More than one in three new vehicles sold in 2030 will be electric thanks to “explosive” growth in the market, according to the International Energy Agency (IEA).

The influential Paris-based group says electric cars are already on track to make up 18% of sales in 2023. With new policies driving growth in the US and the EU, the share of electric models in 2030 is now set to be more than double what it expected just two years ago.

The expansion means that the demand for oil-based fuels such as petrol and diesel in the road transport sector will start to decline within just two years. Around 5% of current oil demand will have been wiped out by 2030, it adds.

The IEA’s new Global EV Outlook report concludes that, by the end of the decade, electric cars sales are on track to cut annual emissions equivalent to Germany’s entire economy.

However, the agency notes that the growing popularity of sports utility vehicles (SUVs) is a “major concern”. Last year, the growth in sales of these large, energy-intensive models nearly cancelled out the emissions reductions from record electric vehicle sales.

Exponential growth

More than 10m electric cars were sold in 2022, reducing global emissions by 80m tonnes of CO2 equivalent (MtCO2e), according to the IEA.

The agency adds that sales are expected to reach 14m by the end of this year. This would amount to 18% of global car sales in 2023, up from 14% a year earlier and just 1% in 2017.

On this trajectory, these vehicles will have nearly quadrupled their market share since 2020, when they made up less than 5% of sales.

The “exponential” growth in electric car sales can be seen in the chart below. China (red) has consistently dominated the market, making up roughly 60% of global sales in 2022.

The other two key players are the US and the EU, both of which have recently raised their 2030 targets for cutting emissions from road transport. In recent months, the IEA notes that both have “passed legislation to match their electrification ambitions”.

According to the new report, a combination of the new CO2 targets for cars and vans in the EU, and the suite of new measures in the Inflation Reduction Act combined with state-level action will continue to drive electric car sales in the coming years.

Under the IEA’s Stated Policies Scenario (STEPS), which accounts for policies and measures that have been put in place by governments, electric cars’ share of the market is set to double to 36% by 2030. This narrows the “implementation gap” between action and targets set by governments, which in total would bring this share up to 40%.

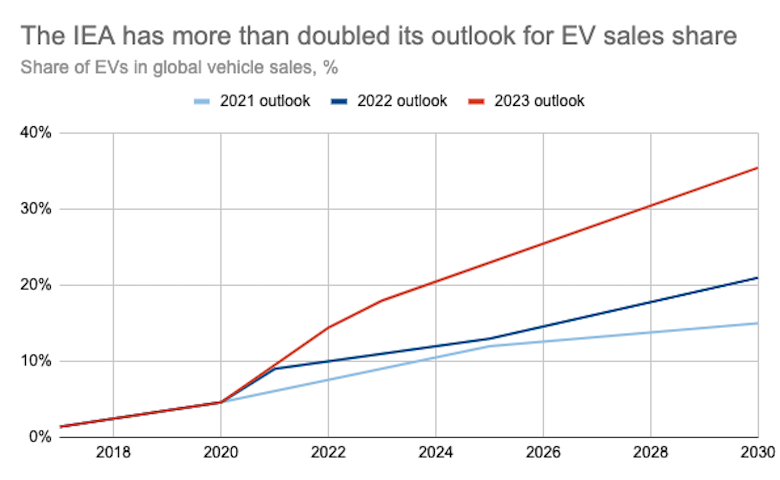

As the chart below indicates, this is a significant upward adjustment on the agency’s previous outlooks. In its 2021 outlook, the IEA said electric cars would reach 15% of sales by 2030, a level nearly reached already in 2022. Last year, the IEA said existing policies would drive electric cars’ share to just 21% by 2030.

Outlooks for electric vehicles’ share of overall global sales, %, 2020-2030, in the IEA’s Stated Policies Scenario (STEPS), from successive editions of the agency’s “global EV outlook” reports. Each line indicates the outlook given in that year. Source: IEA. Chart by Joe Goodman for Carbon Brief using Highcharts.

