Owner of the Moti Group, Zunaid Moti.

(Photo: Instagram)

On the face of it, Zunaid Moti, owner of the sprawling Moti Group of companies, had lined up a mining deal worthy of a Randlord.

Throughout 2018, the controversial businessman cobbled together a massive portfolio of lithium claims in Zimbabwe’s Mashonaland East province under a new mining venture called Pulserate Investments.

The project has been intensely publicised, especially since Moti “stepped away” from his leadership position at the group his family still owns — a move spurred by his own notoriety after a stint in a German prison between 2018 and 2019 on what appeared to be trumped-up charges levelled by a business rival.

The new chief executive, former director general of South Africa’s well-regarded National Treasury, Dondo Mogajane, has picked up the torch, loudly hailing the lithium plan as a “gamechanger” for Zimbabwe backed by a formidable Chinese investor.

But there is a problem.

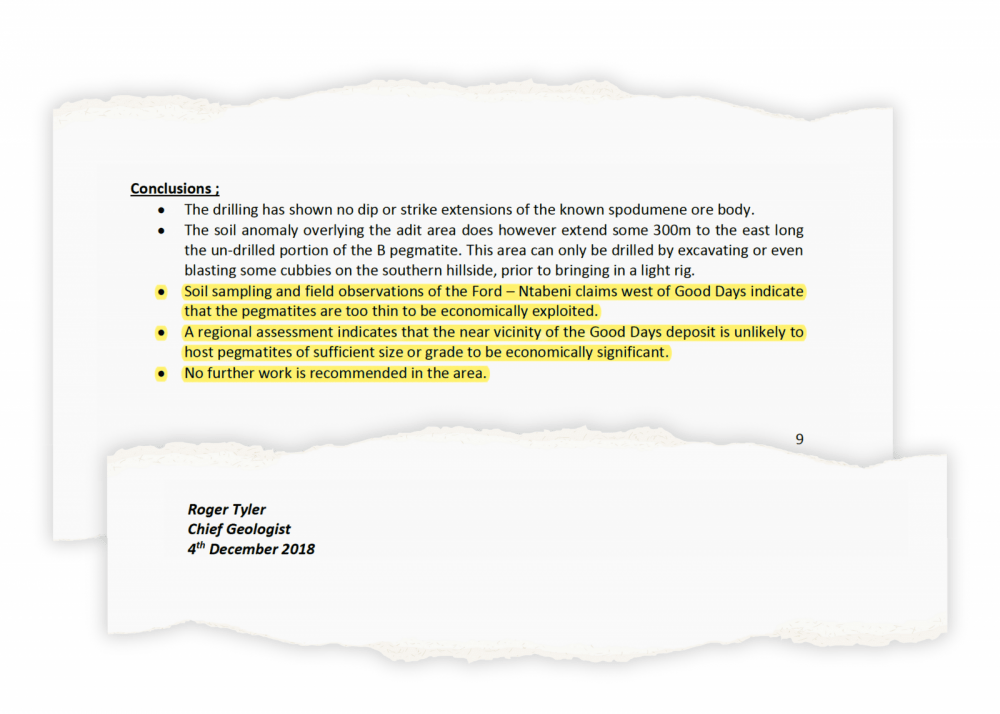

A 2018 exploration report established that the area around Pulserate’s claims is “unlikely to host [lithium-bearing] pegmatites of sufficient size or grade to be economically significant” and concluded that “no further work is recommended in the area”.

After the Moti Group started its own exploration, the group’s own chief operations officer has been recorded stating that “there is Jack shit there – just rock”.

His colleagues have similarly opined that “we know there is nothing” and even admitted that they have no qualms about losing the entire project as long as they can keep a down payment from their apparently unsuspecting investor.

One leaked recording has Moti himself telling a subordinate that “there is fuck-all there” in what appears from the context to be a clear reference to the Pulserate claims.

All these internal admissions predate, by several months, glowing paid-for features about the “African lithium powerhouse” in South African newspapers this year.

In response to questions, Moti dismissed all of the above, saying that not all of the claim area has been explored and that there has in fact been “positive” feedback from geologists which he cannot share due to confidentiality. (See his full response to questions posed by our partner OCCRP here)

The apparent internal conviction that the project has little value did not stop Pulserate from drawing in Chinese billionaire Pei Zhenhua and his Yibin Tianyi Lithium Industry Co.

