Don’t miss CoinDesk’s Consensus 2022, the must-attend crypto & blockchain festival experience of the year in Austin, TX this June 9-12.

The epic collapse (and now bankruptcy case) of the once-mighty crypto hedge fund Three Arrows Capital has roiled the digital-asset industry and contributed to a record first-half tumble in bitcoin’s price.

Yet for investors and enforcers following the money trail, the arrows point to an obscure legal entity that has so far mostly remained out of the headlines – while still aggressively trading – and possibly shielding some assets from recovery.

While Three Arrows Capital used its tens of billions of dollars of assets under management to invest in new projects and take large market positions, it also operated an over-the-counter trading desk called Tai Ping Shan (TPS) Capital. The entity was once described on LinkedIn as “the official OTC desk of Three Arrows Capital,” according to a scraped version of the site by Google, but the language has since been changed, distancing the two firms.

TPS Capital continues to make trades, according to sources in the digital asset industry in Asia, even as its parent company faces liquidation in the British Virgin Islands and an investigation in Singapore.

For those seeking restitution from Three Arrows Capital via a lawsuit, the legal separation may complicate efforts to obtain a payout. Named after Tai Ping Shan mountain on the island of Hong Kong, TPS Capital is registered in Singapore but domiciled in the British Virgin Islands. The parent company is now facing a lawsuit, but according to corporate filings, TPS Capital has a different ownership structure and hidden directors.

According to registration documents filed in Singapore, TPS Capital’s ownership is split between a BVI-registered firm called Three Lucky Charms Ltd, BVI-registered TPS Research and Cayman Islands-registered Tai Ping Shan Ltd.

While BVI law holds that the directors of a company aren’t public information, the name Three Lucky Charms rings like Three Arrows Capital, whose three principals are Su Zhu, Kyle Davies and a third individual whose identity isn’t clear.

TPS Research, which owns 47.5% of TPS Capital’s Singapore entity, also keeps its directors hidden from the public as allowed under BVI law.

Caymans-registered Tai Ping Shan, which owns 5% of the Singapore entity TPS Capital, lists Paul Muspratt, the managing director of West Bay Global Services, a corporate services provider, as one of its directors, alongside Steven Sokohl, another West Bay employee, and Yi Long Fung.

Yi doesn’t have much of a presence online. He is listed as a director of TPS Capital’s Canadian-registered entity, which operates by the same name, founded in February 2022, and provides an address in the Toronto suburb of Thornhill.

Where’s Three Arrows’ money?

For a fund that was touted to be managing billions of dollars, Three Arrows’ filings with the Singaporean government show a paltry income that would suggest management of a significantly smaller amount.

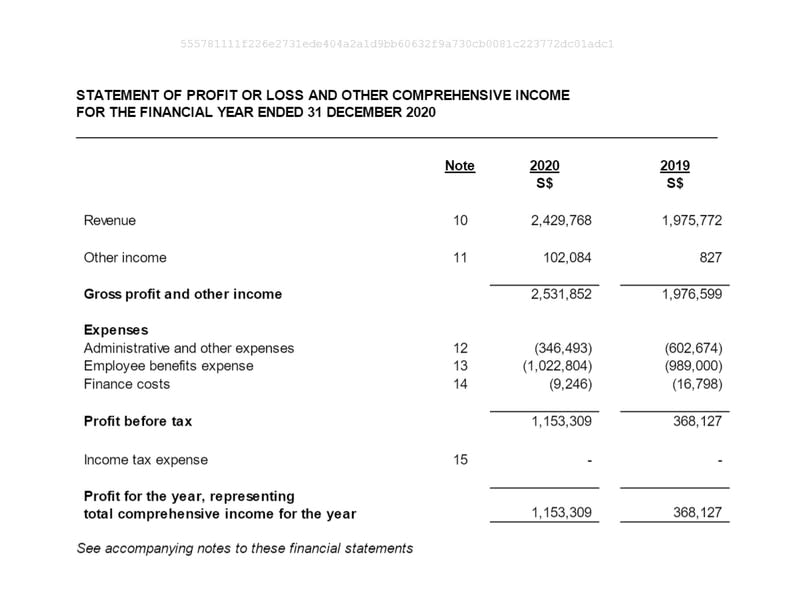

According to a return filed for the 2020 fiscal year-end, Three Arrows Singapore reported it had S$3.3 million ($2.36 million) in total assets, and claimed a S$1.15 million ($823,015) profit for the year. Some S$6.33 million was paid out in dividends to Zhu and Davies.

Three Arrows’ 2021 year-end filing is not available.

Three Arrows’ Singapore and Three Arrows’ BVI units split the purchase of Three Arrows’ December 2020 position in Grayscale Bitcoin Trust (GBTC), according to Securities and Exchange Commission (SEC) filings. The Singapore entity was licensed to manage S$250 million ($179 million), according to the Monetary Authority of Singapore.

A Singapore-based person involved in the institutional digital assets industry who spoke to CoinDesk on the condition of anonymity said TPS held and traded most of Three Arrows’ treasury. Another person, in a similar position at an Asia-based institutional crypto firm, also speaking with CoinDesk on a condition of anonymity, said that TPS is “where the action was” for Three Arrows.

Singapore’s authorities are not impressed

Earlier this week the Monetary Authority of Singapore censured Three Arrows for misreporting information about the size of its holdings and issued a reprimand.

“The reprimand relates to contraventions by [Three Arrows Capital] which occurred prior to its notification to MAS in April 2022. MAS has been investigating these contraventions since June 2021,” MAS wrote. Three Arrows provided “misleading” information, according to the regulator.

MAS also wrote: “In light of recent developments which call into question the solvency of the fund managed by [Three Arrows Capital], MAS is assessing if there were further breaches.”

But while Three Arrows has filed for bankruptcy in New York (it’s yet to declare bankruptcy in Singapore as of July 2), TPS continues to use capital to trade, the people with information said.

The question is, can regulators or plaintiffs in the suit pierce the corporate veil between the two firms?

LinkedIn Changed

Descriptions of TPS Capital on LinkedIn appear to have been changed to eliminate an apparent connection to Three Arrows Capital.

Here’s what it looked like before:

And here’s what it looks like now:

Discussion about this post