FBK Markets was founded in 2020 and is proudly South African-owned. Deposits and withdrawals are available using options like OZOW and EFT. FBK Markets’ spreads start from 0.0 pips EUR/USD on the Zero Spread Account.

FBK Markets Review – Analysis of Broker’s Main Features

FBK Markets Spider Chart

FBK Markets at a Glance

Who is FBK Markets?

Regulation and Safety Of Funds

FBK Markets Account Types

How to Open a FBK Markets Account step by step

What Can I Trade with FBK Markets?

FBK Markets Fees

Education and Trading Tools

FBK Markets Trading Software

Broker Comparison

FBK Markets Incentives and Bonuses

FBK Markets Introducing Broker Programme

FBK Markets Deposit and Withdrawals

Customer Support

Pros and Cons

Conclusion

Frequently Asked Questions

References

FBK Markets Spider Chart

Here are the numerical ratings (on a scale of 1 to 10) for FBK Markets:

- Regulation & Safety 6/10

- Trading Conditions 7/10

- Account Types & Features 6/10

- Trading Instruments 5/10

- Deposit & Withdrawal Options 7/10

- Customer Support 3/10

FBK Markets at a Glance

Who is FBK Markets?

FBK Markets, established in 2020, is a South African-owned brokerage headquartered in Sandton.

As a Financial Sector Conduct Authority (FSCA) a regulated entity, it caters to traders locally and globally, emphasizing trust, transparency, and accessibility.

FBK Markets strives to make trading more approachable for South Africans while expanding its footprint internationally.

- FBK Markets executes 99% of trades in under 0.9 seconds.

- There’s a 100% deposit bonus for the Bonus 100 account that doubles the trader’s initial capital.

- FBK Markets uses the globally popular MetaTrader 4 (MT4) platform, enhanced with custom tools like a Margin Calculator and mobile apps.

- Local phone lines, WhatsApp, and email ensure accessibility and support is available 24/7.

FBK Markets in Numbers

The company’s rapid growth reflects its commitment to client satisfaction:

- Active Clients Worldwide: Over 57,062 active clients rely on FBK Markets for their trading needs.

- Trades Executed: The platform boasts 846,387 completed trades, demonstrating its reliability and efficiency.

- Local Relevance: With a minimum deposit of R20 for Micro accounts, FBK Markets is accessible to a broad range of South Africans.

Local and Global Ambitions

Local Roots

- FBK Markets blends local expertise with global ambitions:

- By operating under FSCA oversight, FBK Markets prioritizes compliance with local regulations, ensuring safety and legitimacy for traders.

- Its tagline, “Trade with trust, trade with us,” resonates with South Africa’s growing retail trading market, fostering confidence among first-time and seasoned traders alike.

Global Reach

- FBK Markets provides trading opportunities in Forex, Commodities, Cryptocurrencies, and Indices, bridging the gap between South African traders and global markets.

- FBK Markets’ ultra-fast execution speeds (99% of trades in under 0.9 seconds) align with global standards, making it competitive internationally.

FBK Markets for South Africans

South Africa’s trading landscape is expanding, with over 190,000 retail traders engaging in Forex and other instruments daily. This growth has spurred demand for platforms like FBK Markets that provide low-cost entry points and localized features.

- Accessibility: FBK Markets’ Micro account requires just R20 to open, catering to budget-conscious traders.

- Cultural Understanding: Operating from Sandton, the broker understands the unique needs of South Africans, from ZAR-based trading pairs to integration with local banks like FNB, Standard Bank, and ABSA through OZOW.

Core Values

FBK Markets adheres to three fundamental principles that resonate with South African traders:

- Transparency: Clear communication of fees, processes, and account conditions.

- Trust: As an FSCA-regulated broker, it complies with financial laws, providing peace of mind to local and international clients that they’re dealing with a legit, transparent broker.

- Customer-Centric Approach: Tailored services and local support enhance the trading experience.

Our Take

FBK Markets is a young but rapidly growing brokerage that blends local understanding with global aspirations. By prioritizing accessibility, regulation, and customer trust, FBK Markets has positioned itself as a compelling choice for South African traders seeking a secure and reliable trading platform.