Pei, whose personal net-worth is estimated to be around $8 billion, is a major shareholder of Contemporary Amperex Technology (CATL), the largest supplier of electric vehicle batteries in the world.

According to documents contained in the #MotiFiles, a massive leak from inside the Moti Group, intense negotiations following a MOU signed on 31 March last year led to the signing of a Share Purchase Agreement on 20 May with a low-key ceremony over a video call.

Yibin Tianyi made a $6 million upfront payment for 20% of Pulserate with an option to buy another 50% based on exploration results.

Pulserate was thus able to secure an upfront payment while, in the words of Moti Group inhouse lawyer Natalie Graaff, Pei’s people were busy “drilling holes for two years, if they stay that long”.

Documents also show that Moti hoped to secretly leverage this relatively modest initial payment into a far larger cash infusion with one plan involving pre-selling future receipts from Pei to commodities giant Trafigura for R1 billion.

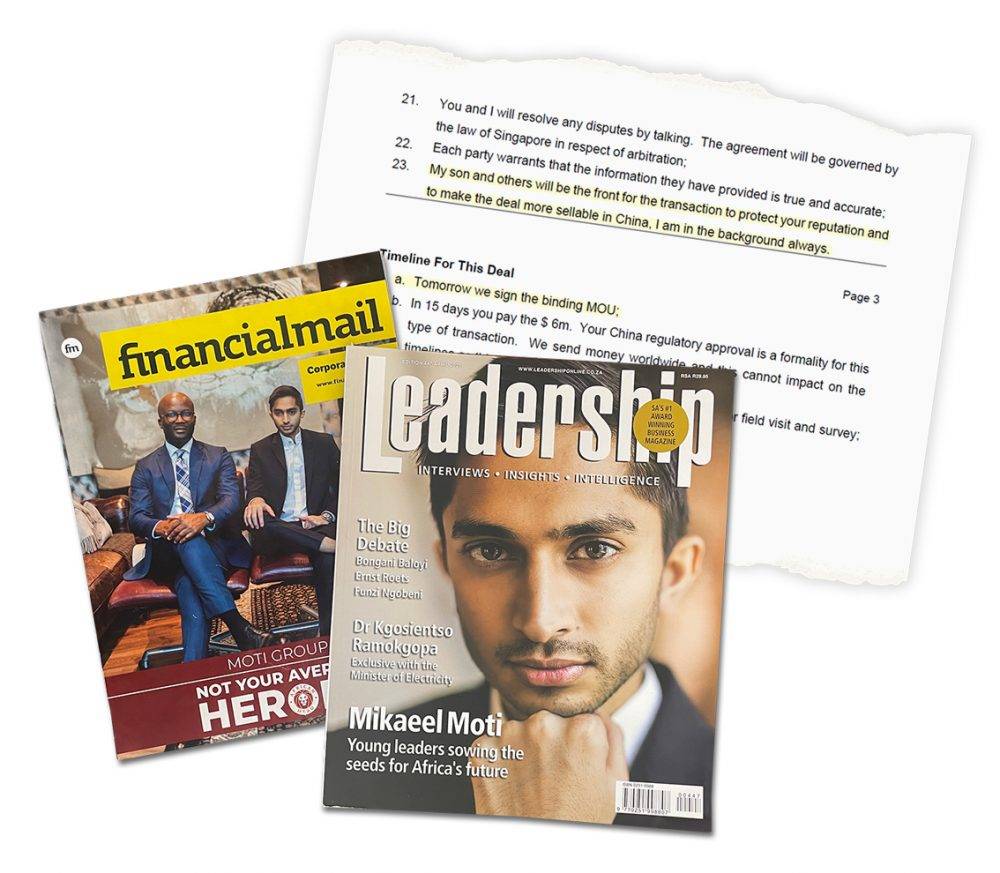

Lastly, embarrassingly for Mogajane, Moti personally assured his investor that setting up his young son Mikaeel and “others” as the faces of the project did not mean he would relinquish involvement, but that he would be “in the background always”.

