Check out the on-demand sessions from the Low-Code/No-Code Summit to learn how to successfully innovate and achieve efficiency by upskilling and scaling citizen developers. Watch now.

The new year will see AI tools for chip design, video streams with ad support, and a crowd of satellites in space, according to the annual tech, media and telecom predictions from accounting and consulting firm Deloitte.

In its predictions, Deloitte said it expects we will see the major formerly ad-free streaming services shift to offering cheaper or free options with advertising. The firm also sees a lot of M&A activity continuing across the tech, media, gaming, and telecom markets in 2023.

It also said that streamers are getting in the game with live sports, in a bid to turn fans into subscribers. Jumping over to deep tech, the company also said chips are getting more complicated and design talent more scarce. As a result, AI tools could come to the rescue. (This trend has been happening in chip design tools for a lot of years already, but it’s accelerating.)

And Deloitte said five thousand satellites in orbit could connect the world with data, but managing traffic in space is getting more challenging, according to the Deloitte Technology, Media & Telecommunications

2023 Predictions report.

Event

Intelligent Security Summit

Learn the critical role of AI & ML in cybersecurity and industry specific case studies on December 8. Register for your free pass today.

Rising inflation and interest rates, slowing economies, and plunging consumer confidence have dominated discourse this year, Deloitte said. And economic conditions are driving a rebound in tech divestitures and growth in M&A activity around gaming as many targets are much cheaper than a

year ago.

The report focuses on the crucial roles artificial intelligence (AI), advertising video on demand (AVOD), 5G and chips could play in our hyperconnected world. These broad and diverse subjects reflect how far and wide Deloitte’s reach is in terms of industries that it analyzes.

