Kim Moody: Poorly trained auditors, risible decisions are taking away from the essential work the tax agency performs

Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Article content

When I attend social events and introduce myself as a tax professional, the conversation often turns to the Canada Revenue Agency.

When asked about it, I like to explain that the Canada Revenue Agency (CRA) simply administers the laws that politicians and the Department of Finance draft and ultimately bring to Parliament to enact. It performs a critically important function, since without it the laws would be meaningless and there would be no funds to ensure that various levels of government can carry out their duties.

Advertisement 2

Article content

Despite such explanations, it is common for my new acquaintances to expound negatively about the CRA or state that they are scared to interact with its representatives.

Such views are consistent with the distrust of tax collectors that seems to have been in fashion since biblical times. In the New Testament, in particular, they are portrayed negatively, likely due to their association with the oppressive Roman government and because they apparently had a habit of collecting more than what was owed.

I think it’s fair to say that views about government tax collectors have improved since Roman times, but people still hold deeply personal, mostly negative, views about such agencies.

Personally, I’m agnostic about the CRA. I don’t hold negative or positive views, but instead continue to respect it for the critically important job it does.

Over my 30-year career as a tax advisor, I have seen both the good and the bad.

On the “good” side, I’ve had the pleasure of working with some of the most talented and dedicated public servants who truly care about Canada. They make a difference. Often the “good” involves getting to an answer quickly, courteously and efficiently with the CRA’s help. An audit that is done efficiently and effectively is also “good.”

Article content

Advertisement 3

Article content

The “bad” involves stories of public servants who are poorly trained, use their “power” to purposely intimidate taxpayers, conduct very poor audits and form conclusions that are laughable, forcing the affected taxpayers to spend time and money challenging the decisions.

On balance, my historical experience with the CRA has been positive. It’s not easy to run a behemoth that is beholden to the government of the day.

Lately, however, the “bad” experiences are starting to become much more common than the “good.”

In chats with my colleagues across Canada, many are in agreement. This shifting attitude comes despite the CRA’s headcount growing from 40,059 people in 2015 to 59,155 people this year — an increase of 47.6 per cent. Every time I review those figures, I shake my head at such massive increases.

Although it is a simplistic comparative, the U.S. equivalent to the CRA, the Internal Revenue Service (IRS), had 82,990 employees as of 2023.

With a population of roughly 336 million, that is the equivalent of one IRS employee for every 4,049 U.S. residents. In Canada, with a population of roughly 40 million, we have one CRA employees for every 676 residents — or roughly six times more tax employees on a per capita basis.

Advertisement 4

Article content

I’d like to understand the reason. Is the CRA overstaffed? Is the IRS understaffed? My guess is that it’s a combination of both. Notwithstanding, for reasons that I discuss below, I think the CRA can do better.

With increased headcount and resources, I would expect the CRA would be providing significantly improved services to Canadians, but that simply has not been the case. Yes, the electronic services have improved over time, but still lag the private sector, with security often being the primary reason for such slow advancement.

Some of the “bad” experiences that I have experienced lately include audits of taxpayers that are laughable. One such audit involved a holding company that has significant financial assets due to a prior sale of a business. Besides cash and marketable securities, the only other asset of the business was a non-financial property that represented 0.015 per cent of the total assets. The non-financial property’s revenues were the only thing subject to GST considerations and filings. The accounting records of this company are squeaky clean.

Advertisement 5

Article content

The audit started out as a GST audit with a 20-page questionnaire. It has grown to numerous video and phone calls with the auditor (who is obviously working from home with multiple distractions in the background) and, more than 18 months later, with zero adjustments (which is not a surprise), the auditor is still convinced that there is something to find. The case is an example of an inexperienced, poorly trained and guided auditor who has spent countless hours searching for a needle in a haystack, even though the needle doesn’t exist. While I appreciate that the CRA has the right to — and frankly should — review taxpayers’ affairs, there should be a level of practicality and common sense applied to reviews so as to protect Canadians’ assets and not waste available resources.

Other “bad” experiences include the ever-prolonged wait times to contact a CRA representative despite hundreds of millions of dollars in recent budgets to address the problem; the way foreign tax credits are processed by the CRA (especially for those who have U.S. taxes paid and have claimed such taxes as a credit); the very long processing times for routine adjustments to individual and corporate tax returns; audits of the claiming of small business deductions that are aggressive and non-sensical; and many other frustrating experiences.

Advertisement 6

Article content

While the CRA annually publishes its “Service Standards,” such standards do not deal with many of the common frustrations above.

Recommended from Editorial

-

Canadians are wasting money to deal with recent tax changes

-

Details on capital gains released, but Canada is still in bad shape

-

Canadians not getting enough value for their tax dollars

As with those I meet at social events, I know that it is almost too easy to criticize the CRA. But it’s not constructive. The harder thing is to actually try to improve the beast of an agency and ensure Canadians are getting good value for their money.