Moti now denies “vehemently” that this suggested his stepping aside was just for show.

Shortly after our partner OCCRP posed questions to Moti and Pei it was reported by Bloomberg that the Chinese had decided to back-pedal and dramatically reduce their investment.

In response to questions the Chinese investor went further, saying that it “has no investment in the relevant project”, asking that its name not get mentioned.

In this regard Mogajane said that it might be technically true, but that is just because the shareholding was restructured so that Yibin Tianyi’s parent company owns the shares. (See his full response here). The questions to Yibin Tianyi had, however, also been sent to a representative of the parent company.

As a result it is not clear to what extent Moti’s house of lithium cards has already fallen.

But first, the back story.

Land grab

Lithium is used to make the batteries powering electric cars and has in recent years rapidly become a sought-after commodity with mining companies scouring the Earth for major deposits.

In Zimbabwe, one such significant discovery has been made: the Arcadia project developed by Australian mining group Prospect Resources which has recently been on-sold to China’s Zhejiang Huayou Cobalt in an eye-watering $377 million deal.

Having already cemented his place in the country’s mining industry through his African Chrome Fields (ACF), Moti in early 2018 dived head-first into lithium, hoping for similar success.

The Australians, Prospect, had one other potential project in Zimbabwe: an early-stage exploration target centred on an old abandoned mine called Good Days in Mashonaland East. The mine produced beryl in the 1950s and 1960s when no one was looking for lithium but there were indications that the battery-making mineral was also present.

Claims over the mine and adjacent areas were held by a local company called Barrington Resources, reportedly (and likely illegally) part-owned by the Zimbabwean minister of mining, Winston Chitando.

The Australians inked a deal with Barrington in mid-2017 for an option to buy 70% of the Good Days claims after first doing some exploration in the area.

In April 2018, Moti Group’s chief geologist Barry Jones sent an email to his boss and other Moti Group executives:

“Attached is a report on a good lithium project. The average grade is 2.99% — this is exceptionally high as a normal lithium mine would be in the region of 0.9%. Harry Greaves is involved in a lithium project next door (Barrington Resources) and has already pre-sold to the Chinese, they are listed on the ASX under Prospect Resources. The owner (Emmanuel Nyanyiwa) of this claim is willing to sell / free carry. I would suggest we purchase these claims, do limited geological work and can sell them on at a substantial profit.”

Greaves was an old acquaintance of Moti from previous mining deals.

One important qualification here is “next door” — the claims over the Good Days mine were seemingly not themselves available and, as far as anyone knew, belonged to Barrington.

Jones was, however, misinformed on every other count. The supposedly exceptional grade would turn out to be an illusion based on an extremely unrepresentative sample of rocks gathered at the old Good Days mine and the project that had been “pre-sold to the Chinese” was Arcadia, not next door but some 140km away.

As we will see, Prospect cut their losses and walked away from Good Days only months after Jones sent his glowing endorsement.

Nevertheless, the die was cast and several months of feverish deal-making ensued over the remainder of 2018 and into 2019.

