long-term travelers such as digital nomads and backpackers.

You can get coverage from one month up to two years with a monthly subscription that you can cancel anytime.

How Does Genki Work

You can get a free quote on Genki by entering your personal information, date of birth, home country, and departure date.

Then, you’ll get to make a few decisions that could impact the price of your insurance.

Their pricing depends on three main things:

- Your age

- The region you’re visiting

- The deductible you choose

Regarding deductibles, you’ll get two options:

- Everything will be paid in full.

- A deductible of €50 will apply per case.

Once you find a policy that suits your needs, you can go ahead and set up an automatic monthly payment that you can cancel anytime.

Now, let’s take a look at what is covered by the Genki World Explorer plan.

Genki World Explorer Coverage

In this section, we’ll explore what is insured by Genki.

- Medical treatment everywhere

- Covid-19

- Sports injuries for sports that are not excluded under dangerous activities

- Assistance and direct billing

- Hospital visits

- Medical transport

- Repatriation

- Pregnancy

- Emergency dental treatment

- Initial mental issue treatment

- Medication and materials

As you can see, Genki Insurance is more health insurance than travel insurance as it doesn’t cover baggage issues, trip cancelations, etc.

If you wish to learn more about the policy, you can read the full details on Genki’s website. When starting the free quote, you can see all terms and conditions.

Where Are You Covered?

When it comes to coverage, you get to choose between two options:

- Worldwide

- Worldwide excluding Canada and the USA

The Worldwide option gets you covered in every country. Although, it’s important to note that the coverage in your home country is limited.

The second option is exactly the same, but with covers in Canada and the United States limited to 6 weeks per 180 days.

What Is Not Insured?

As in any insurance, some things are not covered. Here are the things that Genki Insurance doesn’t insure:

- Pre-existing conditions

- Dangerous activities like motorcycle and car racing, parachuting, paragliding, bungee jumping, base jumping, mountaineering, free climbing, and diving

- Accidents and illnesses caused by excessive consumption of alcohol or drugs

- Anything not medically necessary

Deductible

As mentioned before, you get two options when it comes to deductibles.

- Everything will be paid in full.

- A deductible of €50 will apply per case.

Coverage In Your Home Country

The coverage in your home country is limited to 6 weeks per 180 days and only includes accidents or life-threatening emergencies.

Waiting Period

The first 14 days of coverage are limited to accidents and life-threatening emergencies.

While you can still purchase Genki after departure, this will limit the attempts to get insurance for unnecessary medical treatments.

Who Is Genki For?

Genki is an excellent medical insurance for long-term travelers, digital nomads, and backpackers.

That said, it’s important to note that depending on your age, the plan price will change. At the moment, Genki only covers travelers up to 49 years old.

We’ll discuss pricing in the next section, so keep reading to learn more.

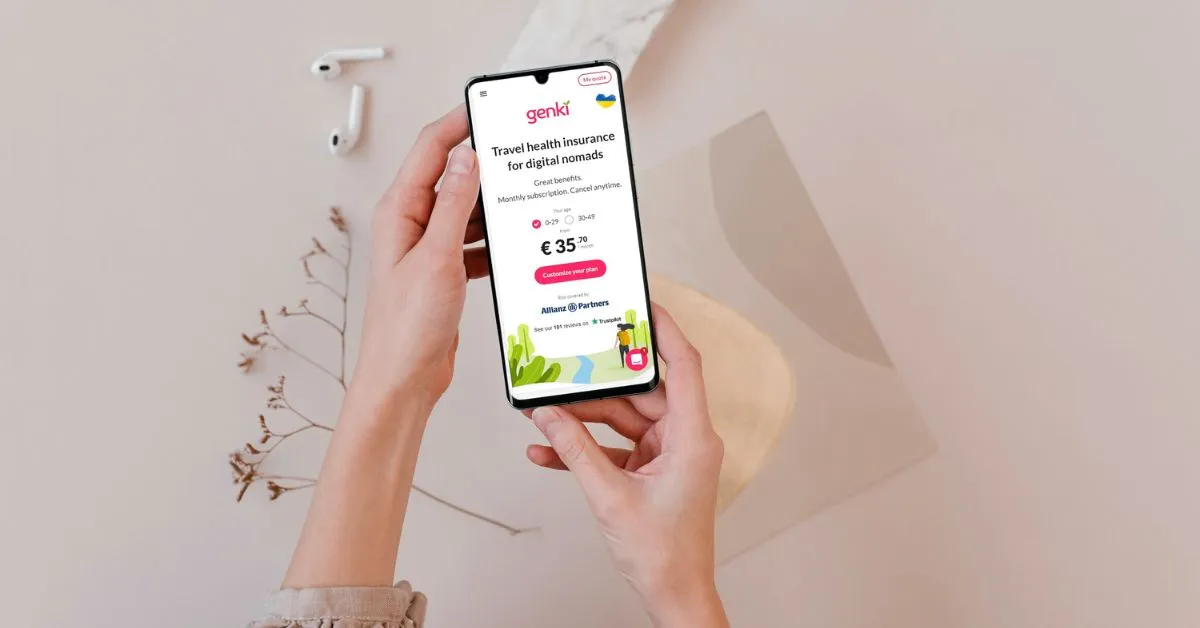

Genki Plans And Costs

Let’s take a look at the plans offered by Genki and, more importantly, what you expect in terms of pricing.