Regulation and Safety Of Funds

Regulation is a cornerstone of trust in the financial markets, especially for South African traders, who often navigate a volatile economic landscape.

FBK Markets is regulated by the Financial Sector Conduct Authority (FSCA), meaning that the broker adheres to South African laws and financial standards.

This compliance provides traders with the confidence that their funds are secure and that the platform operates transparently.

FSCA Oversight

FBK Markets operates under the FSCA, South Africa’s regulatory authority for financial services. This regulation ensures:

- Segregated Client Funds: Client funds are held in separate accounts, safeguarding them from operational risks.

- Fair Trading Practises: The FSCA monitors brokers to prevent unethical practices like market manipulation.

- Legal Compliance: FBK Markets meets stringent financial and operational standards required to maintain its FSCA license (FSP No. 52142).

FICA Compliance

FBK Markets complies with the Financial Intelligence Centre Act (FICA), which combats financial crimes such as money laundering. Traders must verify their identity by providing:

- Proof of Identity: South African ID or passport.

- Proof of Residence: Utility bill or lease agreement, dated within three months.

- Proof of Banking: Recent bank statement, stamped and dated within three months.

Failure to comply with FICA can result in account suspension, preventing traders from accessing their funds. This rigorous process guarantees that only legitimate traders participate, maintaining FBK Markets’ integrity.

Data Protection

In addition to financial safeguards, FBK Markets adheres to the Protection of Personal Information Act (POPIA) to secure client data. This includes:

- Encryption of sensitive data to prevent unauthorized

- Strict protocols for data sharing to keep traders’ personal information confidential.

Key Benefits of Regulation for South African Traders

- Safety of Funds: Segregated accounts protect traders’ money from company liabilities.

- Transparency: Fees, processes, and terms are communicated clearly, minimizing hidden costs.

- Dispute Resolution: The FSCA provides a mechanism for resolving disputes between brokers and clients, guaranteeing fairness.

Limitations

While FBK Markets is regulated and follows local compliance, South African traders should be aware of the fact that FBK Markets does not offer Negative Balance Protection. Thus, losses can exceed deposits during highly volatile market conditions, and traders will be held responsible for paying the negative balance.

FBK Markets’ Safety Measures

Category Category |

Details Details |

Regulatory Authority Regulatory Authority |

FSCA (FSP No. 52142) |

Client Fund Protection Client Fund Protection |

Segregated accounts |

Compliance Standards Compliance Standards |

FICA, POPIA |

Trading Practices Trading Practices |

Transparent pricing, no hidden fees |

Dispute Resolution Dispute Resolution |

Mechanisms available via FSCA oversight |

FBK Markets Account Types

More than one account type exists at FBK Markets to fulfill different trading requirements of clients. The platform provides five account choices including Micro and Standard as well as ECN and Zero Spread alongside Bonus 100 type.

The different account categories at FBK Markets include individual features which include variable spreads and commission plans as well as leverage settings.

Customers cannot access Islamic swap-free accounts or demo accounts at the brokerage. The following explanation outlines vital characteristics of FBK Markets’ different account types.

Features Tailored for South African Traders

Low Minimum Deposits

- The Micro account’s R20 entry point makes it one of the most affordable in South Africa, appealing to new traders.

- Standard and zero-spread accounts start at R100, providing flexibility for traders with slightly larger budgets.

High Leverage Options

- Leverage of up to 1:1000 is available across all account types, offering South African traders opportunities to maximize their trading potential.

Account Variety

- Each account type caters to specific needs, from risk-averse beginners to professional traders requiring advanced tools like tight spreads and market execution.

Benefits for South Africans

- Accessibility: Low deposit thresholds empower individuals from diverse economic backgrounds to participate in trading.

- Flexibility: Account options enable traders to align their choices with experience and risk tolerance.

- Local Currency Support: The ability to fund accounts in ZAR simplifies the trading process for South Africans.

Limitations of FBK Markets’ Account Types

- No Islamic Account Option: Traders adhering to Sharia law will find the lack of a swap-free account restrictive.