Mr. Lithium

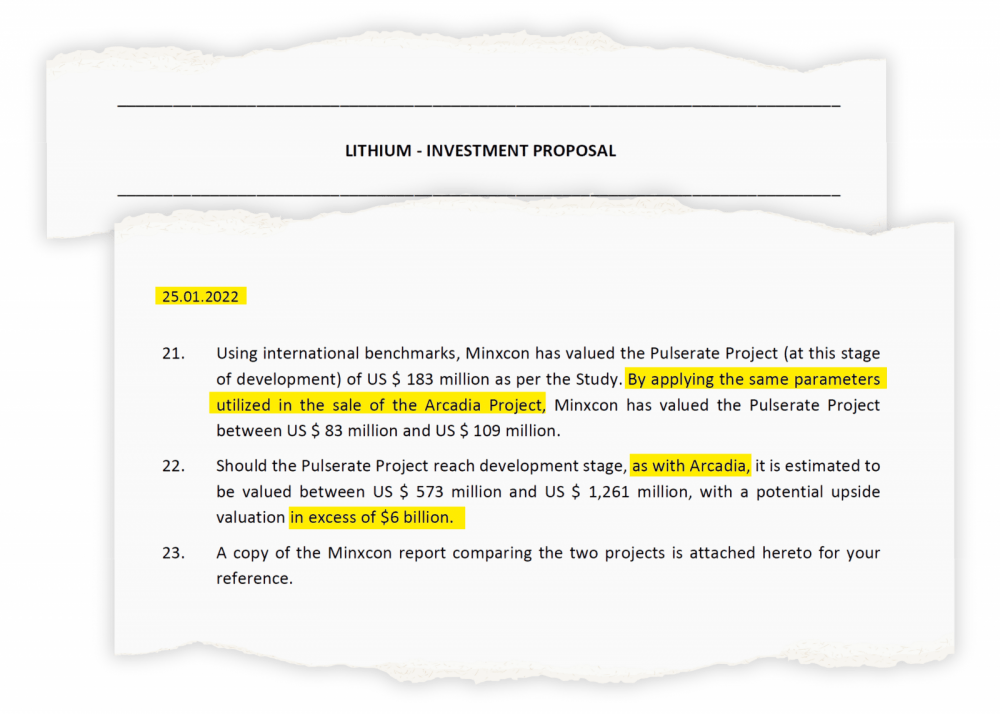

Ultimately, Moti found himself with 84 lithium claims covering nearly 10 000ha. Practically none of it had actually been explored in any meaningful way and any real value was, in the words of Moti’s own consulting geologist Minxcon, entirely “conceptual”.

What this meant is that Minxcon applied the average grades of lithium mines around the world to create a hypothetical range of values for Pulserate. On the one extreme, the project would be worth practically nothing. On the other end of the scale it would be a world-class super-deposit.

In response to questions, Minxcon geologist Maria Antoniades told us that “an informed reader will understand that the ranges imply that the estimation is of low confidence and high risk”.

Despite having next to no real data in hand, the Moti Group started shopping for an investor with what now appear to be extravagant promises.

In an October 2021 meeting with his now-estranged business partner Frederick Lutzkie, Moti piled on the superlatives:

“This lithium is on the fucking surface chommie. Look at me. This is not underground. This is sommer on the fucking surface … I am serious boet. Look at this. There is nothing to be done. You go there, you pick up the material.”

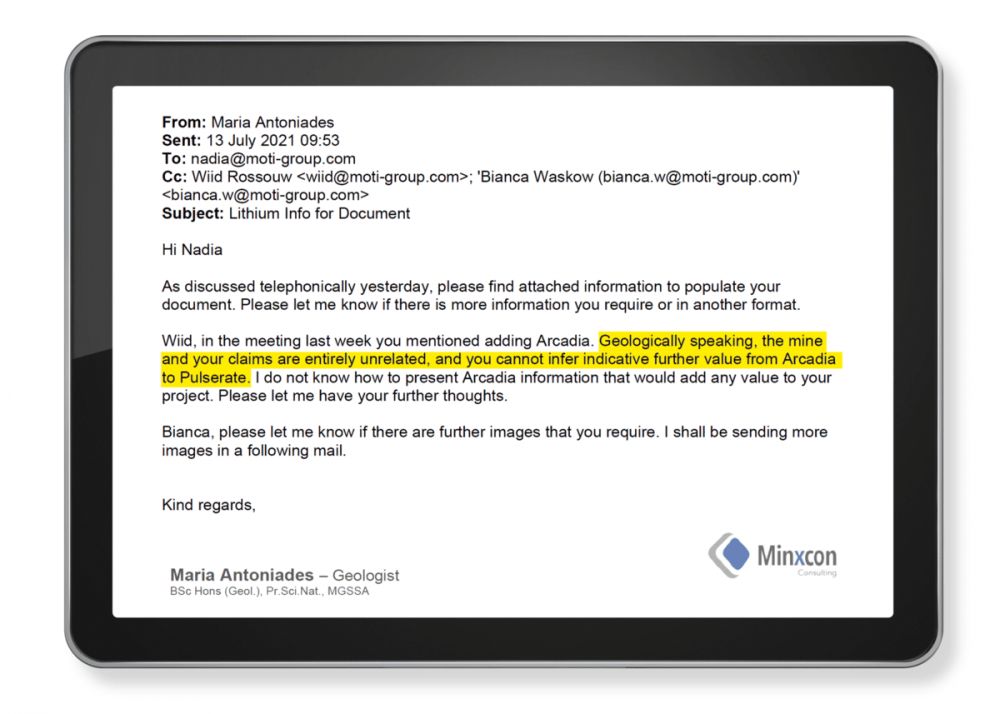

Pulserate ignored the warnings from their own consultants Minxcon that it made no sense to compare their project to Prospect’s Arcadia which was 140km away and had no geological relationship to it.

