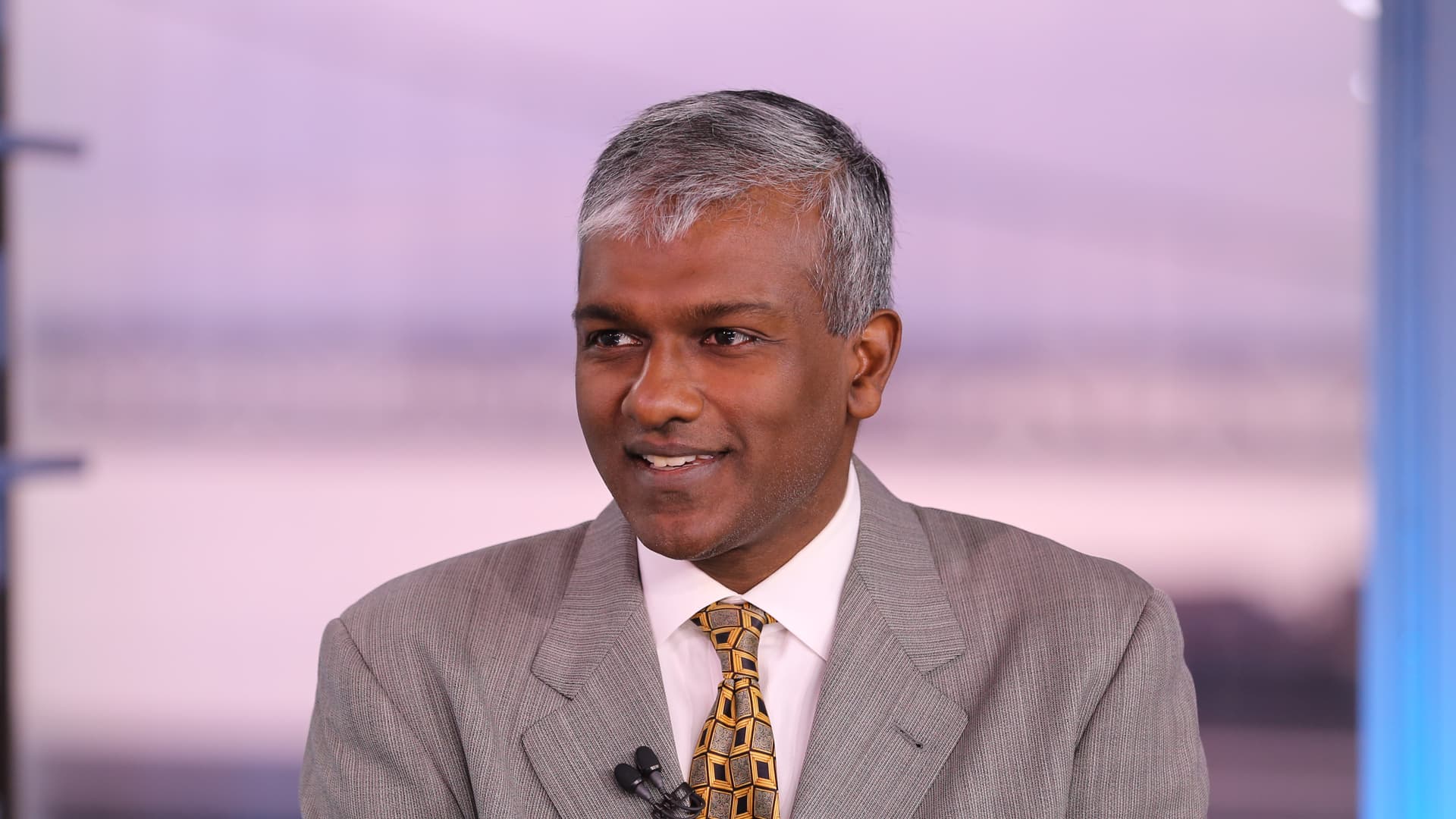

The S & P 500 could decline by 10% by the end of the year to correct for a recent rise in valuation multiples, according to hedge fund manager Dan Niles. The benchmark index is currently valued at 21x forward price-to-earnings (P/E) ratio, even after a 2.4% decline last week. For comparison, the index has, on average, traded at a forward P/E of 19x over the past seven years when inflation was running at 3%, according to Niles, who manages The Satori Fund. The renowned market bear said he sees several macroeconomic headwinds that make valuing the S & P 500 at current levels “much more difficult.” “It wouldn’t surprise me to see a 10% correction between now and year-end,” the portfolio manager told CNBC’s “Squawk Box” Friday. .SPX YTD line Although the headline inflation rate declined towards the Federal Reserve’s 2% target in June, Niles said a strong labor market, a rise in average hourly earnings, and surging crude oil prices added to pressures that could reverse the trend in the future. The Labor Department said that while job vacancies declined in June, there were still about twice as many openings as the number of unemployed people in the United States. The department’s Bureau of Labor Statistics said separately that inflation-stripped hourly earnings had also increased by 0.2% on average in May, compared to last year. “So, to get [the index] just back to average, if you’re worried about inflation maybe ticking up higher than what people think after 10 months of downside surprises to headline CPI, that’s a 10% correction in the multiple, which is a 10% correction in stock prices,” he added. @CL.1 YTD line How to play it Niles, whose fund holds a concentrated portfolio of between 20-40 stocks, also revealed that he was short Apple and long Amazon . In investor jargon, those with a “short” position profit when a stock declines, whereas those with a “long” position profit when the stock rises. According to the hedge fund manager, Apple’s valuation at 30x P/E has been made unsustainable after the iPhone-maker reported three consecutive quarters of declining revenues and net profits. Niles suggested that the expansion in the stock’s multiple had contributed to its share price rising by 40% this year. “Multiple keeps going up. That’s terrific if you own it, but that’s not a game I want to play counting on multiple expansion offsetting earnings going down,” Niles added. Conversely, Niles pointed to Amazon — a stock he expects to rise — as a company with growing top and bottom lines. The cloud-computing giant and online retailer reported an 11% year-over-year rise in revenue to $134 billion. Wall Street cheered the second-quarter earnings, with the stock popping 8%. “I’m long Amazon. It’s the largest position in my fund. And that’s with the backdrop where I’m concerned about this [multiple expansion],” Niles added. At the start of the year, the hedge manager named Meta Platforms his “top pick” for the year. The stock has risen by 158% this year.

Dan Niles says S&P 500 could fall by 10%, names stocks to play it

Subscribe To Our Newsletters

Customer Support

1251 Wilcrest Drive

Houston, Texas

77042 USA

Call-832.795.1420

e-mail – news@theinsightpost.com

Subscribe To Our Newsletters

Categories

- Africa

- Africa-East

- African Sports

- American Sports

- Arts

- Asia

- Australia

- Business

- Business Asia

- Business- Africa

- Canada

- Defense

- Education

- Egypt

- Energy

- Entertainment

- Europe

- European Soccer

- Finance

- Germany

- Ghana

- Health

- Insight

- International

- Investing

- Japan

- Latest Headlines

- Life & Living

- Markets

- Mobile

- Movies

- New Zealand

- Nigeria

- Politics

- Scholarships

- Science

- South Africa

- South America

- Sports

- Tech

- Travel

- Travel-Africa

- UK

- USA

- Weather

- World

No Result

View All Result

Recent News

The Download: What Trump’s tariffs mean for climate tech

April 5, 2025

PICTURES: World Press Photo winners revealed

April 5, 2025

Theinsightpost ©2024 | All Rights Reserved. Theinsightpost is an Elnegy LLC company, registered in Texas, USA

Discussion about this post