- Demo Account Absence: The inability to practice trading without financial risk limits opportunities for new traders to learn.

How do FBK Markets Cater Specifically to South Africans?

South Africa’s growing retail trading market has cultivated a demand for brokers that offer affordability and flexibility.

With a population of over 59 million and an unemployment rate of approximately 32.6%, the low-barrier entry provided by FBK Markets aligns well with the financial constraints faced by many South Africans.

Moreover, the emphasis on diverse account types caters to the local trading community’s experience levels, from novice to professional.

How to Open an FBK Markets Account step by step

Step 1: Start Trading

Click on Start Trading or Open a Micro Account to start your registration.

Step 2: Fill in the Form

Fill in the registration form with all your details and click on Sign Up.

FBK Markets Account Registration

What Can I Trade with FBK Markets?

FBK Markets provides South African traders access to global financial markets with 22 trading instruments. These include popular categories such as Forex, Commodities, Indices, and Cryptocurrencies.

For South African traders, familiar instruments like gold (XAU/USD) and ZAR-based Forex pairs (USD/ZAR, EUR/ZAR) offer opportunities to trade assets with local relevance.

Although FBK Markets has fewer instruments compared to some competitors, the selection focuses on highly traded and sought-after markets, ensuring that traders have access to impactful assets.

Available Trading Instruments

FBK Markets’ Local Relevance

Forex Pairs with the ZAR

- South African traders often favor USD/ZAR and EUR/ZAR due to their familiarity with the local currency.

- The high volatility of the ZAR offers the potential for significant trading opportunities, especially during economic announcements or policy shifts.

Gold and Commodities

- Gold trading is relevant in South Africa, a country that remains one of the world’s largest gold producers.

- Commodities like oil allow traders to explore markets influenced by global supply and demand dynamics.

Digital Assets

- With widespread Bitcoin adoption in South Africa, cryptocurrencies provide a modern avenue for diversification and high-risk, high-reward opportunities.

Leverage and Flexibility

FBK Markets offers leverage of up to 1:1000, letting South African traders amplify their trading positions. For example, a trader with R100 can trade positions worth up to R100,000, enhancing their exposure while managing their capital effectively.

However, high leverage carries risks, especially for inexperienced traders, requiring a strategic approach.

Benefits and Limitations

Benefits for South Africans:

- Local Currency Pairs: Lets traders capitalise on ZAR volatility.

- Commodities Like Gold: Align with South Africa’s historical and cultural familiarity.

- Access to Cryptocurrencies: Caters to the rising interest in digital assets among young South Africans.

Limitations:

- Limited Instrument Range: With only 22 instruments available, traders who want broader diversification could find options restrictive.

- Absence of Local CFDs: While international indices are offered, South African-specific CFDs, such as the JSE Top 40, are not included.

How FBK Markets Aligns with South African Traders

South Africa’s expanding retail trading market, which includes over 190,000 daily active Forex traders, creates a demand for brokers with local relevance.

FBK Markets caters to this demand through ZAR pairs and commodities like gold, offering familiar and profitable trading opportunities. However, expanding the range of instruments, including local stock indices, could strengthen its appeal further.

Our Take

FBK Markets offers South African traders an accessible gateway to global financial markets. Despite its limited range of instruments, FBK Markets focuses on high-impact assets, including Forex pairs with the ZAR and gold, which align with the preferences and needs of local traders.

FBK Markets Fees

For South African traders, understanding a broker’s fee structure is a vital part when deciding on the right trading partner. FBK Markets outlines its trading and non-trading fees clearly.

With spreads starting from 0.5 pips for Standard accounts and zero commission fees for most trades, FBK Markets appeals to cost-conscious traders. FBK Markets’ adherence to local financial regulations also provides a fair, transparent trading environment that gives confidence in its pricing policies.

Breakdown of Fees

Calculating Fees in ZAR

Calculating fees in local currency simplifies understanding and planning for trades. Here’s how you can calculate FBK Markets’ fees:

Example Spread Cost for Standard Account:

- Spread: 0.5 pips.

- Currency Pair: USD/ZAR.