Despite this, leaked documents show Pulserate had Minxcon prepare an entire presentation a few months after this email entitled “Review of Lithium Claims vs Arcadia Project”.

Simply applying the geology of Arcadia to the huge surface area of the Pulserate claims led to Moti claiming the potential “upside” was a staggering $6 billion.

Minxcon however told us that “the presentation corroborates and explains the point made in the email — that the value of the Pulserate project could not be compared directly with Arcadia because Arcadia is in a far more advanced stage of development than that of Pulserate”. (See their full response here).

In paid-for content placed in various South African newspapers in May this year following amaBhungane’s first #MotiFiles articles the Moti Group still hyped up its prospective “$1 billion African lithium powerhouse”.

Up to a point, Moti may very well have believed his own sales pitch. By the time he was finally reeling in his big fish investor last year the evidence suggests he must have known better.

‘Jack-shit there’

Some exploration had been done around Good Days by the Australians Prospect, which had abandoned the site back in 2018. On request, Prospect’s chief geologist Roger Tyler emailed a report he had produced to Moti Group executive Bianca Waskow on 2 September 2021.

In his report, Tyler noted that there were sporadic instances of lithium-rich rock but that these were “highly zoned” and very limited in extent. They were in other words like needles in a haystack and there probably weren’t enough of them to warrant upending the haystack to begin with.

“No further work is recommended in the area,” he said.

Minxcon’s conceptual desktop studies predated the disclosure of this damning geology report to the Moti Group.

However, the report came to the Moti Group’s attention long before it called on Minxcon for further presentations in January 2022, in which it asked Minxcon to do a “direct comparison” between Pulsate and Arcadia.

There is a simple reason this new information was not taken into account: “The Tyler report was not made available to Minxcon, nor was it mentioned to Minxcon. Minxcon was not aware that this report exists,” Antoniades told us.

In the course of 2022, the Moti Group seemingly independently became aware just how unpromising their lithium claims were.

A series of recordings of meetings between Moti Group executives contain unguarded discussions of this problem, laying bare the stark divergence between the negative private views and all the ongoing public hype about the supposed lithium mega-project.

In one recording from October last year, Pulserate chief operations officer Mark Beukes discusses the project with in-house legal counsel Natalie Graaff.

Beukes recounted a conversation he had with Pulserate chief geologist Godfrey Chagonda:

“I said to him, listen, I’m not asking you for a preview. I’ll pay you for your opinion. I’m going to get my core results. I’d like your professional opinion. He said, I’ll do it for free, there’s fuck-all there. He said, don’t ever send your cores in. Don’t waste your money. It’s not worth it, there’s nothing there.”

In the same recording, former in-house lawyer Clinton van Niekerk asks Beukes whether there is anything else in the ground:

VAN NIEKERK: Still not tantalum hey?

BEUKES: There’s no tantalum

VAN NIEKERK: Did you even find any beryl, man? Turn it into an emerald mine there. There’s supposed to be emeralds in Good Days.

BEUKES: There’s jack shit there, just rock.

Later on, Beukes explained to his colleagues the problem of “highly zoned” deposits that had been raised in the geological report that caused the Australian Prospect Resources to leave the area.

“You know what the reality is. Good Days is … It’s a nugget … You can’t drill if it’s such a small seam and you’re going to miss, miss, miss. I mean, fuck it, it’s not worth mining.”

Yet another recording from September 2022, of Moti instructing a subordinate Wiid Rossouw to negotiate to reduce the asking price for a new set of claims unrelated to the Pulserate project, seemingly includes him complaining about how they previously bought claims containing “fuck-all”. The reference to “10 000 hectares” identifies it as Pulserate.

