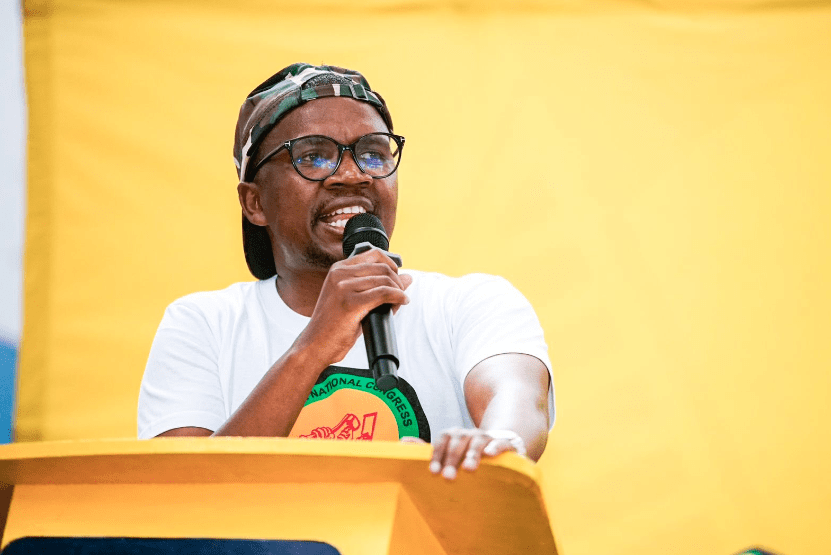

Millions of South Africans are ‘payday millionaires’ which has led to a growing debt problem in the country, says John Manyike, head of financial education at Old Mutual.

“When that payday cheque hits the bank, it’s time for a celebration. For many of us, this means heading for the closest restaurant, spending the money while the going is good, and there is enough money for the luxuries we enjoy,” he said.

“The problem is that we do this while knowing that within a week or so, we are going to be struggling, trying to fill the enormous money sinkhole that is standing between us, our next payday and renewed millionaire status.”

Manyike said the only way to address this issue and avoid falling further into debt is to make hard decisions around cost-cutting.

Some of these ‘survival actions’ could include:

- Selling that dream car, you couldn’t afford anyway, settling the outstanding balance and freeing up some cash. Remember, too, that no vehicle also means no more large insurance premiums, no more buying fuel and dreading the thought of what the next car service is going to cost.

- Realising that those after-work drinks, the steak dinners and fancy whiskies are a thing of the past. Forget being a payday millionaire and start the month as you would normally finish it. Counting the cents and spending cautiously from the beginning will have immediate benefits. The debt sinkhole will get smaller and the days easier to cope with.

- While you are about it, taking a lunchbox and your own refreshments to work will help. You can always tell your colleagues that it’s all part of your new fitness plan.

- Downgrading your property or renting it out. It’s much better to let your bank help you sell off a house you can’t afford than wait for the property to be repossessed. Get what you can out of the sale and move to a cheaper area. The ego may take a hit, but extra money in your pocket will make up for it.

- If you rent, downgrading is even easier. Speak to the landlord and explain your money position and that you want to break the lease agreement. This is better than leaving things and facing the stress of legal action because you are in arrears. Your landlord, who will end up paying these costs, will probably be quite understanding. You can also explore renting your property out to use your rental income to pay your bond.

- Making sacrifices for your children is what parents do. But when the family’s survival is at stake, perhaps it’s time to be realistic about what that private school is costing you and seek alternatives.

- Reducing costs by doing the housework yourself and buying cheaper brands. To help the process, ask yourself if you need something before you buy it.

- Defeating those clothing and grooming addictions that make you feel good, but whose costs are adding to your sleepless nights. Achieve this by shutting down those unnecessary accounts.

“Basically, stopping the flood from the wide-open debt tap means wading through the debt and turning off the tap. Only then can the mopping up truly begin,” said Manyike.

“It is also important to realise that once the hard work is underway and recovery is on the horizon, the best way to stop repeating costly mistakes is to empower yourself, assume responsibility for your decisions and equip yourself with the financial education needed to create positive futures for you and your family. Live a life of investment and not a life of consumption.”

Read: How Russia’s war in Ukraine is pushing up prices in South Africa

Discussion about this post