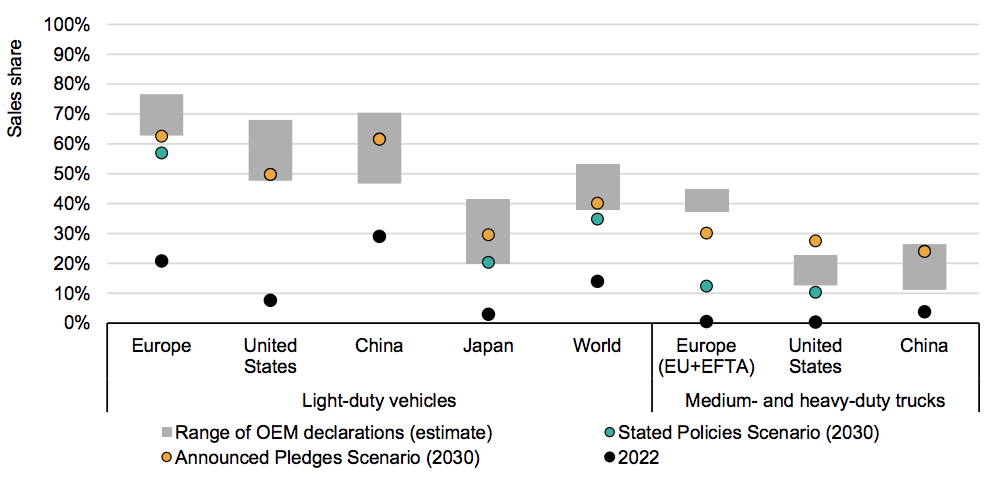

Besides governments, car manufacturers have also been announcing their own targets for electric vehicle sales.

The chart below shows how the goals set by these original equipment manufacturers (OEMs) compare to the pledges announced (yellow dots) and acted upon (green dots) by governments. It indicates that companies’ ambitions are running in line with or, in the case of Europe, slightly ahead of governments.

The IEA notes that in all major markets, these company targets have come after major government policy announcements and net-zero goals, “showing how policy ambitions can spur corporate announcements”.

Deep cuts

The rapid growth in electric car sales under existing government policies is expected to have a significant impact on fossil-fuel use. The IEA says oil demand for road transport is expected to peak around 2025 in the STEPS scenario.

The surge in electric vehicles on the roads would eliminate the need for 5m barrels of oil per day by 2030. This amounts to around 5% of global oil demand today.

The IEA notes that overall this would mean an emissions cut of 700m tonnes of carbon dioxide equivalent (MtCO2e) by the end of the decade, roughly the annual emissions of Germany or Saudi Arabia.

(This figure accounts for any fossil fuels used in the generation of electricity to run the electric car fleet.)

(The IEA’s emissions calculations are based on “well-to-wheels” analysis of fuel consumption in cars, rather than full lifecycle emissions. However, even when accounting for emissions from battery and car manufacture, electric vehicles have significantly lower emissions than their fossil-fuelled counterparts in most circumstances.)

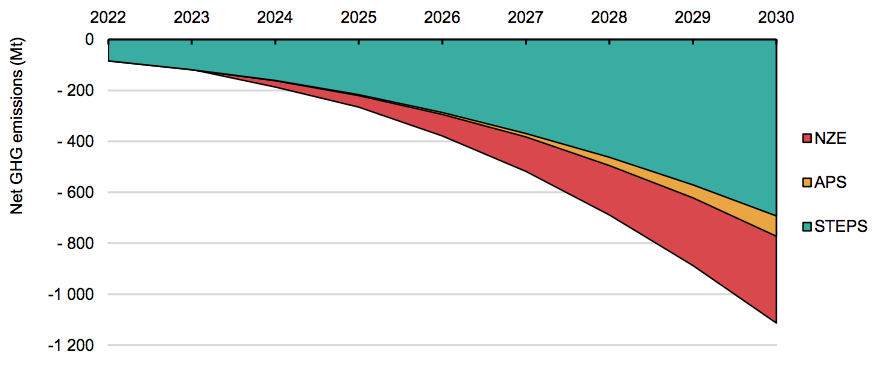

If governments go even further and meet the targets they have set themselves both for electric vehicles and clean power generation, 770MtCO2e in emissions would be avoided.