MOTI: Tell them to go fuck themselves. They can go mine it themselves, okay. Six hundred thousand dollars…

ROSSOUW: Zunaid, can we offer them 300?

MOTI: For what would you? We don’t even know what’s there.

ROSSOUW: Okay

MOTI: You’re just assuming that you’ve got shit there again. We bought a ten thousand hectare reserve on the basis of that.

ROSSOUW: Ja, ja

MOTI: There’s fuck-all there.

In a 23 August recording Graaff is captured saying that losing Pulserate to Yibin Tianyi altogether in terms of a guarantee agreement they signed would not be a loss at all:

“I would say he [Pei] can have Pulserate. We don’t care. You know, because we know there is nothing there.”

In response to questions, and being confronted with these recordings, Moti did not challenge their authenticity but dismissed them as irrelevant.

“A material part of the transaction with Tianyi was related to a large-scale exploration taking place over a period of two years … Until such a time as these exploration activities were completed, nobody could truly make any objective assessment of the value of Pulserate’s claims.”

He further referred to “numerous meetings and site reports where the geological team provided positive feedback on their progress and the prospects of the project”.

“I am not at liberty to share any of these with you as they are subject to confidentiality … The Moti Group continues to believe in the Pulserate Project, and is continuing its exploration efforts and doing the necessary test work required to develop its project.”

Likewise, Mogajane separately dismissed the recordings saying “there can be no objective opinion as to the value or potential of our lithium resource until the exploration activities have been completed by experts in this field. This is the very purpose of the exploration phase. It has always been clear that, of the 10 000 hectare reserve, there would be sections that would contain very little to no lithium”.

“That has always been a discussion point between various executives of the Moti Group. This was also discussed in detail with CATL in numerous meetings”

In the meantime, Moti ran into another roadblock. Despite the vast expanse of his claims the entire deal with the Chinese seemed to ride on one single small corner of the land — the old Good Days mine itself.

But the problem was, someone else claimed to own it and that someone was allegedly the Zimbabwean minister of mining.

The minister and the vice president

Back when the Australians Prospect were exploring the area they did so in terms of a deal with a company called Barrington Resources, which was as far as anyone knew the actual owner of mining claims covering the Good Days mine.

Official mining maps and also those published by Prospect showed Moti’s closest claim, dubbed Good Days K, only bordering the Barrington claims. The Chinese did not miss the discrepancy and Pei’s due diligence team drilled Moti’s team about it mercilessly.

“We are mostly concerned about the potential overlapping of mining claims for Good Days area with competing mining claims held by certain third parties,” read a list of “key issues” as the Share Purchase Agreement was being finalised.

Moti’s version was that it “appears from all published material by Prospect that they were [mistakenly] labouring under the impression that they owned Good Days K”.

To hopefully settle the matter, on 21 April 2022, Pulserate procured a letter from the provincial office of the Ministry of Mines and Mining Development seemingly confirming the coordinates of Good Days K — coordinates encompassing the mine.

Despite the confident assurances the leaks suggest the Moti Group was fretting.

On 23 August 2022, top Moti executives Salim Bobat, Wiid Rossouw, Natalie Graaff, and Van Niekerk met at the Moti Group’s headquarters in Parkmore, Johannesburg. It appears from a recording of the meeting that the Moti Group was already planning ahead for when their claim to the mine gets challenged.

BOBAT: Two things can happen. Is it, will they ask for the $6 million back, if that is the case…

GRAAFF: No. Then he must tell them, ‘Come, let us jointly sue the ministry of mines. It is their fault’.

BOBAT: Now it is … Remember that’s the rush. The $6 million.

GRAAFF: And whatever they spent to date on the drilling.

BOBAT: No, they won’t have that. Let’s first find out about this. By the time they get to it, you are going to know about that.

GRAAFF: In their minds they think we own that thing.

BOBAT: But the whole problem is, our problem is … we must find a way to keep the $6 million

ROSSOUW: So once we get the six million, we are blowing up.