- Trade Size: 1 standard lot (100,000 units).

- Cost Calculation: Spread cost = 0.5 pips x 100,000 x exchange rate (approx. R18.50) = R92.50 per trade.

Zero Spread Account Example:

- Fixed commission: $9 per standard lot.

- Exchange Rate: R18.50 = R166.50 per trade.

This transparency lets traders make informed decisions based on their budgets and trading volumes.

Overall, based on our research, South Africa’s economic landscape, characterized by high unemployment (32.6%) and limited disposable income for many individuals, requires affordable trading solutions.

FBK Markets addresses this by maintaining competitive spreads and offering free deposits. Its fee transparency further builds trust, and traders can understand the costs upfront.

Education and Trading Tools

Education plays a pivotal role in the success of traders, especially in South Africa, where the number of beginner traders has surged recently.

FBK Markets provides some resources and tools integrated into the MetaTrader 4 (MT4) platform. These include video tutorials and market analysis to help traders improve their understanding of the financial markets.

While these tools address foundational needs, we found that there’s definitely room for enhancement to cater to more advanced South African traders.

Educational Resources

Relevance to South African Traders

Growing Demand for Financial Literacy

- With approximately 70% of South Africans lacking advanced financial education, tools like tutorials and market updates empower traders to build confidence in their decisions.

Local Market Alignment

- Market analysis often highlights commodities like gold, crucial to South African economic history, helping traders make informed choices on familiar assets.

Accessibility of Tools

- The availability of tools directly within MT4, along with mobile access, ensures that traders can learn and trade simultaneously, even on the go—a vital feature in a country where mobile internet usage exceeds 80%.

Benefits of FBK Markets’ Trading Tools

- Video tutorials allow traders to study at their convenience, aligning with South Africa’s growing online learning culture.

- Technical tools and analysis ensure traders can react to market changes promptly.

- MT4’s intuitive interface makes it easier for beginners to access and use these resources effectively.

Limitations

- Limited Depth for Advanced Traders: While suitable for beginners, FBK Markets lacks webinars, mentorship programs, or advanced strategies that could benefit experienced South African traders.

- No Localised Content: Educational materials are only available in English, which may exclude traders fluent in other South African languages.

Our Suggestions for Improvement

FBK Markets could expand its educational offerings to include:

- Webinars: Live sessions tailored to advanced strategies and local market conditions.

- One-on-One Mentorships: Personalised training programs for South African traders to refine their skills.

- Localized Resources: Providing tutorials in Zulu, Afrikaans, or Xhosa could cater to South Africa’s linguistic diversity.