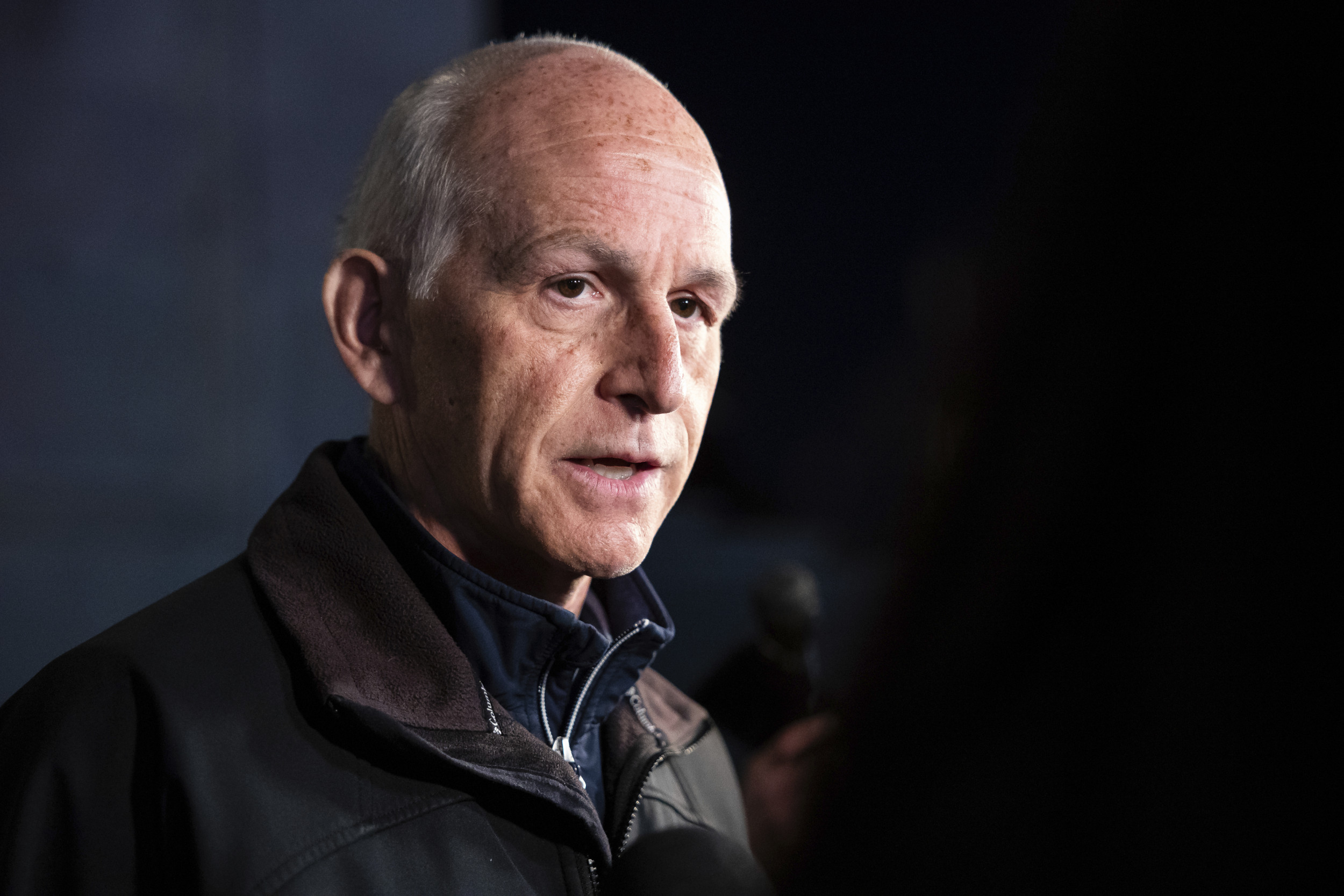

“This year’s TMT predictions underscore a common theme, both with consumers and businesses to do

more with less as inflationary pressures, supply chain issues and other world events continue to cause

uncertainty,” said Kevin Westcott, vice chair at Deloitte U.S. global Telecommunications, Media and entertainment (TME) practice leader, in a statement. “Given this, consumers are looking for more cost-effective ways to communicate, to be entertained, and to be productive, while businesses are looking for efficient ways to innovate in order to compete, differentiate and grow revenue. Our thinking on these emerging trends should help guide organizations as they plan for the future and strive to meet their customers’ needs.”

Gaming M&A is growing on the back of consolidation, portfolio plays, and game tech

Deloitte predicts that in 2023, the number of video game company mergers and acquisitions will continue to increase by around 25%, slightly slower than the estimated 30% quarterly growth of 2022. Video game services, experiences, and business models are innovating, console supply chains are loosening up to meet pent-up demand for next-gen experiences, and many anticipated games that were delayed in 2022 are now set to reach players in the coming year.

Deloitte predicts that the VR market will generate $7 billion in revenue globally in 2023, a 50% increase over 2022’s $4.7 billion. As VR grows in popularity, 90% of that revenue will likely come from headset kit sales, with 14 million units averaging $450 each expected to sell in 2023. The remainder should comprise mostly of VR content — principally games, but also some enterprise applications — which could see revenues of just over $1 billion.

That said, in terms of numbers, VR has a long way to go to catch up with other digital devices. Smartphones alone count almost five billion users worldwide, and billions also use PCs, tablets, and

TV sets. Even smart speakers, a relatively new device that launched in 2017, will likely boast an

installed base of more than 500 million units by the end of 2023. At an active installed base of just

22 million in 2023, VR will therefore remain relatively niche for the time being.

Now that component shortages have been alleviated some by the economic downturn, game hardware and VR hardware companies may be able to ship more products in 2023, said Hanish Patel, a Deloitte managing director who specializes in gaming, in an interview with GamesBeat.

Improvements in the underlying technology, including power, screens, and audio should fuel this growth. Next year, headsets should offer higher frame rates, higher-resolution displays, and enhanced spatial audio, enabling a realistic, immersive experience.

“I truly believe that because of just the sheer pace of new technology, new innovation, adoption, it’s leading to incredibly more exciting and accelerating times,” said Patel.