Responding to questions, Moti said that this recording must be seen in its proper context: “Moti Group took the full legal risk for any issues with the coordinates of the Good Days K claim (and all the other claims for that matter) by way of warranties contained in the agreements. The Moti Group would continuously assess its legal and commercial options in respect of this matter, debating potential outcomes amongst its team members and legal advisors.”

The Moti team need not have worried.

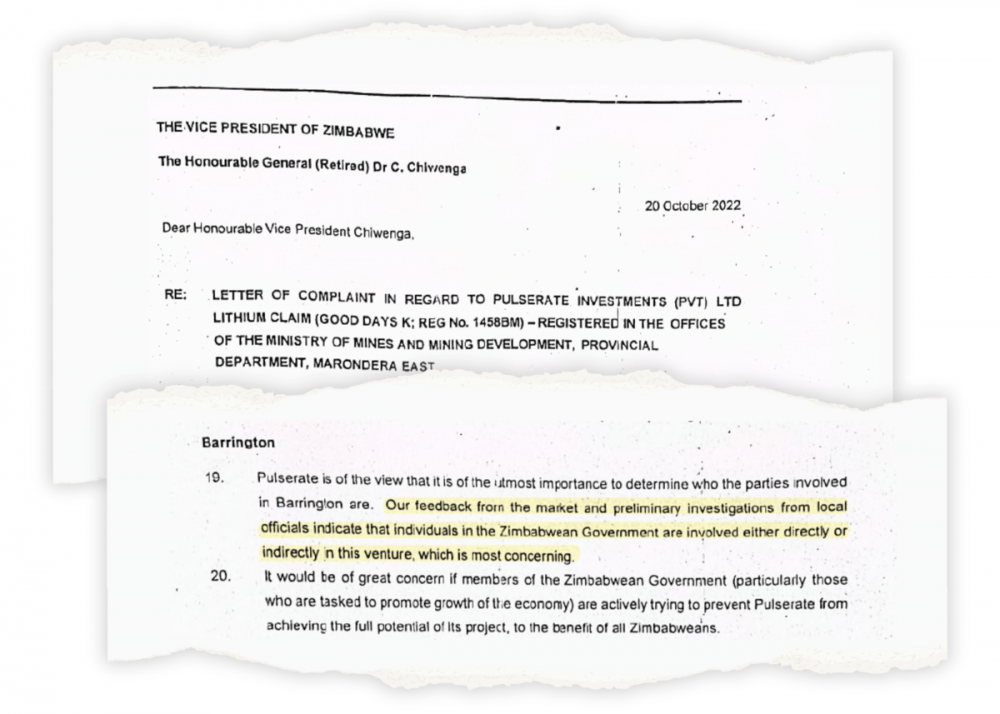

Barrington, of course, objected to what, in their view, amounted to being dispossessed of their claim and they took the matter to the Zimbabwe high court in December 2022.

According to affidavits Barrington had called on the provincial director of mining Tendai Kashiri to adjudicate the supposedly overlapping claims. Moti’s people, however, failed to pitch up for two scheduled meetings.

Instead, Moti Group CEO Dondo Mogajane went over the entire ministry of mining’s head and wrote to the vice president of Zimbabwe, known Moti ally Constantino Chiwenga. Their cosy relationship was canvassed in a previous #MotiFiles exposé.

In the “highly confidential” letter Mogajane laid into Barrington and perhaps most importantly hinted darkly at the rival being owned by — then still unnamed — “individuals in the Zimbabwean government”. In Zimbabwe it is illegal for an official involved in regulating mining to have an interest in a mining project.

In court Barrington levelled accusations of forgery and fraud against Pulserate, specifically alleging that it had moved the coordinates of Good Days K with the connivance of a mining official.

Moti however had a trump card, alluded to in the letter to the vice president.

In court Pulserate quoted mining minister Winston Chitando as the alleged owner of Barrington and claimed his “nefarious and greedy conduct” underpinned an attempt to “annex the mining claims in question”.

In Zimbabwe, playing such a card against the mining minister would be a high risk strategy, unless of course the letter to the vice president had paved the way.

In any case, it was successful. The court found not only was it illegal for the mining minister to own a mining claim, but Barrington could not even convince the judge that its own claim was legitimate.

