SAS, a leader in analytics, hosted an exclusive gathering of financial services key players, experts, and decision-makers in Cairo recently.

The event, which was held at the St. Regis Cairo Hotel, centred on how technology, analytics, and AI can support the banking sector in Egypt and why they play a critical role in defining the future of data-driven banks and their growth.

Following a long period of dedication and careful planning, Egypt has established a robust banking system. The industry has maintained low nonperforming loan levels, high capital adequacy ratios, and sufficient provisioning. Avoiding some of the most severe economic effects of the COVID-19 pandemic witnessed elsewhere, was one of the sector’s most remarkable achievements in recent years. However, challenges never cease to arise.

The turbulence in capital markets, concerns of a recession, global geopolitical tensions, the rise of cyber threats, and the escalating climate crisis require immediate action by the financial services industry in order to maintain its current positive trajectory.

In this unpredictable environment, SAS industry experts how analytics and artificial intelligence can become the banking industry’s most valued ally. Starting with a glimpse of banking in 2035 via three potential scenarios, the company’s analytics and AI specialists outlined essential success strategies and shared rare insights on the digital transformation journey of major financial institutions that pioneered in adopting AI.

Abed Hamandi, Senior Regional Director – EMEA Emerging at SAS stated: “From rapidly accelerating digitalization and rising cyberthreats to economic fragmentation and pervasive economic and social inequities, banks face a defining moment. The decisions that banking leaders make today will redefine the industry as a whole. By embracing technology and innovation with purpose, banks can pave the way for a more purpose-driven evolution of our world. Thanks to SAS’s breakthroughs in data analytics, cloud, AI, and smart decisions, we can help the financial services industry thrive in this shifting landscape.”

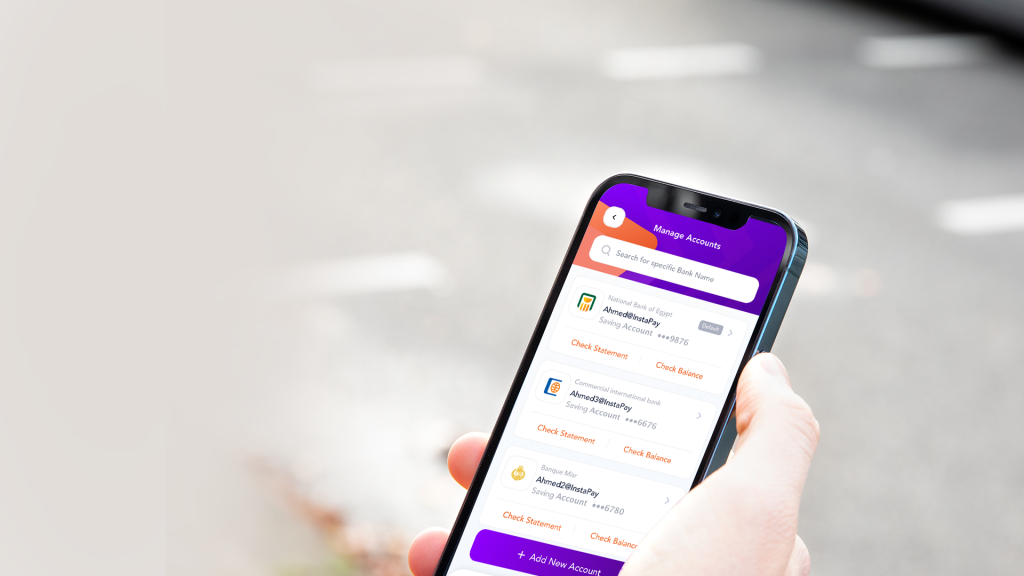

Through an engaging panel discussion and parallel sessions, SAS highlighted the potential of AI and analytics in navigating challenging conditions. To address a wide range of strategic business demands and ensure success in the face of disruption, banks must embrace cutting-edge technology including analytics, AI, cloud, and open banking APIs. In the field of risk management, rapid, data-driven decision-making is necessary to respond to market volatility. Additionally, embedded AI and machine learning techniques can assist banks in identifying fraudulent transactions in real time, allowing them to remain ahead of evolving fraud schemes. Likewise, banks can apply AI to streaming customer data to automate customer experience decisions at scale and enable personalized customer service.

“SAS has been supporting more than 20 Egyptian banks with advanced solutions in areas such as fraud management, anti-money laundering, risk management, and analytics since 2005. We are still going strong, thanks to our local operational team and our six local partners who act as an extension of our company,” Samer Naguib, Country Manager for Egypt at SAS,added. “We firmly believe that better banking begins with better insights. Thus, our sophisticated array of solutions can help organizations in every aspect of financial services make optimal decisions based on reliable data, unleash AI’s immense potential, and digitally transform with speed and agility.”

Discussion about this post