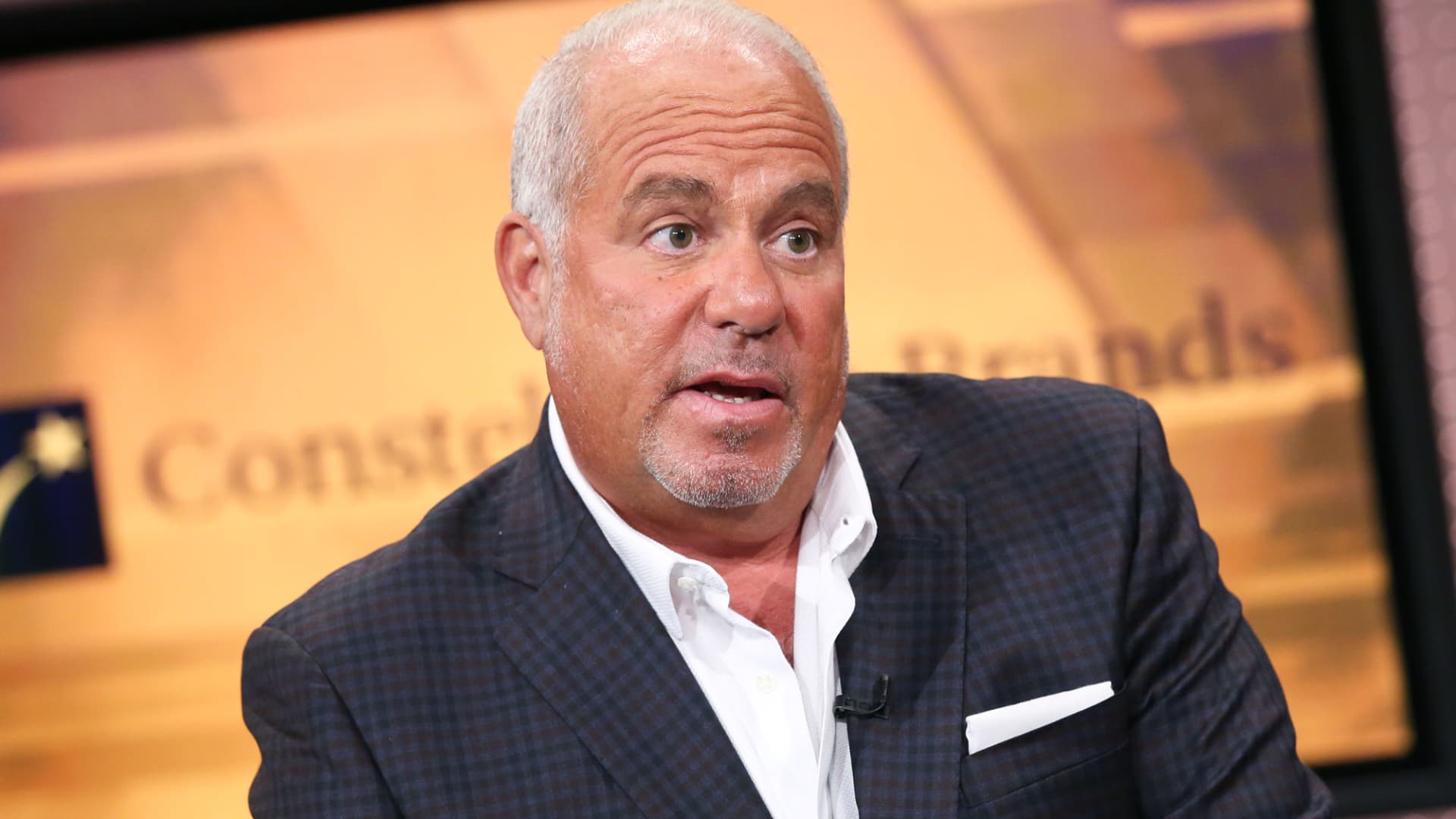

Shares of Constellation Brands will get a boost as demand for beer remains strong, according to BMO. Analyst Andrew Strelzik initiated coverage of Constellation Brands with an outperform rating, saying that the parent company behind imported Mexican beer brands Modelo and Corona in the U.S. will continue to see strong demand for its products. “We have seen no signs of slowing consumer spending on STZ’s key beer brands and expect continued resiliency,” Strelzik wrote. “Despite evidence of changing consumer behavior in other food/beverage categories, measured channel data for STZ’s beer brands and Mexico beer import data remains consistent with — if not ahead of — prior months. We expect continued resiliency.” The analyst expects Constellation Brands has “ample room” to expand distribution outside of its core region, and sustain strong sales of beer in the coming years. This supports a view that there is potential upside to the company’s beer revenue guidance. “We believe STZ is an attractive investment with favorable risk/reward as it balances a solid multi-year growth outlook with a valuation discount to peers that is too wide. We see potential upside to FY23 Beer revenue guidance and expect EPS growth to reaccelerate in FY24,” Strelzik wrote. Constellation has a $290 price target, implying roughly 20% upside from Monday’s closing price of $244.15. The stock has outperformed the broader market this year, falling just 2.7%. —CNBC’s Michael Bloom contributed to this report.

Discussion about this post