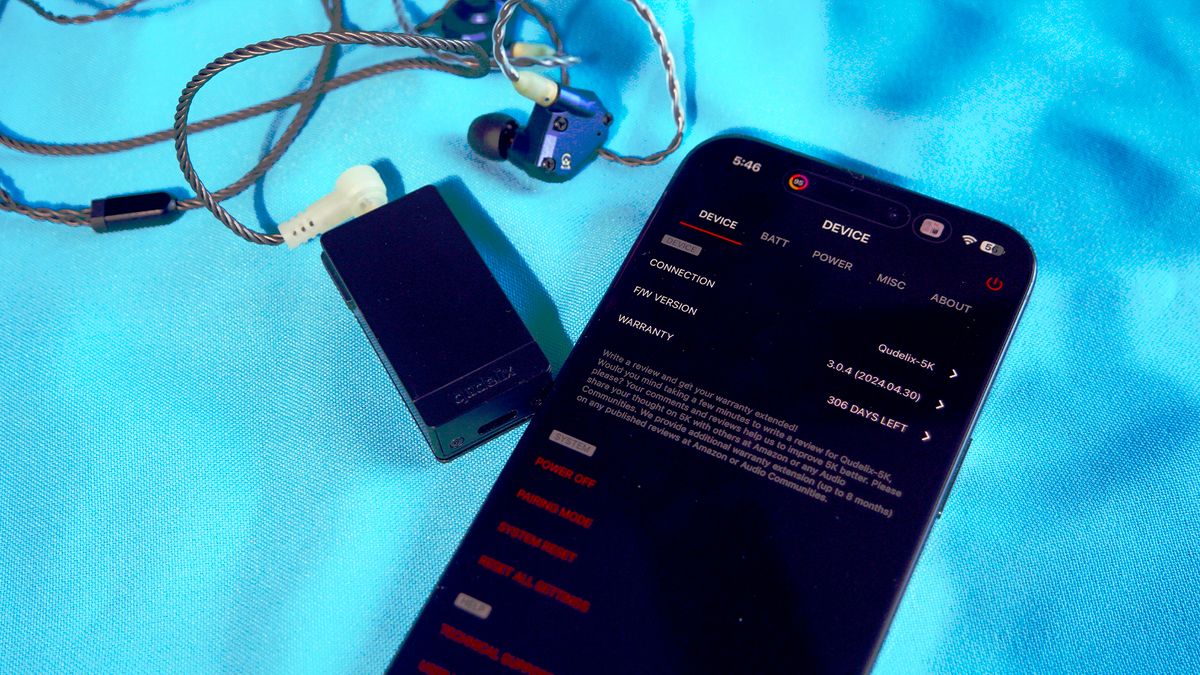

Reviewing FBK Markets’ Trading Software

FBK Markets provides traders access to the globally renowned MetaTrader 4 (MT4) platform, a favorite among South African traders due to its versatility and robust tools.

Known for its advanced charting, technical analysis capabilities, and support for flexible trading strategies, MT4 is well-suited for both beginner and experienced traders.

While FBK Markets enhances MT4 with features like a Margin Calculator and mobile apps, comparing it to other popular platforms in South Africa highlights its strengths and areas for improvement.

Key Features of MT4 with FBK Markets

Comparing Trading Platforms in South Africa

Suggestions for Improvement

To enhance its platform offering, FBK Markets could consider:

- Introducing MT5: Providing access to more instruments and faster execution speeds, appealing to advanced traders.

- Localizing Features: Incorporating tools for ZAR-specific instruments, like local stock indices or JSE-related analytics.

- Developing a Proprietary Platform: Tailored to South Africa, focusing on localized insights, tools, and resources.

Broker Comparison

FBK Markets Incentives and Bonuses

FBK Markets incentivizes new and existing traders through a 100% deposit bonus to enhance trading capital.

This promotion is appealing to South African traders to maximize their initial deposits to increase their market exposure across forex, indices, commodities, and bonds.

However, like all bonuses, it comes with specific terms and conditions that traders need to understand.

Key Features of FBK Markets’ Bonus Offer

How Can South African Traders Benefit from the 100% Deposit Bonus?

- By doubling deposits, traders can open larger positions or diversify their strategies, especially in popular instruments like USD/ZAR and gold.

- The low minimum deposit of R100 makes the bonus available to most South African traders, from students to seasoned professionals.

- South African traders can use the bonus to explore higher leverage (up to 1:1000) without risking their full capital, a vital benefit in volatile markets.

Bonus Limitations

- Traders can only withdraw profits, not the bonus itself, which limits flexibility.

- The Prohibition of Expert Advisors deters traders who rely on automation for strategy execution.

- Violating the terms, such as using restricted methods, can disqualify traders from the bonus.

Suggestions for South African Traders

To make the most of the Bonus 100 offer:

- Understand the terms and comply with the rules to avoid forfeiting the bonus.

- Use the bonus to experiment with new trading strategies on small positions.

- Stay updated on any modifications to the bonus program to align strategies.

Can I withdraw my bonus?

No, the bonus itself is non-withdrawable. However, profits generated from trading with the bonus can be withdrawn.

Does FBK Markets offer a sign-up bonus?

No, FBK Markets doesn’t offer a separate sign-up bonus; the 100% deposit bonus applies to eligible deposits.

Are there any restrictions on trading methods with the bonus?

Yes, automated trading, including with Expert Advisors, is prohibited.

What happens if I violate the bonus terms?

Violating the terms will result in the bonus and profits being forfeited.

