Enzinc’s Series A funding was led by TO VC, with participation from American Century Investments (ACI), which led Enzinc’s seed round. The funding comes as global demand for batteries skyrockets and the world searches for alternatives to lithium-ion chemistry, and the funds will accelerate commercialization.

RICHMOND, Calif. – 11 December, 2024 – Enzinc Inc., an advanced zinc battery developer, today announced it had closed its Series A funding, raising $8 million. The round was led by TO VC, with participation from American Century Investments (ACI), which led Enzinc’s seed round.

The funding comes as global demand for batteries skyrockets and the world searches for alternatives to lithium-ion chemistry. Enzinc’s proprietary technology unleashes zinc’s full potential, creating rechargeable advanced nickel-zinc batteries with high energy density and unparalleled safety.

Enzinc’s technology enables its customers—lead-acid battery manufacturers—to leverage the existing 400GWh of global manufacturing capacity to make high-performance batteries without a massive capital investment. They can triple their output and boost revenue and margins while meeting the growing demand for efficient batteries for mobility and stationary uses.

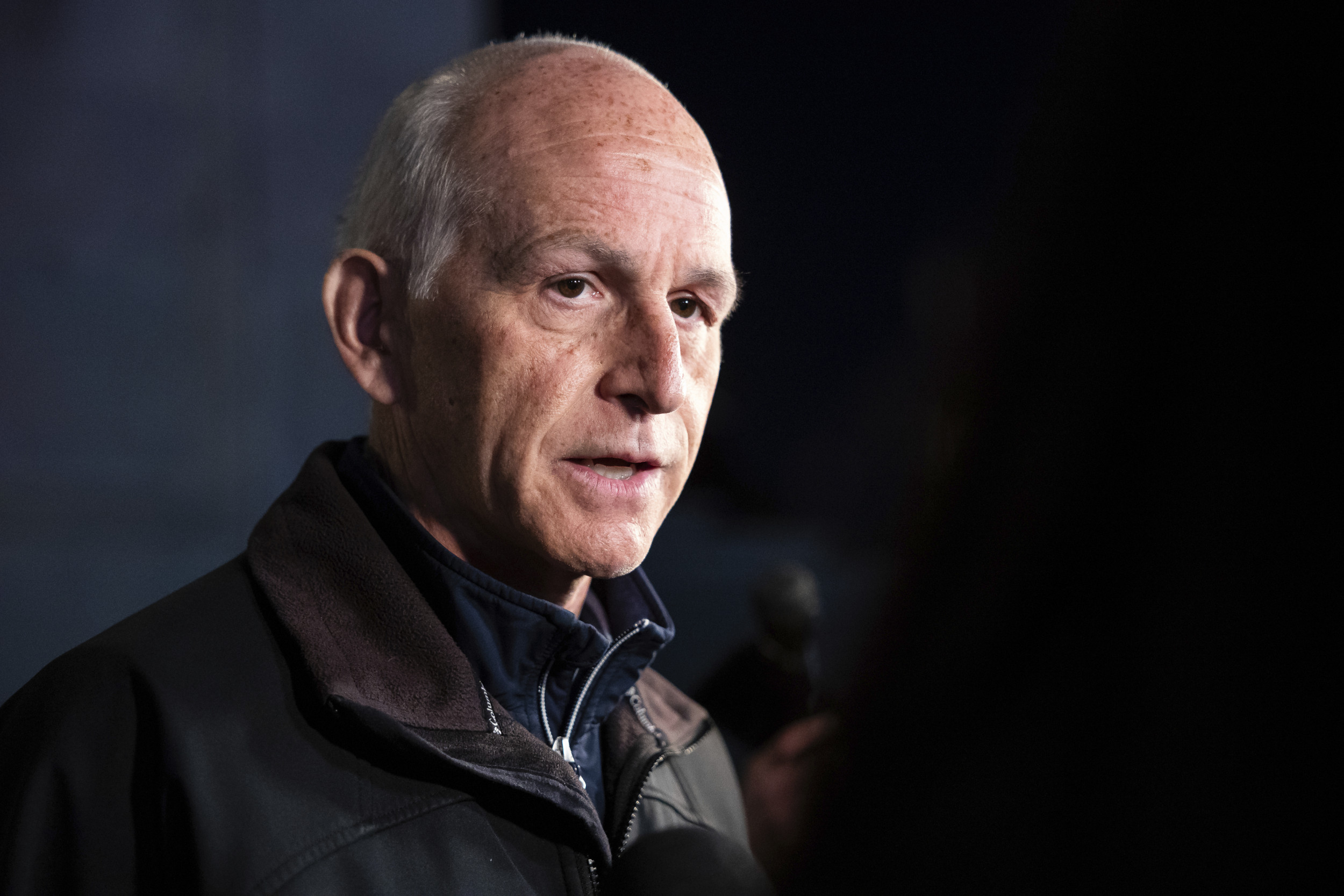

“There’s a vast untapped resource in the global lead-acid manufacturing infrastructure and Enzinc is poised to unlock this potential,” said Joshua Phitoussi, cofounder and managing partner at TO VC. “The US can leverage its global leadership in lead-acid battery manufacturing capacity to position itself as a leader in advanced battery manufacturing without investing many billions of dollars in gigascale factories. We invest in companies that are building earth’s most vital ventures, and energy storage is one of the most powerful areas of innovation to get to net zero greenhouse gas emissions. Enzinc’s technology unlocks the ability to transform these existing factories into powerhouses for advanced batteries.”

TO VC focuses on early-stage startups with transformative technologies in energy systems, food systems, and carbon removal. Known for its active partnership with founders, TO VC has a track record of nurturing companies from concept to market leadership.