Microsoft is in the process of acquiring Activision Blizzard for $68.5 billion, and the thing about big acquisitions is they inspire more acquisitions, Patel said. Prices for some companies are falling and that could inspire more M&A as well.

“That in itself is going to still result in a fair amount of deal flow,” Patel said. “Companies are maximizing their intellectual property. And in order to do that, there still will be some more consolidation.”

One interesting point is that Deloitte didn’t really bring up the metaverse or blockchain gaming much in the gaming section of the report. But Patel said that the firm has been watching those areas develop for a while. The slowdown in crypto and its “rollercoaster year” could affect blockchain gaming’s growth, he said. And while gaming is an onramp for the metaverse, Deloitte did not weigh in on that topic in a big way in this report. Still, Patel said he sees growth ahead for the metaverse and Web3 technologies in gaming.

As for growth in 2023, Patel said he could see the that supply chain shortage that held back the console game industry has begun to ease. This holiday season could well determine whether the shortage caused gaming to permanently lose console sales or if there is still pent-up demand that could be fulfilled now that consoles are more plentiful.

“We’re saying the foundations of gaming are strong and have been strong for a long time,” Patel said.

Global growth in streaming services includes AVOD increase

Deloitte predicts that major streaming services that have been ad-free will add AVOD (advertising video on demand) options. While ad-free subscriptions aren’t going away, Deloitte anticipates that by the end of 2023, major subscription video-on-demand services in developed markets will likely launch new ad-funded tiers. By the end of 2024, half of these providers will likely also have launched a free ad-supported streaming TV service (FAST). And by 2030, Deloitte expects that most online video service subscriptions will be partially or wholly ad-funded.

“Our recent research showed the churn rate for streaming services in the U.S. was 37%. This means

media and entertainment companies should continuously look for ways to generate new revenue while

appealing to cost-conscious consumers who have a growing appetite for more compelling and diverse

content,” said Jana Arbanas, vice chair of Deloitte and U.S. telecom, media and entertainment sector

leader, in a statement. “Advertising video on demand, for example, can satisfy both objectives by giving consumers more options that work within their budget and streaming companies more opportunity for growth by working with eager advertisers, not to mention the more lasting relationship with consumers.”

Semiconductor companies turn to AI and high-power materials to design future chips

Chip companies are using AI to help design chips faster, cheaper, and more efficiently. Deloitte predicts that the world’s leading semiconductor companies could spend $300 million on internal and third-party AI tools for designing chips in 2023, and that number may grow by 20% annually for the next four years to surpass $500 million in 2026. The impact of AI will likely go far beyond the money spent on AI design tools.

They can enable chipmakers to push the boundaries of Moore’s Law, save time and money, and even drag older chip designs into the modern era. In 1965, Intel chairman emeritus Gordon Moore predicted the number of components on a chip could double every couple of years. For decades, that held true, resulting in huge technological advances. A number of chip leaders say the easy advances from manufacturing over the decades have been exhausted.

“The semiconductor shortage has demonstrated the need for faster, more efficient manufacturing of

chips in order to meet demand,” said Paul Silverglate, vice chair, Deloitte and U.S. technology sector

leader, in a statement. “Artificial intelligence-aided design can be used to address this need and can also make older chips better by moving to more advanced process nodes, and even help close the chip talent gap. By making chip design exponentially faster with AI, semiconductor companies can move beyond the

current market challenges and focus more on what’s next.”

Supercharged semiconductors made of high-power materials are taking chip development to a new level. Replacing silicon, these materials — primarily gallium nitride and silicon carbide — are suited for the higher voltages, power levels, and resilience needed for increasingly common applications such as EV batteries, super-efficient consumer electronics chargers, powerful solar panels, advanced military applications, space technology and nuclear energy.

Deloitte predicts that chips made of high-power semiconducting materials could sell a combined $3.3 billion in 2023, up almost 40% from 2022. Growth in these types of chips, collectively known as power compound semiconductors, is expected to accelerate to nearly 60% in 2024, possibly generating revenue of more than US$5 billion.

