Barely a day goes by without news of layoffs emerging from the tech world — from cybersecurity to gaming, no industry is impervious. It’s not limited to any particular size of company, either — everything from fledgling startups and scaleups, to billion-dollar public entities such as Netflix have all “downsized” or put their hiring plans on pause this year. On top of that, there is no geographical factor at play, with companies spanning North America, Europe, Asia, Africa, and beyond all impacted.

But juxtaposed against this, some companies seem to be bucking the downsizing trend by not only hiring, but opening physical offices to accommodate broader expansion plans.

London in particular remains a key destination for international firms looking to spread their proverbial wings, with U.S. unicorns and public companies revealing inaugural or upsized offices in the U.K. capital in recent months. And closer to home, a bunch of smaller European tech companies have also extended their reach out across the English Channel with their first U.K. hubs.

Cross-border investments

Data from FDI Markets*, the Financial Times’ cross-border investment monitoring service, indicates that London has attracted the highest number of foreign direct investments (FDI) into tech from international companies for the past few years, ahead of Singapore, Dubai, and New York. This includes international companies that are establishing a presence for the first time, and those that are expanding an existing footprint (this may include M&A activity).

Image Credits: fDi Markets, from The Financial Times Ltd 2022 (*Data provided by London & Partners)

While this data doesn’t necessarily tell the whole story, at a broad level it does suggest that some companies are still expanding, and London is still an appealing proposition relative to other major cities.

Janet Coyle, managing director of business growth at London’s official publicity arm London & Partners, told TechCrunch that there are various financial perks that might appeal to overseas companies looking to establish a base in the capital. This includes tax incentives such as the lowest corporation tax rate among G7 countries, in addition to “some of the world’s most competitive research and development tax credits,” she said.

“Other incentives such as the Enterprise Investment Scheme, Patent Box Scheme, and the ‘regulatory sandbox‘ make London an ideal place for innovative companies to test new technologies, products, and services,” Coyle added.

This narrative is supported by another recent report from real estate giant Cushman & Wakefield, which found that of the 398 Central London leasing transactions (over 5,000 square ft in size) it analyzed in 2021, 59 of these were “new market entrants,” which it defines as new businesses setting up for the first time, or those relocating from outside London. The report added that this was the highest number it had recorded since it began tracking relocation trends in 2013.

While it’s impossible to ignore the location-agnostic remote- and hybrid-working revolution spurred by the global pandemic, some believe that companies are turning to London for the same reasons they always did — it’s a major accessible conurbation, and it’s a place where people want to live.

“We expect the post-pandemic evolution of London’s office market to continue as occupiers focus upon easily accessible, high quality office space surrounded by vibrant amenities,” Ben Cullen, Cushman & Wakefield’s head of offices U.K., said in a statement in June. “The key will be about creating locations where talent wants to be.”

But this arguably raises more questions than it answers during what can only be described as turbulent times for the world’s economy. Why are some companies seemingly swimming, while others sink? Does their industry, profitability, business model, or financial independence come into play? And why might the U.K. — now economically untethered from its EU counterparts via Brexit — still appeal as a launchpad for growth?

Moreover, why is something so mundane as a bunch of companies opening new offices remotely remarkable in the first place?

The great reset

The reasons for the widespread downsizing we’ve seen in recent times are manifold, but some common threads permeate many of the organizations that are scaling back. The post-pandemic reset is one obvious factor, with some of the companies that benefitted from the world’s retreat behind closed doors succumbing when things returned to normal. Peloton is a good example of this, with the at-home fitness hardware giant skyrocketing through the pandemic before falling back to Earth with an almighty bump when people ventured into the great outdoors again. In the U.K., virtual events platform Hopin serves as another example, rising from a seed-stage upstart at the pandemic’s outset to become a $6 billion juggernaut in just twelve months — before laying off a huge chunk of its staff in pursuit of more sustainable growth.

As things transpired, people might prefer to network in-person versus digital breakout rooms.

