Dividend stocks are shares in companies that reward investors with regular payouts. These payouts can supplement investors’ income, cover living expenses, or reinvest in their stock portfolio.

Some factors set certain dividend stocks apart from others, such as dividend history, growth, yield, and payout ratio. Additionally, companies that continue to grow earnings and boast competitive advantages can continuously pay higher dividends to shareholders.

In this article, we will explore three income stock investments for May 2024 with dividends that we consider to be safe, including Realty Income Corporation (O), Verizon (VZ), and UGI Corporation (UGI).

Affiliate

The Sure Dividend Newsletter for high-quality dividend growth stocks.

- The monthly newsletter includes stock analyses, portfolio ideas, dividend risk scores, real money portfolio, etc.

- Risk free 7-day free trial and $41 off only through Dividend Power for $158 per year.

- Sure Dividend Coupon Code – DP41S

Click here to try the Sure Dividend Newsletter (7-day free trial).

Three Income Stocks with Safe Dividends

Realty Income Corporation

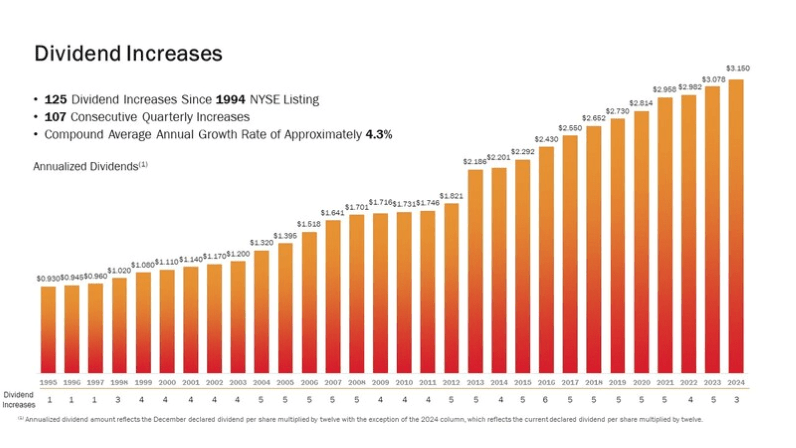

Realty Income Corporation (O) is a real estate investment trust (REIT) that owns 15,450 properties across 89 industries. Its properties are leased to more than 1,500 clients in all 50 U.S. states, the U.K., and six other European countries. The company went public in 1994 and has since increased its dividend 125 times.

Realty Income has increased its dividend for 26 consecutive years, with multiple raises in most years, making it a Dividend Aristocrat. On May 20th, 2024, the company raised its dividend again by 2.1%. The new annual dividend amounts to $3.15 per share. Furthermore, Realty Income pays its dividend monthly, enabling investors to compound their wealth slightly faster or regularly cover living expenses.

With a current share price of $52, Realty Income has a high dividend yield of 6.0%. This yield is 25% above its 5-year average of 4.6%, which indicates that shares are undervalued here.

Realty Income is projected to generate adjusted funds from operations of $4.17 per share for fiscal year 2024. And with the $3.15 dividend payment, the company is expected to pay out 76% of its earnings. This is a reasonable and safe payout ratio for a real estate investment trust, which typically pays out most of its earnings. Due to this reliable payout ratio, Realty Income should have many more years of dividend growth ahead of it. On top of the 4.4% AFFO growth rate expected for FY 2024, the company is forecasted to grow AFFO by 3.4% in FY 2025.

Based on Realty Income’s current stock price and AFFO forecast, the company trades at a forward P/AFFO ratio of 12.5X. This valuation is just a 3% discount to its fair value P/AFFO ratio of 12.9.

Related Articles About Realty Income on Dividend Power

Verizon Communications

Verizon Communications Inc. (VZ) is a telecommunications company that provides wireless and wireline communications services and products. It operates as two business units: Verizon Consumer Group and Verizon Business Group. It is our second income stock with a safe dividend.

Verizon is a Dividend Contender with a 20-year dividend growth streak. It last raised its dividend on September 7th, 2023, from $0.6525 to $0.665 quarterly.