The main problem was that Barrington claimed to have bought its Good Days claims in 2012 but the company was only registered in 2013 and could not produce any kind of pre-incorporation contract as required. The acquisition of the claims was consequently a “nullity in law”, wrote judge Mutevedzi in a July ruling.

This meant that Pulserate never had to defend itself against any of the factual allegations about faking coordinates and colluding with officials. By all appearances Moti is completely in the clear.

From $6 million to $76 million

The efforts to secure the Good Days mine were obviously necessary to keep the Chinese interested, but in the larger context of the Moti Group’s operations Pei’s $6 million was not

an astronomical amount of money.

If, contrary to Moti’s denials, the internal consensus really was that there was “jack shit

there” — which the Chinese would likely find out soon enough — why go to so much trouble to reel them in?

Leaked documents suggest, however, that Moti hoped for a much more dramatic and

immediate bonanza.

One day after securing Pei’s signature on the Pulserate MOU, on 1 April last year, Moti was pitching a back-to-back agreement with commodities trading behemoth Trafigura.

According to a proposal contained in the leaked #MotiFiles the idea was to leverage the Pei deal into an instant cash bonanza of $70 million (R1 billion) irrespective of whether the mining project ultimately succeeded.

Moti proposed the following: Trafigura would provide Moti with the $70 million cash and several months down the line, when further payments from Pei were theoretically due, Trafigura would get paid back $100 million – an extremely generous return on investment of 43%.

However, in the event of the lithium project failing, Trafigura would not have any recourse

against Moti himself but rather have to settle for 20% of a platinum project in Rustenburg,

South Africa, which was offered as security.

The platinum project Kilken is itself mired in disputes between Moti Group shareholders and another shareholder, Frederick Lutzkie.

In response to questions, Moti said that this was just a conceptual discussion document and was never implemented in any form. It does however show how Moti hoped to capitalise on the lithium project whether it actually ever came to anything or not.

As for the Chinese, it seems they have lost faith in Moti, and acted even before waiting for

the recent positive outcome of the court case around Good Days K.

In response to questions, Yibin Tianyi said on 13 July, “Tianyi has no investment in the

relevant project and thus please do not name Tianyi in your publication” without offering any further explanation.

On 19 July, Bloomberg reported that the Chinese investor had cut its initial investment to 10% rather than 20%.

SIDEBAR: “In the background always”

The leaked #MotiFiles suggest that the Moti Group’s new CEO Mogajane and executive director, Moti’s son Mikaeel, are mere figureheads.

In March this year Zunaid Moti announced that he would be “stepping away” from leadership of the sprawling group bearing his name, citing the damage being done by his reputation to the company. He would henceforth concentrate on the group’s major subsidiary African Chrome Fields, read a press release.

In Moti’s stead Mogajane would take over as CEO, bringing with him a clean record and the glow of having sat at the top of an unusually well-regarded state institution, the national treasury.

During the negotiations with Pei around Pulserate, Moti wrote the Chinese billionaire a personal letter dated 29 March 2022 which is contained in the leak.

In it Moti reassured the investor that “my son and others will be the front for the transaction to protect your reputation and to make the deal more sellable in China, I am in the background always”.

With regards to his son, Moti rejects this reading outright, saying that “the assumption that Mikaeel’s succession of myself is merely cosmetic is vehemently denied”.

In one recent paid-for article Mikaeel is referred to as a “business prodigy”.

With regards to Mogajane, Moti suggests that he could not be the “others” being referred to because, although he was already negotiating with Mogajane to take the helm, the letter predates the decision to employ him:

“At the time that the Moti Group entered into the transaction with Tianyi, I was already contemplating stepping down from the operations because of the impact that negative media coverage in relation to me personally was having on the group. At this stage, I was already in discussions with Dondo Mogajane to join the group as the CEO. Accordingly, this letter predates the announcement that I would be stepping down formally in March 2023 after completing a lengthy handover period during which time Mogajane was familiarising himself with the group on a practical level.”

Ironically this response seemingly supports rather than refutes the notion that Moti may have had the soon-to-be-appointed Mogajane in mind when he wrote to Pei.

This article was produced by amaBhungane in collaboration with the Organised Crime and Corruption Reporting Project.

.jpg)

Discussion about this post