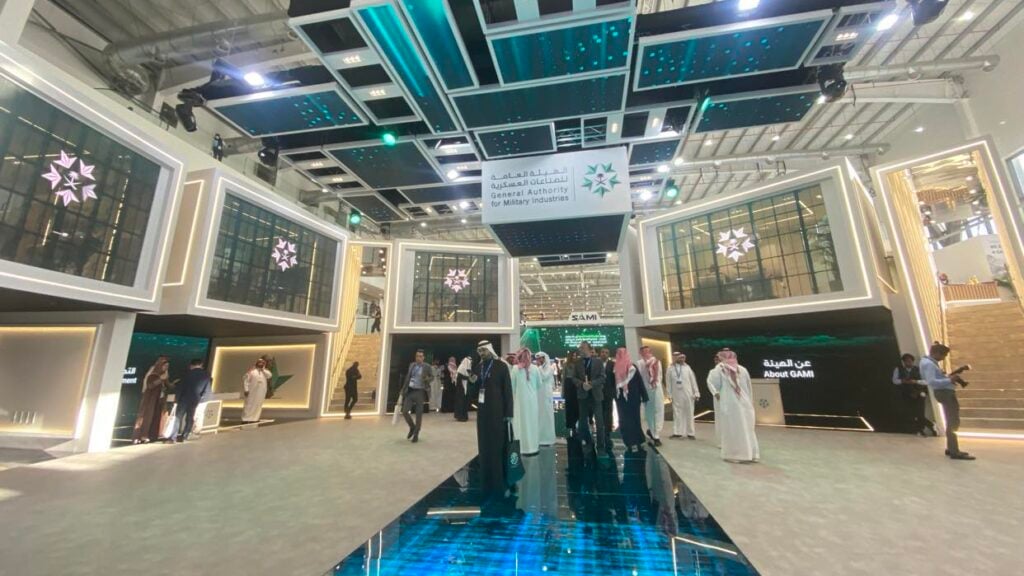

The GAMI stand seen at World Defense Show 2024. (Agnes Helou/Breaking Defense)

WORLD DEFENSE SHOW 2024 — While the Kingdom of Saudi Arabia is “very keen” on joining the UK-Italy-Japan Global Combat Air Program (GCAP), localization remains a priority for any deal to be sealed, a key Saudi industrial official tells Breaking Defense.

“I think [joining] the program [GCAP] is important to Saudi Arabia and it’s managed by MoD. And we are part of that from the localization point of view. There is a serious discussion [as] Saudi Arabia is very keen on the sixth-generation fighters, and we are talking to the UK their partners and we are making good steps forward,” Ahmad Al-Ohali, the governor of the Saudi government’s General Authority for Military Industries (GAMI), said in an interview at this week’s World Defense Show.

He added that there are some challenges “but I think we have options and we know what we require. As His Royal Highness Prince Mohammed said seven years ago, there will be no armament transaction without localization. To us, this is our motto … there’ll be no transaction without serious, decent and important localization in Saudi Arabia.”

Al-Ohali told Breaking Defense that the Kingdom sees potential contributions towards GCAP in the realms of manufacturing, development and technology, as well as providing human capital for the program. But ultimately, KSA has to be fully involved, “otherwise it doesn’t make sense for us.”

Unlike the UK, Japan and Italy, nations with a wealth of industrial expertise in the design and production of fighter jets, Saudi Arabia has consistently relied on foreign imports rather than domestic aviation suppliers and technologies to acquire new platforms. With a whole host of major airframe, weapons and subsystems suppliers already tied to the GCAP effort, Riyadh has still to fully articulate the scale of the contribution it could make to industry workshare arrangements.

Those arrangements are typically heavily contested by partner nations who are all looking to maximize returns — each nation wants as much domestic production, and the economic benefits that come with it, as possible. But in financial terms, Riyadh has the upper hand, and is capable of offering much needed, additional cash for GCAP that would potentially ease concerns around development costs and the long-term health of the project.

RELATED: FCAS? SCAF? Tempest? Explaining Europe’s sixth-generation fighter efforts

Saudi Arabia has been eyeing the GCAP program for most of 2023, including an unusual moment in March where a Saudi statement said the Kingdom was joining the program only for the UK to walk that back. One British official in September said he believes the Saudis “will be part of GCAP in due course.”

That official added, “I think, from a UK point of view, the expectation, and the hope is that, that’s the direction that we will go in,” before stressing there is some time to go before it gets there and stating the UK is hopeful more Eurofighter Typhoons can be sold to strengthen that relationship.

However, Japan has reportedly opposed adding KSA to the program, and any new member would require agreement from all three of London, Tokyo and Rome.

Localization Efforts

More broadly, GAMI, which is the contracting authority for the Saudi MOD, is looking to advance across all areas of defense, including its naval domain. Al-Ohali said that a new government-owned company called Sofon has been stood up in order to be the “champion for the Navy and marine industry in Saudi Arabia.”

He added that Sofon has a “huge” shipbuilding facility on the Kingdom’s east coast. “We are working very closely with them, guiding them and …. [supporting their work with] international companies, reputable international companies in the navy sector,” he said.

That seemingly includes Italian shipbuilder Fincantieri, whose CEO told Breaking Defense earlier this week that they are in discussions on a deal with Sofon.

Saudi Arabia, historically one of the largest defense importers worldwide, is concentrating heavily on the Kingdom’s Vision 2030, which has a set goal of localizing 50 percent of all defense spending by 2030.

Al-Ohali said that the percentage rose from 3 percent in 2016 to 13.7 percent by the end of 2022. He added that GAMI will announce in April the 2023 percentage totals, as they are waiting for the closing of financials of the defense industry in Saudi Arabia.

“I am really confident that by 2030 we will reach 50 percent, [even] more than 50 percent,” he said.

In October of last year, GAMI launched an “Invest in Saudi Arabia” section on its official website, with the goal of pointing international firms to areas of opportunity. The authority identified “more than 70 opportunities in the supply chain,” he said, worth up to $64 billion over the next decade.

“So if we localize only 50 percent of this, we are talking about [$32 billion] of opportunity investment over the next 10 years. And we already started looking into those investments. We pick the top 80 percent value and we have opened [to] all investors the [electronic] portal of GAMI and portal of MISA [ministry of investment of Saudi Arabia], for those who are interested, [to know] where they can start, looking into doing a full due diligence and feasibility study,” Al-Ohali said.

He added that the targeted firms are both national and international firms.

Discussion about this post