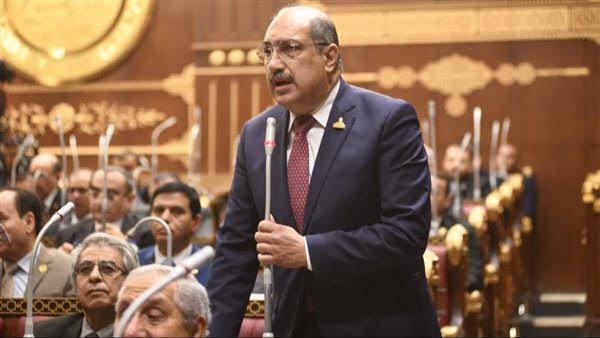

The Egyptian medicine market is suffering from a shortage of medicines, including important medication for chronic diseases and mental illnesses, according to the Chairman of the Parliamentary Group of the Popular Party in the Senate, Ihab Wahba.

The market is grappling with a critical shortage that extends to numerous treatments for both chronic and non-chronic conditions, such as those for diabetes and hypertension, staples in countless households.

The most significant reason for the shortage, according to Wahba, is a lack of foreign currency to import raw materials for local production.

Shipping delays, pricing, limited availability of alternatives, and the public’s hesitation to use substitutes—often due to concerns about the effectiveness of the active ingredients or a strong preference for following the doctor’s original prescription—have also worsened the problem.

Ali Auf, head of the Pharmaceuticals Division at the Federation of Egyptian Chambers of Commerce, estimated in July that there are approximately 800 medications currently unavailable in the Egyptian market.

While the first quarter of 2024, Egypt’s imports of pharmaceuticals and medicinal preparations fell by 6.9 percent, totaling USD 751.38 million (EGP 36.7 billion), a decrease of USD 56.22 million (EGP 2.7 billion) compared to USD 807.6 million (EGP 39.4 billion) recorded during the same period in 2023, the market is still suffering.

Hisham Hajar, a board member of the Chamber of Industry of Cosmetics & Medical Supplies, highlighted reliance on international sources, stating that the pharmaceutical industry is highly dependent on imports for its raw materials, sourcing roughly 95 percent of these essentials, including both active ingredients brought in directly and inactive ingredients occasionally supplied by importers.

The shortage of active ingredients, essential for drug manufacturing, is estimated to range between 15 and 20 percent, according to Mohie Hafez, a member of the board of directors of the Chamber of Industry for Cosmetics & Medical Supplies.

Reformative Efforts

The government, under the leadership of Prime Minister, Mostafa Madbouly, has made medicine a top priority. It is now aiming to ensure that essential drugs and medical supplies are available in the Egyptian market, while also tackling the challenges of shortages and pricing in the local pharmaceutical industry.

At a press conference on 6 August, Minister Abdel Ghaffar assured that the current drug shortage would be resolved within three months.

To meet the problem head-on, the government will allocate EGP 7 billion (USD 143.4 million) to meet the shortage of medications and medical supplies needed by hospitals and pharmacies., Mohamed al-Homosany, the spokesperson for the Egyptian Cabinet, announced on 9 August.

Additionally, on 11 August, Wahba announced a detailed proposal aimed at resolving Egypt’s persistent medicine shortages. The plan, set to be presented to the government, addresses the ongoing crisis of medicine shortages in the Egyptian pharmaceutical market and outlines the necessary strategy to localize drug production in Egypt.

Recognizing the critical role of pharmaceuticals in both global and local contexts, Wahba’s proposal highlights the industry’s importance to national security and the health of Egyptian citizens. He stated that Egypt’s pharmaceutical industry, which primarily serves the local market, must adopt a modern strategy to achieve greater self-reliance in medication production.

This strategy aims to effectively integrate imported technologies with locally developed solutions, to produce safe, effective, and high-quality medications at affordable prices. It also seeks to localize unconventional pharmaceutical manufacturing to cover the Egyptian market with non-traditional drugs, which will help reduce import costs and increase pharmaceutical exports.

Wahba also emphasized the strategic importance of medicine as a critical commodity and the pharmaceutical industry as one of Egypt’s most vital industries.

Pharmaceuticals in Egypt

According to figures released by the cabinet’s Information and Decision Support Centre, the Egyptian pharmaceutical market is one of the largest in Africa with annual sales amounting to approximately USD 7 billion (EGP 341.7 billion).

“Local production meets about 91 percent of the market’s needs and exports to 80 countries, making it a vital national industry,” Hafez noted.

During the first five months of 2024, the pharmaceutical market has recorded sales of approximately EGP 73.3 billion (USD 1.5 billion), compared to EGP 51 billion (USD 1.05 billion) during the same period of 2023, according to a recent report by IQVIA, an organization dedicated to monitoring pharmaceutical market sales.

Egypt’s exports of pharmaceuticals and medical supplies totaled around USD 432.2 million (EGP 21.1 billion) in the first quarter of 2024, according to Ali El-Ghamrawy, chairman of the Egyptian Drug Authority.

The nation is home to 170 factories that collectively produce four billion drug packages annually, meeting 91 percent of the country’s pharmaceutical needs, the Minister of Health and Population, Khaled Abdel Ghaffar reported.

Egypt produces 92 percent of its traditional medicines locally and imports eight percent of non-traditional medicines, such as serums and cancer treatments. According to Wahba, importing this eight percent costs USD 1.13 billion (EGP 55.1 billion), which accounts for 35 percent of the country’s total medicine expenditure.

The Pharmaceuticals market in Egypt is forecasted to achieve a revenue of USD 1.54 billion (EGP 75.2 billion) in 2024, according to Statista.

Despite current challenges, the efforts to revive Egypt’s pharmaceutical industry could create a more resilient and self-sufficient healthcare system for the future.

Discussion about this post