Other contributing factors include an over-reliance on venture capital funding for businesses that had yet to figure out a robust business model, while the broader economic downturn has forced companies to cut their costs and safeguard their remaining capital amidst a climate of inflation and rising interest rates.

But for every yin, there’s a yang. Some companies adversely impacted by the pandemic have bounced back, such as Airbnb which laid off a significant portion of its global workforce to see it through the worst times, before recovering and then hitting the public markets to become a $67 billion business.

But corrections and resurgences aside, there’s no denying the peril that many companies currently face. According to startup sacking tracker Layoffs.fyi, there has been more than 150,000 layoffs in the past two years, spanning 1,000 startups. And this trend is showing little sign of easing.

So why are some companies thumbing their noses at all of this, and opening shiny new offices instead?

Financial independence

Proton, the Swiss company behind encrypted email service ProtonMail, already has hubs across its native Switzerland, Lithuania, North Macedonia, and Taiwan. Earlier this year, Proton revealed it was gearing up to open its first U.K. office to support its existing dozen or so employees in the country and 40 open roles advertised for the U.K. capital.

The main purpose for the London hub was that it needed somewhere for its U.K.-based workers to call home — despite a broader industrial embrace of remote or hybrid working, Proton is all about the office.

“Proton does from time-to-time make remote hires, but as a general rule we are an office-centric — rather than remote-centric — company, and most of our team works from our offices around the world,” Proton founder and CEO Andy Yen explained to TechCrunch.

While being tethered to a centralized physical office may or may not hinder Proton’s hiring chances in an increasingly remote working world, the fact that it’s in a position to expand at all, as other startups flounder, is worth exploring.

Compared to many other startups and scaleups, Proton has taken on very little venture capital (VC) funding in its nine-year history — aside from a small $2 million seed funding round back in 2015 and a $500,000 equity crowdfunder the previous year, Proton has managed to grow mostly through people paying money for its service.

“The biggest driver of our hiring is our financial independence,” Yen said. “Our focus on a subscription model allowed us to monetize early, which ensured that we didn’t have to rely on VC investment to scale, and gave us a reliable and growing revenue stream. This sets us apart from other companies that have remained dependent on annual funding rounds. As a result, we’re insulated from the global slow-down in VC investment and can continue to hire in-line with our growth.”

The nature of Proton’s product has also been instrumental in ensuring that it can be as self-sufficient as possible. Privacy-focused technologies remain in high-demand across the consumer and business spheres, and while Google’s unlikely to be knocked off its email and productivity software perch any time soon, there are still enough people out there willing to pay hard-cash for a service that’s not funded by advertising or other data-harnessing practices.

“Our user base is currently growing at a rapid rate because global demand for tech that respects privacy is on the rise,” Yen said.

Proton recently claimed that it passed 70 million accounts, up from 2 million five years ago, though the company doesn’t break out how much of those accounts are actively used, or how many are paying subscribers. But still, those 70 million accounts represent a captive audience that have demonstrated at least some interest in preserving their privacy. On top of that, Proton’s technology pitch is very much in line with the European Union’s thinking on privacy, which has been encapsulated by regulation such as GDPR. As such, Proton was able to secure a €2 million grant from the EU in 2019, further bolstering the company’s “financial independence”.

But where does London come into all of this, and why open a new office there? According to Yen, it’s a combination of factors, including where it’s seeing demand for its service, and the available talent pool.

“From the beginning, the U.K. has always been one of the countries with the largest Proton communities,” Yen said. “While Proton users come from over 180 countries, the largest segment has always come from the English-speaking world. When we were looking to open a new office, London was the natural choice — [it’s] home to an incredible number of talented individuals, who we believe will help us scale the company and build a better internet where privacy is the default.”