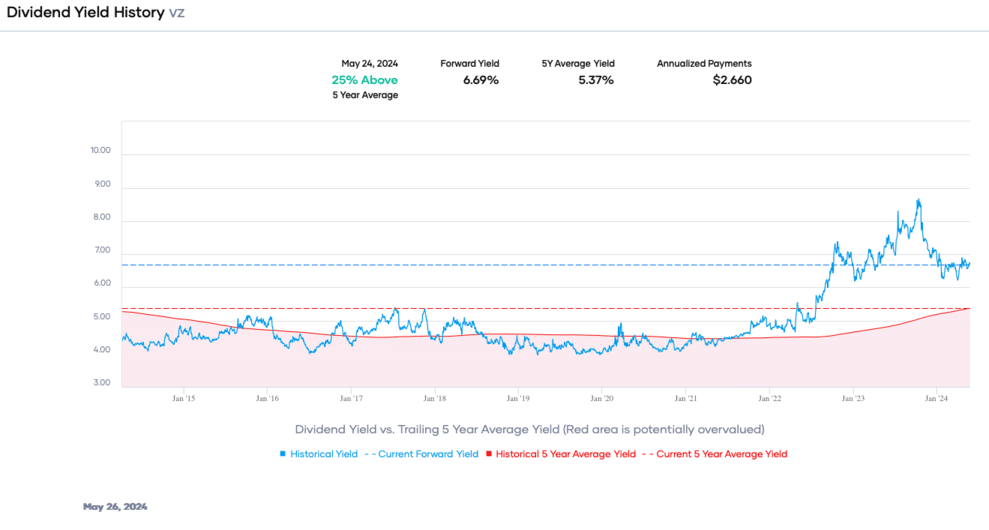

The current share price of $40 and the $2.66 annual dividend mean that Verizon is yielding 6.7%. This dividend yield is 24% higher than its 5-year average of 5.4%, meaning that shares are undervalued on this measure.

Analysts forecast that Verizon will earn $4.58 in 2024, and with an annual dividend payment of $2.66, it is only expected to pay out 58% of its earnings. Given the utility-like stability of its telecom revenues, we see Verizon growing its dividend for years to come. However, the company is constantly making significant investments in its network, which burdens its near-term growth and profitability. While we expect EPS to decline by 2.8% for FY 2024, it is forecasted to grow by 2.3% in FY 2025.

The company is trading at a forward P/E ratio of 8.7X, considering Verizon’s present share price and EPS projections. This valuation is a 13% discount to its 5-year average valuation of 10.0X, so Verizon shares seem attractively priced.

Related Articles About Verizon on Dividend Power

UGI Corporation

UGI Corporation (UGI) distributes energy products and services in the U.S. and Europe. It provides natural gas transmission and distribution, electric generation and distribution, midstream services, propane distribution, and renewable natural gas generation and distribution. The company has more than 2.6 million customers and over 10,000 employees. It has paid a dividend for 139 years, making it UGI one of the longest dividend paying companies in America.

UGI Corp is a Dividend Champion, having increased its dividend for 36 consecutive years. On May 3rd, 2023, it last raised its dividend to $0.375 from $0.36 quarterly. However, this streak is at risk because of changes to the capital allocation strategy.

Based on its share price of $25, UGI Corporation has a 6.1% dividend yield. This is 51% above its 5-year average yield of 4.0% so that new investors will benefit from a much higher starting payout.

UGI is forecasted to earn $2.88 in 2024. Along with its annual dividend of $1.50, the company has a safe payout ratio of just 52%. Given that the company provides a necessity to its clients, its dividends will likely continue increasing. However, leadership has mentioned that the dividend will remain flat from FY 2024 to 2026 to clean up the balance sheet and pick back up at a 4% growth rate in FY 2027 and beyond. We would prefer to see a small token increase to at least maintain its dividend growth streak, so this is a negative. Furthermore, EPS is expected to grow by 4.1% in FY 2025 and 0.6% in FY 2026, off this year’s forecast.

Based on UGI Corporation’s present share price and EPS forecast, the company is trading at a forward P/E ratio of 8.7X. This valuation is a significant 34% discount to its 5-year average valuation of 13.2X, so shares of UGI Corporation appear to be on sale.

Related Articles About UGI Corporation on Dividend Power

Final Thoughts

Income stocks can be essential to an investor’s portfolio, especially those prioritizing regular, reliable income. Like the companies featured in this article, income stocks with safe dividends are generally well-established businesses with a long history of generating consistent earnings. However, it is essential to perform rigorous due diligence to assess the safety of dividend stocks before purchasing.

Disclosure: The author is long O and VZ. This is not investment advice.

Related Articles on Dividend Power

Here are my recommendations:

Affiliates

- Simply Investing Report & Analysis Platform or the Course can teach you how to invest in stocks. Try it free for 14 days.

- Sure Dividend Newsletter is an excellent resource for DIY dividend growth investors and retirees. Try it free for 7 days.

- Stock Rover is the leading investment research platform with all the fundamental metrics, screens, and analysis tools you need. Try it free for 14 days.

- Portfolio Insight is the newest and most complete portfolio management tool with built-in stock screeners. Try it free for 14 days.

Receive a free e-book, “Become a Better Investor: 5 Fundamental Metrics to Know!” Join thousands of other readers !

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Quinn Mohammed

Quinn Mohammed has nine years of experience as a financial researcher, writer, and editor. His background is in software development, which has taught him the importance of paying close attention to even the smallest details. Quinn is a Sure Dividend analyst and also writes snapshots for Portfolio Insight. He focuses on dividend growth investing and passive income.

Discussion about this post