FBK Markets Introducing Broker Programme

FBK Markets’ Introducing Broker (IB) Programme provides an accessible avenue for South Africans to earn additional income by referring traders to the platform.

This program is appealing to South African entrepreneurs who want to capitalize on the country’s growing retail trading market, which has over 190,000 Forex traders who trade daily.

With zero requirement to manage client funds and commissions based on trading volume, the IB Programme lets participants focus solely on client acquisition and relationship management.

Key Features of the IB Programme

Benefits for South African IBs

Leverage Local Networks

- South Africa’s digital penetration of 72% creates significant opportunities for IBs to reach potential clients via social media and online communities.

Income Diversification

- The IB Programme lets participants supplement their income, an advantage in a country with a high unemployment rate of 32.6%.

No Upfront Costs

- With no financial investment required to join, the program is accessible to a diverse demographic, including young entrepreneurs.

How Does the FBK Markets IB Programme Align with the South African Market?

The IB Programme’s structure addresses South Africa’s entrepreneurial spirit, offering a low-risk, high-potential opportunity for individuals to create additional revenue streams.

With a growing retail trading population, especially among young professionals, we believe that FBK Markets’ support tools can help South Africans tap into their networks easily and efficiently.

FBK Markets Deposit and Withdrawals

FBK Markets provides South African traders with multiple deposit and withdrawal options for accessibility and convenience. By supporting local payment systems like OZOW (Smart EFT) and offering instant deposit processing, FBK Markets caters to the unique preferences of South African traders.

The broker also integrates with major South African banks for seamless transactions and timely access to funds.

Deposit and Withdrawal Methods

Benefits for South African Traders

Integration with Local Banks

- FBK Markets supports direct transfers with leading South African banks like FNB, Standard Bank, ABSA, and Nedbank, simplifying deposits and withdrawals for local traders.

Instant Deposits

- Traders benefit from instant processing times for deposits to quickly fund their accounts and capitalize on market opportunities as they occur.

Low Minimum Deposit

- A minimum deposit of R100 makes trading accessible to many South Africans, including beginners with limited capital.

Verification Process Information and Requirements

To comply with FICA regulations, traders must complete identity verification before making deposits or withdrawals. This involves submitting:

- A valid South African ID or passport.

- Submitting a utility bill or bank statement not older than three months.

- A Statement that shows the trader’s name and account details.

Our Suggestions for Improvement

- Expand Payment Options: Adding services like PayFast or SnapScan could further enhance accessibility for South African traders.

- Instant Withdrawals: Implementing faster withdrawal times, especially for local bank transfers, would improve convenience.

- Language Support in Documentation: Offering instructions in multiple South African languages could make the verification process more inclusive.

Our Final Take on FBK Markets’ Deposits and Withdrawals

FBK Markets’ deposit and withdrawal system is well-suited for South African traders, with local payment methods, low minimum deposits, and efficient processes.

By integrating with major South African banks and adhering to FICA regulations, FBK Markets ensures security and accessibility. In our opinion, enhancing withdrawal speeds and expanding payment options could further strengthen FBK Markets’ appeal to the South African trading community.

Suggestions for Improvement

- Multilingual Registration Support: Offering the application process in multiple South African languages (Zulu, Afrikaans, Xhosa) could enhance accessibility.

- Automated Document Review: Implementing AI-powered verification tools could accelerate the FICA compliance process.

- Detailed Guidance: Providing video tutorials or step-by-step guides could help first-time traders navigate the registration process more effectively.

How the Process Supports South African Needs

FBK Markets’ registration system aligns with South Africa’s regulatory framework in terms of transparency and security. By adhering to FICA requirements, FBK Markets builds trust with its clientele, especially in a market where regulatory compliance is a vital factor for trader confidence.

Our Experience and Insights into Account Registration

Based on our experience, registering an account with FBK Markets is a secure and straightforward process that is aligned with FSCA regulations.

By focusing on compliance, accessibility, and trader protection, FBK Markets ensures a smooth onboarding experience. However, by offering multilingual support and streamlining verification, FBK Markets could optimize the process for South African traders even further.

