Canada’s main stock index closed down almost 200 points Tuesday as the price of crude oil plunged and losses mounted in the energy and base metal sectors.

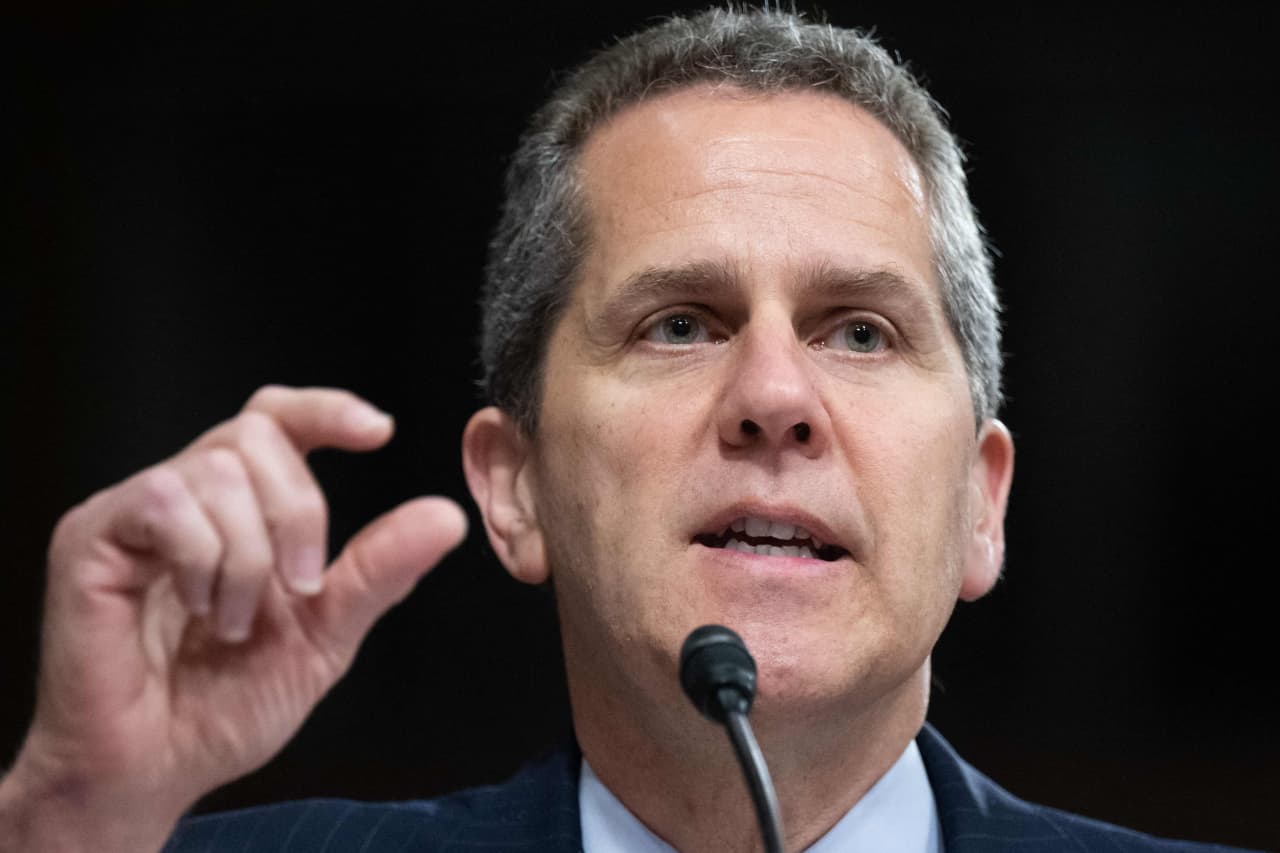

It was the first day of trading in the U.S. after the Fourth of July holiday and on both sides of the border, things quickly got off to an “ugly start,” said Greg Taylor, chief investment officer at Purpose Investments.

By late morning, the S&P/TSX index had plunged more than 400 points, though it rallied later in the day to close at 18,834.16, down 194.70 from the previous day’s closing.

U.S. markets also fell after the opening bell, but the S&P 500 index managed to eke out late-day gains, closing up 6.06 points at 3,831.39, while the Nasdaq composite closed up 194.39 points to end the day in positive territory at 11,322.24.

The Dow Jones industrial average closed down 129.44 points at 30,967.82.

While it’s true that some of the early morning losses were recovered later in the day, Taylor said, Tuesday’s sell-off still indicates that for many investors, “the recession is here.”

“It feels like everyone came in this morning completely in a recession panic,” he said. “The narrative all year has gone back and forth between inflation fears and recession fears, and today feels like the day the recession fears really took hold.”

Bond yields fell, an indication of risk-averse sentiment, and the Canadian dollar declined by more than a cent amid mounting concerns about the economic outlook around the world — particularly in the European Union where a jump in natural gas prices has added fuel to recession fears.

The euro fell to its lowest level in two decades on Tuesday, while the Canadian dollar traded for 76.70 cents US compared with 77.72 cents on Monday.

In Canada, the same energy and commodity stocks that surged in recent months when inflation was the top concern plunged on Tuesday over fears that recession will dampen demand.

“Given the severity of the sell-off earlier this year, the only sector that was working was energy. So a lot of momentum funds and managers were hiding in energy stocks, and now we’ve had to see a quick reversal of people out of energy trying to put it back into tech or something or else,” Taylor said.

The TSX Capped Energy Index closed down 6.8 per cent while the Capped Materials Index closed down 4.4 per cent.

The August crude contract was down US$8.93 at US$99.50 per barrel and the August natural gas contract was down 21 cents at US$5.52 per mmBTU. The August gold contract was down US$37.60 at US$1,763.90 an ounce and the September copper contract was down 19 cents at US$3.42 a pound.

Against the backdrop of plunging commodity prices, Canadian oil and gas stocks suffered large losses Tuesday. Athabasca Oil Corp. closed down more than 13 per cent, while Precision Drilling Corp. was down more than 12 per cent and MEG Energy Corp. closed down more than 10 per cent.

But Taylor said in spite of Tuesday’s eight per cent decline in the price of oil, and the blow to stock prices, investors should not forget that the Canadian oil and gas sector remains incredibly profitable right now.

“At the end of the day, these companies are still incredibly positive from a cash flow point of view. At US$100 oil, it’s still a huge win for them. They were set up to work at $50 or $60,” Taylor said.

Even as recession fears stalk markets, Taylor said investors still expect the Bank of Canada to announce another 75-basis point interest rate increase in its policy decision next week. The biggest question at this point is whether the central bank will ease off after that, or continue with additional rate hikes.

For that reason, Taylor said everyone will be watching for the latest U.S. inflation data, expected to be released the same day as the Bank of Canada’s upcoming rate announcement. Investors will be looking to see if U.S. inflation has peaked, which may be a signal to central banks on both sides of the border to back off additional interest rate hikes.

Investors are also watching for the latest Canadian employment data, expected Friday, as well as second quarter corporate earnings releases coming later this month.

“From a stock point of view, the next big thing is going to be earnings. We’re a few weeks away from that, but that’s going to be a concern — to see how these companies are hanging in,” Taylor said.

Discussion about this post