The pricing depends on your age, regions covered, and deductible option.

In short, the price starts at €35.70 per month but can change depending on the options chosen. Let’s have a look!

Here’s the price per month if you’re between 0-29 years old:

- Worldwide (excluding Canada and the USA) with a €50 deductible: €35.70

- Worldwide with a €50 deductible: €72.30

- Worldwide (excluding Canada and the USA) with no deductible: €45

- Worldwide with no deductible: €83.10

Here’s the price per month if you’re between 30-49 years old:

- Worldwide (excluding Canada and the USA) with a €50 deductible: €54.60

- Worldwide with a €50 deductible: €108.60

- Worldwide (excluding Canada and the USA) with no deductible: €65.10

- Worldwide with no deductible: €128.70

Now, when it comes to payment, you’ll have to pay the first month immediately. Then, the automatic monthly payments will start one month after your cover starts.

You can pay with a credit or a debit card.

Pros And Cons

Now, let’s take a look at the pros and cons of using Genki when traveling.

Pros

- You can purchase insurance even if you’re already on a trip.

- The price is very affordable compared to most insurance providers.

- The insurance can cover you everywhere in the world if you pick the Worldwide option.

- You get limited coverage in your home country for 6 weeks per 180 days.

- Even if you pick the option with the €50 deductible, it’s still affordable compared to other providers, like SafetyWing.

Cons

- There is no coverage after 49 years old (for the time being).

- There’s no “travel coverage” that can help with luggage or trip cancelations issues.

- The coverage doesn’t include dangerous activities like scuba diving. If you decide to go ahead with Genki, purchase insurance with the scuba diving center to cover your dives.

How Does Genki Compare To Other Travel Insurance Providers?

In my opinion, Genki is more of health insurance than travel insurance as it doesn’t cover issues with luggage, personal items, or flights.

That said, a few things set Genki apart from other travel insurance providers:

- The price is affordable, especially for long-term travelers.

- You can buy insurance after departure, and you can cancel anytime.

- Genki can offer coverage everywhere in the world.

- You get coverage in your home country for 6 weeks per 180 days.

How To Buy Genki Insurance

Buying Genki travel insurance is straightforward. First, head to the website and pick a plan according to your age. Then, enter your personal information to receive a free quote.

You can decide what coverage you’d like and remove the deductible if you wish. Then, you can proceed to buy the insurance.

Once the trip starts, you’ll have automatic monthly payments, and you can cancel anytime.

Genki Vs SafetyWing: Which Is Better?

Genki and SafetyWing are two providers aiming to protect long-term travelers.

Let’s take a look at their main differences:

- Price: Genki is more affordable per month, but only if you’re less than 29 years old. Once you’re more than 30 years old, SafetyWing becomes cheaper.

- Coverage: Genki can cover you everywhere in the world, while SafetyWing has a few exceptions, like Cuba, Iran, Syria, and North Korea.

- Deductible: Genki offers a €50 deductible on its plans and a no-deductible plan, while SafetyWing has a deductible of $250.

- Automatic monthly payments: Genki charges you on the same day each month, while SafetyWing charges you every 28 days, resulting in 13 times per year instead of 12 times per year. That said, you may want to add the sums up to see which one is cheaper.

- Travel coverage: Genki covers medical issues but doesn’t cover travel delays, trip interruptions, or luggage issues. SafeyWing offers travel coverage too.

So, which one should you pick?

It depends on your needs, budget, and the type of coverage you’re looking for.

If you need travel protection like flight delays or luggage coverage, SafetyWing might be a better choice. You can learn more by reading our complete SafetyWing review.

If you’re on a tight budget and need medical insurance, Genki is your best bet.

Final Thoughts On Genki Insurance

Genki is a great option for budget-conscious travelers who need medical insurance. The price is affordable, and you don’t have to pay extra for coverage in your home country.

That said, Genki is not really a travel insurance as it doesn’t cover trip delays or lost luggage.

If you’re looking for a full-fledged travel insurance provider, take a look at SafetyWing.

If you’re happy with the coverage offered by Genki, head to the website, pick a plan according to your age, and get coverage. It’s fast and straightforward!

Planning a trip soon? Read one of the following guides:

Discussion about this post