City slickers

Fresh off a $10 million series A funding round, SoftBank-backed German climate tech startup Plan A recently revealed plans for its first U.K. office, scheduled to house some 100 employees in the coming years. The five-year-old company, which has existing offices in Berlin, Munich and Paris, offers automation technology to help companies account for their carbon emissions. Its upsizing plans are also consistent with trends elsewhere in the climate tech space, which has been on a perennial upwards trajectory.

In 2021, around $40 billion was invested across some 600 climate-focused startups, and despite strong headwinds elsewhere in the startup investment space, this trend is seemingly continuing into 2022. Climate-focused companies are still an attractive proposition for investors, with countless dedicated funds continuing to crop up, and much of this is to do with demand from within industry which is being driven by external pressures such as regulations.

Europe’s Sustainable Finance Disclosure Regulation (SFDR) came into force just last year with a mission to enhance transparency in sustainable investments. In effect, it’s to make finance companies more accountable for claims they make around sustainability and prevent greenwashing. While Plan A targets all manner of industries, the finance sector is a central focus, given that climate change and the global economy are closely intertwined.

“The financial system is the backbone of our economy — through loans, investments, and the controlling of global cash flows, it is the most important vehicle when it comes to sustainably transforming our economy,” Plan A cofounder and CEO Lubomila Jordanova said.

The decision to launch its new office in London ultimately boiled down to strategic practicalities. Despite Brexit, London is still a global financial powerhouse, and is currently the only European city in the top 10 of the Global Financial Centers Index (GFCI), sitting behind New York in second place.

“From a business perspective, we see great potential in this location as London is both one of the world’s largest financial and business hubs and has a vibrant tech, service, and IT ecosystem — and U.K. businesses face very market-specific regulatory requirements,” Jordanova continued.

Emergency (Br)exit

It would be somewhat remiss to paint the U.K. as the land of milk and honey though — there is ample evidence that businesses seeking more liquidity, or favorable conditions for going public, often prefer to look elsewhere. And there is the thorny Brexit elephant in the room to contend with, too.

Australian tech titan Atlassian recently confirmed that it was “exploring” the possibility of redomiciling its main parent holding company from the U.K. to the U.S. It is worth stressing that Atlassian has only ever really been a U.K.-domiciled company on paper, though — its global headquarters has always been in its native Australia, and it has never had an office in the U.K., though employees are allowed to base themselves from the U.K. as part of Atlassian’s remote work policy.

So while Atlassian has never meaningfully existed in the U.K. since it officially moved there in 2014, its desire to relocate to the U.S. points to some drawbacks for companies in the U.K. Indeed, despite its U.K.-domiciled status, Atlassian has been listed on the U.S. Nasdaq since 2015, and the company said the reason that it’s now looking to move is to access more capital and a “broader set of investors” by shifting its corporate entity across the Atlantic. It said earlier this year:

We believe moving our parent entity to the United States will increase our access to a broader set of investors, support our inclusion in additional stock indices, improve financial reporting comparability with our industry peers, streamline our corporate structure, and provide more flexibility in accessing capital.

Elsewhere, it seems that the U.S. also remains a more desirable option for tech companies considering going public, with SoftBank-owned U.K. chip giant ARM reportedly favoring an IPO in the U.S, though the U.K. government is trying to engineer a dual-listing that includes the U.K. However, SoftBank has made it clear that it would prefer a U.S. listing.

“We think that the Nasdaq stock exchange in the U.S., which is at the centre of global hi-tech, would be most suitable,” SoftBank CEO Masayoshi Son said earlier this year.

And then there are the numerous companies — big and small — that have moved their official base away from the U.K. due to political events. One of those is Eigen Technologies, a seven-year-old AI startup backed by Goldman Sachs, which last year transitioned its headquarters from London to New York, citing the U.K.’s exit from the EU bloc as a driving force behind the move. Nearly three-quarters of the company’s business was already stemming from North America, however, so Brexit may have been more of a nudge in that direction rather than a violent shove.