“Securing this funding in today’s challenging environment is a testament to the confidence our investors have in Enzinc’s vision and ability to scale our safe and powerful battery technology rapidly,” said Michael Burz, CEO and cofounder of Enzinc. “We appreciate the deep expertise, collaborative approach, and shared commitment to healing our planet that our investors bring.”

The funding will enable Enzinc to scale production, expand partnerships, and bring its breakthrough zinc-based battery technology to market, supporting the global transition to renewable energy. As part of the investment, Phitoussi, a seasoned venture capitalist known for championing disruptive startups, will join Enzinc’s Board of Directors. He will work alongside Jake Pflaum, a member of the private investments team at ACI and board member at Enzinc since its seed round in mid-2022.

“Enzinc’s technology addresses critical challenges in energy storage, making renewable energy more reliable and affordable. American Century Investments is proud to continue our partnership and support Enzinc’s growth as a key player in the clean energy revolution,” said Pflaum.

The announcement comes after the recent opening of Enzinc’s Manufacturing Technology Center in Oakland, CA.

About Enzinc

Enzinc is an engineering technology company focused on developing advanced high performance green batteries to accelerate the energy transition. Its zinc microsponge ‘Enzinc Inside’ anode is a drop in technology that can rapidly scale deployment of better batteries by using existing manufacturing infrastructure. Based in the San Francisco Bay Area, the company applies aerospace and automotive engineering practices to energy storage development. Enzinc is an ARPA-e awardee and has received multiple grants through the California Energy Commission’s EPIC program.

For more information visit the Enzinc website or join the conversation on BlueSky or LinkedIn.

About TO VC

TO VC backs vital teams tackling the world’s most pressing challenges. As an early-stage decarbonization venture capital fund, TO VC invests in groundbreaking climate tech companies focused on transforming food systems, energy systems, and pioneering carbon removal solutions. TO VC believes these areas are the key to achieving net-zero greenhouse gas emissions and restoring harmony between humanity and the planet. TO VC is steadfast in its conviction that tomorrow’s giants will be climate innovators and that the most compelling companies today are those dedicated to combating climate change. Discover more at to.vc.

Discussion about this post