Instead of continuous self-reviews, I think it would be good and proper for the CRA to be subject to a thorough and independent review with mandated adherence to the recommendations provided.

Tackling the recent rise of “bad” CRA experiences will benefit all Canadians — and the CRA itself.

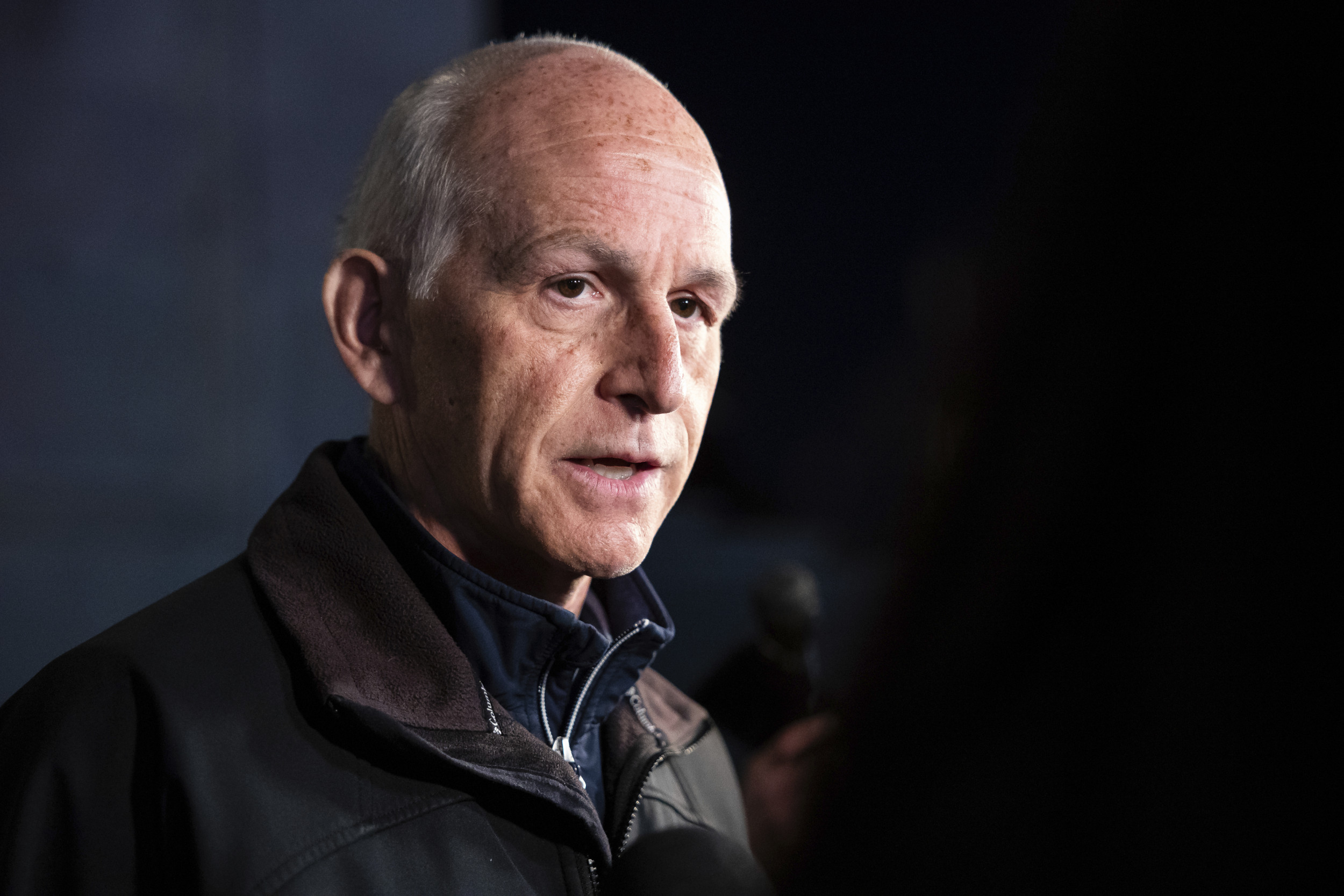

Kim Moody, FCPA, FCA, TEP, is the founder of Moodys Tax/Moodys Private Client, a former chair of the Canadian Tax Foundation, former chair of the Society of Estate Practitioners (Canada) and has held many other leadership positions in the Canadian tax community. He can be reached at kgcm@kimgcmoody.com and his LinkedIn profile is https://www.linkedin.com/in/kimgcmoody.

_____________________________________________________________

If you like this story, sign up for the FP Investor Newsletter.

_____________________________________________________________

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Discussion about this post