“Brexit has significantly undermined the benefits of the U.K. as a home market for us, particularly in weakening the university ecosystem and the loss of a single unifying market with Europe,” Eigen’s cofounder and CEO Dr. Lewis Z. Liu said in a statement at the time. “So, while I am very sad to leave London, it is time for me to return to New York [where Liu is from] and lead Eigen on to the next stage of its journey in order for it to fulfil its potential.”

But for the same reason that companies have opened offices in London over the past year, Eiger has retained a strong presence in the U.K. capital, and it still serves as home for its technical leadership and command center for the EMEA and APAC regions. Similar to the Big Apple, Liu acknowledged that London remains a major draw as in international player.

“We reflect the unique international outlook of New York and London, the global cities that Eigen is rooted in,” Liu said.

Hire ground

Whether it’s privacy tech or green tech, startups with a focus on solving real problems may be better positioned to weather the current storm. But that doesn’t mean purely in terms of attracting large enterprise customers or big-name VCs — it very much extends to the hiring realm too, with workers emerging from the great resignation looking for more meaning and purpose in their day-to-day working lives.

“I think a lot of this will come down to which companies are working on solving big, important technical or societal challenges,” Dan Hynes, partner at European VC juggernaut Atomico, said. “That is where talent wants to work these days, and candidates will ask themselves ‘does this fit into my personal value system? What is its ESG (environmental, social and governance) strategy,’?”

But in terms of which companies are likely to prove more resilient during this downturn, there are many factors at play, including those that have secured enough capital to see them through this turbulence, and “which companies are being well-managed and disciplined,” Hynes said.

“It also depends on what stage companies are at — those that have found go-to-market fit will be very cautious, but they will be hiring to build out the commercial arms of those teams, and those that have product-market-fit looking for go-to-market fit will be doubling down on hiring engineering, design and product talent to get their product in the best possible shape as quickly as possible,” Hynes explained.

With much of big tech trimming their workforce or curtailing their hiring, this could also help startups with fewer financial resources to access talent that may previously have been unaffordable to them. Or, where other startups have had to scale back, this serves to enrichen the broader talent pool for other companies that are expanding.

“At a high level, things are still very positive in technology today — in-house recruiters will be going through the lists of talent that have recently been laid-off very quickly, as recycling of talent has always been a positive part of the tech industry and continues to drive the European technology ecosystem flywheel,” Hynes continued. “Europe has had deep pools of talent, across all business functions, for a number of years now with direct experience of scaling at all levels.”

Remote control

But while London might well remain a compelling option for businesses looking to expand, location might be less of a priority than it once was. There is more than enough evidence that workers aren’t keen to rush back to the office and endure 3-hour round-trip daily commutes — but despite all that, people still like having options. American sales and marketing software giant HubSpot, a $14 billion publicly-traded company, announced its first U.K. office in London last September, alongside plans for 70 new jobs in England, Scotland, and Wales. The company already had around 1,500 employees across Europe, with hubs in Berlin, Dublin, Ghent, and Paris.

It’s worth noting, though, that HubSpot’s new London office only houses 20 people, so it’s not expecting everyone to relocate to the U.K. capital — the majority of its workforce in the country would rather be remote.

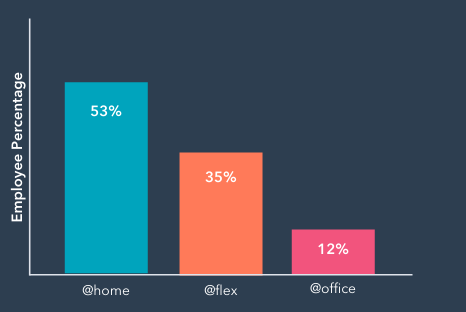

“Based on our survey of how employees want to work in 2022, we know that more than two-thirds of our U.K. team is planning to work remotely long term, while the rest prefer to work from the office some or most of the time,” HubSpot’s VP of global recruiting Becky McCullough said.

From a business perspective, the U.K. has emerged as a major focal point for HubSpot too, and it’s now the company’s second biggest market globally (and largest in Europe), claiming more than 10,000 paying customers last year.

