Following a quarter when Nvidia Corp. grew data-center revenue and earnings each by more than 400%, another number illustrates the company’s dominance even more.

Among the record-setting elements of Nvidia’s

NVDA,

stunning fiscal fourth quarter was its 76% GAAP gross margin, which was up from 66% a year before. Nvidia forecasts that margin will remain around the same level for its ongoing quarter.

Nvidia’s gross margins appear to be the second highest in the semiconductor industry, behind only those of Arm Holdings PLC

ARM,

which licenses chip designs but doesn’t sell its own chips directly. Arm’s gross margins were roughly 93% in the December quarter.

Unlike Arm, Nvidia incurs expenses for things like inventory and supply-chain distribution, which helps explain why the company’s gross margin is lower. At the same time though, Nvidia’s margins stand out among those elsewhere in the chip sector. Intel Corp.

INTC,

reported a gross profit margin of 46% while Advanced Micro Devices Inc.

AMD,

reported a 40% margin in the fourth quarter, according to FactSet.

Admittedly, those companies have different business mixes. Intel and AMD make processor chips for PCs, among their other offerings, while Nvidia and AMD both have gaming-chip businesses. Plus, Intel manufactures its own semiconductors.

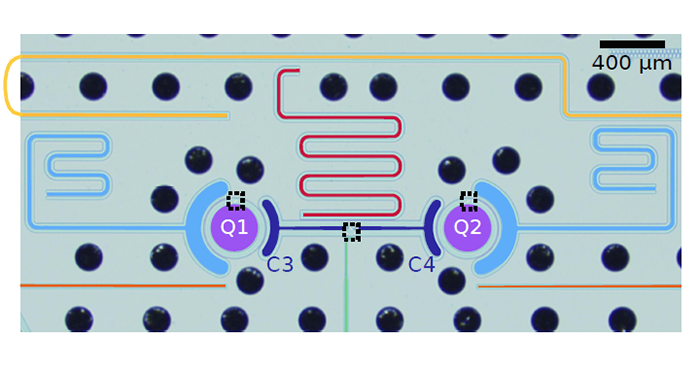

Leaving mix aside, however, Nvidia’s margins are so high in part because of the high prices the company is able to command for its products, due to their complex nature and their unstoppable demand. And Nvidia’s chips really are complex — not just a motherboard with a graphics processor unit (GPU).

“People think that the Nvidia GPU is just a chip, but the Nvidia Hopper GPU has 35,000 parts. It weighs 70 pounds,” Nvidia Chief Executive Jensen Huang said on the company’s earnings call Wednesday. “These are really complicated things we’ve built. People call it an AI supercomputer for good reason.”

The average cost of an H100 GPU is about $30,000.

Nvidia did note that its margins for the latest quarter and the current one could represent a peak due to favorable component costs in the supply chain in the past few months. But Chief Financial Officer Colette Kress said Nvidia had “visibility” into a mid-70% gross margin for the balance of this fiscal year, which would take margins back to where they were before this latest high-water mark.

In other words, even if Nvidia’s margins come down a bit from here, they’re still poised to sit above those from virtually every peer in the sector.

Nvidia will also be ramping up its next-generation GPU product, called Blackwell, but it is also currently supply-constrained. That could pressure Nvidia’s margins if it has to spend more on components that are in tight supply or if it cannot meet all the demand.

Read also: Wall Street keeps likening Nvidia to dot-com era Cisco. Is it justified?

Wall Street had been nervous about the demand for Nvidia’s products and investors have been on the lookout for any signs that the boom is ending. The company talked up years of growth potential ahead, but the margin figures add an understated element to the story of Nvidia’s prime positioning and help throw cold water on investors’ skepticism.

While Nvidia has had a near monopoly on the market for AI hardware so far, it will be facing more competition soon. Still, those record margins are clearly indicative that demand is continuing, and Nvidia should be able to command premium prices for its chips and accompanying systems due to the value they bring to customers.

Discussion about this post