Broadband satellites will need to navigate a crowded sky

Deloitte predicts that more than 6,000 broadband satellites could be in low-Earth orbit (LEO) by the end of 2023, because of growth in commercial data satellite deployments to provide high-speed internet to every corner of the world. They could make up two working constellations providing high-speed internet to nearly a million subscribers on all parts of the planet, no matter how remote.

Starlink alone has more than 2,600 satellites in space, and Amazon plans to put 3,236 satellites into orbit.

If every organization currently planning to build an LEO constellation succeeds, seven to 10 competing networks could be operational by 2030, with a total of 40,000 to 50,000 satellites serving more than 10 million end users. This growth would likely require more to protect the commons of space including increased industry collaboration and new capabilities for space situational awareness, in-orbit satellite servicing, and space debris removal.

Among the impacts: Deloitte expects a lot of demand for radiation-hardened semiconductors.

Additional Deloitte 2023 TMT predictions:

Many organizations want to reach net zero and the technology industry is making a strong commitment. According to an analysis of the Deloitte CxO sustainability survey, tech companies are working harder and faster to impact climate change and are 13% more likely than non-tech companies to target net zero by 2030.

By introducing virtualized, cloud-centric capabilities, 5G standalone (SA) networks are poised to drive disruptive change that could make previous advances in wireless technology (2G/3G/4G) appear incremental. Deloitte expects the number of mobile network operators (MNOs) investing in 5G standalone networks — with trials, planned deployments, or actual rollouts — to double from more than 100 operators in 2022 to at least 200 by the end of 2023. Deloitte expects to see $99 5G phones.

Virtual production is also getting real. The tools and techniques of virtual production are transforming film and cinema, increasing flexibility, shortening production times, and bringing real-time computer-generated imagery and visual effects out of post-production and onto real-life sets. Deloitte predicts that the market for virtual production tools will grow to $2.2 billion in 2023 — up 20% from an estimated $1.8

billion in 2022.

The next arena for the streaming wars: live sports

Streaming providers are spending billions of dollars on live sports. They have purchased rights across the

spectrum of sporting events in a bid to attract, retain, and monetize their audiences via this popular content. Deloitte predicts that in 2023, streamers could spend more than $6 billion on major sports rights in the largest global markets.

Streaming services are the latest to enter the live sports ring, with cable, broadcast, and satellite services all contending for fans. In one corner stand entertainment companies and regional sports networks with traditional linear channels that also offer a streaming service. In another corner are the “pure play” streaming providers who have only their streaming service as an option to reach consumers. In the third corner, there are tech companies looking to broaden the reach of their streaming services and increase time spent within their ecosystem.

Apple has committed to spend at least $2.5 billion for the sole rights to stream every U.S. Major League Soccer (MLS) game over the next 10 years via a dedicated Apple TV app.

Shopping goes social, trending past $1 trillion annually

Deloitte predicts spending for goods and services on social media will surpass $1 trillion globally in 2023, growing 25% annually with more than two billion people shopping this way in the last year. The social commerce market is outgrowing traditional e-commerce. In a Deloitte survey, Generation Z and Millennials are more likely than Gen X respondents to say that social media influencers affect their buying decisions.

And cloud, telco, equipment, and platform companies are vying for a share of enterprise investments in edge services and products that make computing faster, safer, and cheaper. Deloitte predicts that the enterprise market for edge computing will grow at 22% in 2023, compared to 4% growth in spending on

enterprise networking equipment and 6% on overall enterprise IT for the same year. Most of this growth will likely come from expenditures on hardware initially but should migrate toward software and services as the market matures.

GamesBeat’s creed when covering the game industry is “where passion meets business.” What does this mean? We want to tell you how the news matters to you — not just as a decision-maker at a game studio, but also as a fan of games. Whether you read our articles, listen to our podcasts, or watch our videos, GamesBeat will help you learn about the industry and enjoy engaging with it. Discover our Briefings.

Discussion about this post