“While our Dublin office has supported our U.K. growth over the years, we recognized that with increased growth, it was the right time to increase our local presence to better support our customers with more face-to-face engagement,” McCullough added. “We [also] know that there is a hugely talented pool of individuals in the U.K., and pairing the top talent with the thriving tech business scene, London made the most sense for us to put down roots.”

On a related note, HubSpot recently published the results of a survey it carried out with its 6,000 workers globally, finding that 52% of its employees would prefer to work from home all the time, while 36% would choose a hybrid model and just 12% want to be in the office permanently.

HubSpot: Global work preferences survey

This helps to highlight why a major company might elect to expand through smaller offices — it’s a reflection of what workers want, and there are signs that other big companies are adopting a similar approach.

San Francisco-based API and microservices platform Kong opened a new London office in May. The company, which hit unicorn status last year off the back of a $100 million fundraise, wanted a hub that was easier to access for its U.K. workforce, which constitutes more than 10% of its global headcount of 450. Moreover, 25% of its current open positions are based in the EMEA region — so having an office that is accessible for short-term visitors from the continent, and from within the U.K. itself, was key.

“London is an easy hub to navigate to and within,” Kong’s VP of EMEA Carl Mattson said. “At the end of the day — and in the new ‘remote-first’ world we live in — the office must be easy to access and centrally located. Naturally, our U.K.-based team will utilize the space on a more regular basis due to proximity, but the space is also available as a collaboration space for those located elsewhere.”

Kong serves as another good example of how the office of the future is evolving in-line with the growth of remote working — smaller offices located strategically in locations near to where employees are based, should they need to use it.

“We’re beginning to plan our workforce locations more deliberately,” Mattson said. “While we will always be a remote-first company, the pandemic has taught us that we need and value the ability to gather, collaborate, connect and engage in person. As a result, we anticipate additional offices where we have a high concentration of employees.”

Kong’s new office currently has a capacity for just 20 people, though its arrangement allows it to scale up quickly as its headcount in the region grows, and when in-person collaboration returns to normal.

“Kong is eager for more in-person collaboration, especially after such a long period of time working primarily in isolation due to the global pandemic,” Mattson added.

Some six months after its debut on the Nasdaq last June, enterprise project management and team collaboration software company Monday.com launched its first U.K. office, serving as the Israeli company’s official European HQ. Then in May, Monday.com expanded into a new office located in Fitzrovia, revealing plans to grow its existing 60 headcount to as much as 150 in the coming years.

As TechCrunch noted after Monday.com’s Q1 earnings this year, its strong growth figures were a further indication that SaaS remains strong in an environment of slowdowns and scalebacks, which positions businesses such as Monday.com well. Moreover, as Monday.com’s new London office suggests, hunkering down and hiding isn’t really a long-term strategy.

“Companies struggling to find their footing during this time might be moving towards a ‘hibernation’ period where they abandon growth and only focus on maintaining,” Naveed Malik, Monday.com’s regional director for EMEA channel partnerships, explained. “While this can sometimes be a viable strategy, it may be less sustainable now as we emerge from the peaks of the pandemic, where many organizations were already pulling back and trying to re-stabilize.”

Given that its product is all about connecting disparate teams, Monday.com might be well-positioned to flourish in a world that has rapidly transitioned to remote work. But as its new office indicates, the company itself hasn’t abandoned real-world interactions — it wants people in the office, at least part of the time.

“During the pandemic, the entire, global organization adopted a remote-first work model,” Malik said. “Today, as it becomes safer to open back up, we’ve transitioned back to an office-first approach that encourages employees to embrace both in-person and remote work models depending on their needs. While offices remain open for everyone throughout the week, individual teams are able to choose which days they want to collaborate in-person, and which days they will work remotely.”

Similar to other companies that have recently arrived in the U.K. capital, Malik pointed to the “outstanding talent” as one reason it chose London, though the new office is also strategically located close to customers.