In this scenario, termed the Announced Pledges Scenario (APS), nations would be roughly two-thirds of the way to the IEA’s net-zero emissions by 2050 scenario (NZE), which is compliant with the Paris Agreement’s 1.5C warming target.

To bridge the remaining gap, indicated in red in the chart below, the IEA says governments would need to move faster on decarbonising trucks and buses, in particular.

It notes that 25% of the electric vehicle-related emissions avoided in the NZE can be attributed to the electrification of heavy-duty vehicles.

SUV dominance

The continued growth in sales of large sports utility vehicles (SUVs) almost wiped out the emissions cuts achieved by electric vehicle sales last year, according to the IEA.

SUVs now make up nearly half of global car sales, including 40% of electric vehicles. They are growing in popularity worldwide, particularly in the US, Europe and India.

The IEA says this “overwhelming dominance” is a “major concern”. SUVs’ size means they require more energy to run, more materials to build and, in the case of electric models, larger batteries. All of this means higher emissions and greater environmental impact per mile travelled.

In 2022, the CO2 emissions from driving SUVs increased by 70MtCO2e, the IEA says, with sales growing even as the wider car market contracted. This effectively cancels out most of the 80MtCO2e emissions reductions from new electric vehicles sales that year.

Overall, the IEA says the 330m SUVs on the road today emit around 1GtCO2e.

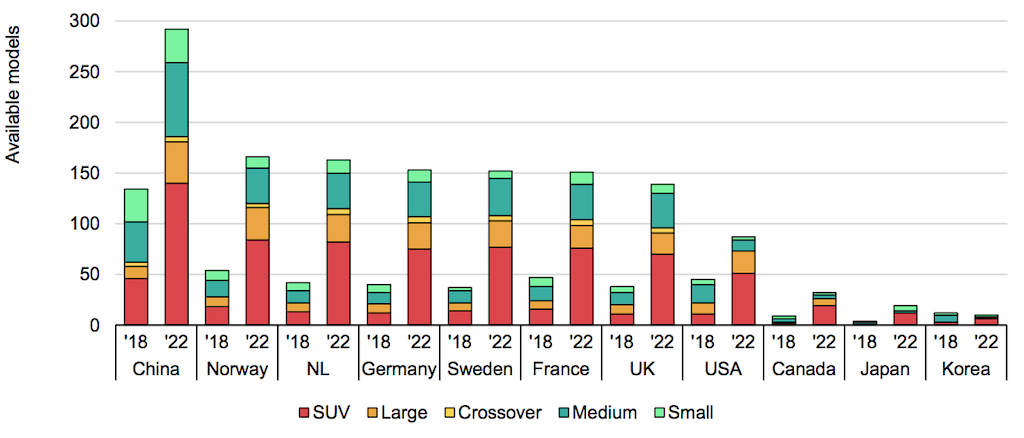

Around 16% of SUVs sold in 2022 were electric – slightly above the 14% share of EVs in the market overall. As the chart below shows, an increasing share of electric cars on the market in every country are SUVs or other large cars.

As with other electric vehicles, these electric SUVs result in emissions being displaced relative to if they had had a combustion engine instead. In 2022, the IEA says 150,000 barrels per day of oil were avoided due to people driving electric SUVs.

In fact, the agency says that although electric SUVs represented 35% of all electric cars in 2022, their share of oil displacement was higher – around 40% – as SUV drivers tend to use their cars more than owners of smaller cars.

However, the report notes that on top of emissions from driving, “mitigating the impacts of higher battery sizes will also be important”. It notes that the larger amounts of minerals required to build SUV batteries can result in CO2 emissions from processing and manufacturing being more than 70% higher than regular electric car batteries.

Sharelines from this story

Discussion about this post