Customer Support

Reliable customer support is a vital component for South African traders who often require quick support, especially considering the complex and time-sensitive nature of financial markets.

FBK Markets addresses this need by offering 24/7 customer support for traders to access help whenever they require it. This continuous availability is beneficial given the time zone differences with global markets.

FBK Markets provides multiple support channels, including:

- Email Support: Traders can reach out via email for detailed inquiries or documentation submissions.

- Phone Support: Local South African phone numbers are available for direct communication.

- WhatsApp Support: For quick and convenient assistance, traders can use WhatsApp.

- Physical Office: FBK Markets maintains an office in Sandton, Gauteng, offering an additional layer of confidence for local traders.

Contact Details

Below is a table summarising the contact details for FBK Markets’ customer support:

Our Experience: Accessibility and Quality of Support

In our experience, FBK Markets’ commitment to 24/7 customer support is advantageous for South African traders who need assistance during non-standard trading hours.

The availability of local phone numbers and a physical office in Sandton provides reassurance and convenience, letting traders engage with support staff familiar with local needs and time zones.

While the support services are comprehensive, we need to mention that support is primarily available in English.

Given South Africa’s 12 official languages, this could limit accessibility for some traders. Expanding language support could enhance the inclusivity and effectiveness of FBK Markets’ customer service.

Pros and Cons

Conclusion

Based on our research and experience, FBK Markets stands out as an ideal broker for South African traders that still maintains global ambitions.

With its regulation under the Financial Sector Conduct Authority (FSCA), FBK Markets offers a secure trading environment where all operations comply with local laws. This gives South African traders confidence in the platform’s credibility, especially where trust is essential for financial growth.

One of FBK Markets’ most significant advantages is its low minimum deposit requirement of R100 on all deposit methods, making it accessible to most local traders, including those just starting their trading journey.

We found that this feature, combined with tailored account types such as Micro, Standard, and ECN accounts lets novice and experienced traders engage with the platform based on their unique needs and goals.

FBK Markets demonstrates its commitment to South African traders by offering local customer support and 24/7 availability via phone, email, and WhatsApp.

However, while FBK Markets’ customer service is robust, the lack of multilingual support limits accessibility for South Africa’s diverse population, which includes Zulu, Afrikaans, and Xhosa speakers.

MetaTrader 4 (MT4) is globally recognized and features like advanced charting tools and automated trading options align well with traders who rely on data-driven decision-making.

That said, the absence of a proprietary platform or MetaTrader 5 could be a drawback for more customization options or access to a wider range of instruments.

While FBK Markets has made strides in offering educational resources like video tutorials and market analysis, its offerings remain limited compared to competitors.

South African traders, especially more advanced individuals, will benefit from more comprehensive materials such as webinars, mentorship programs, or advanced trading courses.

This gap presents an opportunity for FBK Markets to expand its appeal among experienced traders to refine their strategies.

Overall, despite the drawbacks, FBK Markets is a broker with strong foundations in South Africa, excelling in regulation, accessibility, and customer service. Its commitment to low entry barriers and localized support makes it an attractive option for all South African trader experience levels.

Frequently Asked Questions

Is FBK Markets a reputable broker in South Africa?

Yes, FBK Markets is a South African financial broker operating since 2020. FBK Markets acts as a legal representation of RocketX (Pty) Ltd, a licensed financial services provider regulated by South Africa’s Financial Sector Conduct Authority (FSCA).

What account types do FBK Markets have?

FBK Markets offers Standard, Zero Spread, Bonus 100, ECN, and Micro accounts to South Africans.

What leverage options does FBK Markets offer?

FBK Markets has customizable leverage of up to 1:1000 based on your account equity.

Does FBK Markets provide customer support?

Yes, FBK Markets offers customer service Monday through Sunday, 24 hours a day, seven days a week.

What is FBK Markets’ minimum deposit in ZAR?

FBK Markets’ minimum deposit to open a Micro Account is 20 ZAR, while all other accounts are 100 ZAR. However, note that the minimum you can deposit according to the deposit methods is 100 ZAR.

South African Edition (Updated 2025)

South African Edition (Updated 2025)

Discussion about this post