“We have seen terrific traction on our platform in the area, and having the team headquartered there will support our continued growth,” Malik said.

What all this shows is that the future of work is not a rigid, one-size-fits all model — some companies want workers in the office more than others, but for the most part, they will need to offer a degree of flexibility if they’re to attract the best talent.

Future of work

Another emerging theme here is how companies’ relationships with local communities and society in general are evolving, with remote and hybrid working playing a pivotal part.

Around the world we’ve seen how high concentrations of companies can have negative consequences for the area they inhabit. This includes places such as San Francisco and the wider Bay Area, where the price of housing, pervasiveness of homelessness, and a growing wealth gap are symptoms of billion- and trillion-dollar companies permeating the region. There are some early signs that things are changing.

A few weeks back, esteemed Silicon Valley VC Andreessen Horowitz revealed it was “moving to the cloud,” meaning that it was shifting its center of gravity away from the Bay Area in response to the world’s newfound love affair with remote working. It initially committed to three new offices in Miami, New York, and Santa Monica, in addition to its existing hubs in San Francisco and Menlo Park. It’s also planning more physical offices around the world.

While acknowledging the historical reasons around why Silicon Valley and surrounding area emerged as a magnet for technical talent, Ben Horowitz, Andreessen Horowitz cofounder and partner, noted that the pandemic changed everything — companies were “forced to figure out how to work remotely,” and while it may not be perfect, the benefits of decentralization perhaps outweigh the bumps.

“Concentrating all of those companies into one or two geographies cuts off great opportunities from anyone who can contribute, but cannot easily move,” Horowitz wrote. “Remote work is opening up many new locations for entrepreneurs and technology workers.”

A slow but steady number of companies have either abandoned the Bay Area or opened secondary headquarters and satellite offices. Fintech giant Xero transitioned its Americas HQ to Denver in 2018 long before the pandemic, while Oracle and Tesla have since revealed similar plans but with Texas as the destination. While there is no love lost between Tesla and California, CEO Elon Musk attributed the HQ move to simple practicalities — Austin is more accessible for workers.

“It’s tough for people to afford houses and people have to come in from far away,” Musk said of its Palo Alto HQ. “There’s a limit to how big you can scale it in the Bay Area. In Austin, our factory is like five minutes from the airport, 15 minutes from Downtown.”

One of the most notable facets of the tech industry is that it’s always moving and evolving, with cities competing for companies, workers, and inward investment. So what’s true today, may not be true tomorrow, meaning that no city can rest on its laurels, but they must also address the unintended consequences of their successes.

London, as with many other major global cities, has long laid in the shadows of tech holylands such as Silicon Valley, but it has suffered similar problems on a smaller scale. In 2017, the Shoreditch area of the city, home of the so-called Silicon Roundabout, received the dubious honour of being named the world’s most expensive technology district in terms of office real estate. And more recently, news emerged that housing development in west London could be curtailed due to the high concentration of data centers in nearby Slough — data centers require a lot of electricity, and the grid is apparently approaching capacity.

This demonstrates the inextricable link between companies, infrastructure, and the environment they inhabit. “Tech scenes” and high concentrations of specific kinds of companies have their benefits, but there are downsides. And that could be one positive consequence of the pandemic — major cities such as London will always be in demand, but location in 2022 is not as important as it was three years ago, which may lead to a more balanced technology ecosystem.

“London continues to be in a good strong position in terms of talent and access to capital, but the world has changed significantly since Covid,” Atomico’s Hynes said. “The majority of companies today, especially at the early-stage, are either remote-first or definitely hybrid, and you will see that continue as tech will always be a talent-driven market. [But] London will continue to be an important part of the tech ecosystem in Europe — it has more engineers than anywhere else in Europe, but I think the way of working has certainly changed again in terms of remote and hybrid, and I can’t see people wanting to go back to pre-Covid full-time office hours.”

Discussion about this post