Agenda for the Morningstar Investment Conference Announced

Adapt, innovate, and stay ahead with our packed lineup at the Morningstar Investment Conference. Get cutting-edge research, hear from expert speakers, and network with thousands of peers by registering today. |

An unusual thing happened in the markets a couple of weeks ago. The S&P 500 was right near the highs, and yet people were getting really nervous. Investors are so on edge that there were more bears two weeks ago than during the COVID-free fall, when stocks were gapping down every day.

People are feeling especially emotional because of the political landscape. For non-Trump voters, their greatest fears are coming to fruition. “Oh my god. I knew it. He’s going to crash the market. Why didn’t I sell!?!?!

For Trump supporters, there’s a feeling of, “Wait. I thought we were getting deregulation, lower inflation, and a pro-growth agenda. This is not what I was expecting!”

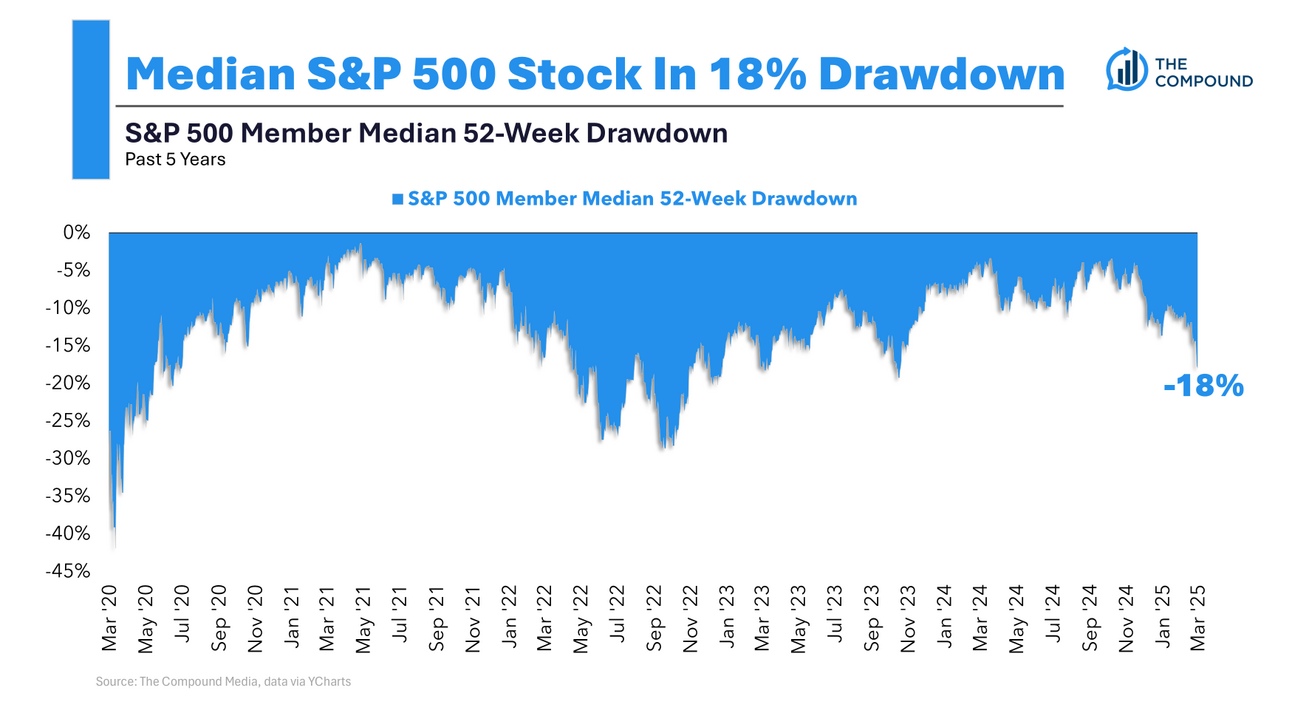

Nobody likes it when their portfolio goes down, but it’s easier to stomach when it’s coming from inside the market. A self-inflicted wound with no end in sight has people on edge. And I get it. The market just took a beating. According to Callie Cox, the S&P 500 just experienced the fifth-fastest 10% decline since 1950. And for the median stock, it’s even worse. If you own individual stocks, there’s a good chance it’s already 20% off its high, or worse.

I have no idea if this is an overreaction or not. I’m not smarter than the market. But, if you’re on edge and thinking about doing something extreme with your portfolio, I’m telling you in no uncertain terms, do not. If you wanna reduce risk because you can’t sleep, well then fine. No offense, but if you’re that worried now, clearly you were taking too much risk, and are at risk of panicking if stocks take another leg down. But if you’re thinking about going to cash, like sell everything, out of fear that it’s going to get much worse, that’s not going to go well. I promise you.

Let’s play this out. You’re right, and the market goes lower. Be honest, are you really going to get back in? Or, are you going to tell yourself you’ll get back in when the dust settles? If that’s where your head is at, I’ve got some bad news for you. By the time it feels safe to get back in, the market will already have rallied, and you’ll feel like you missed it.

We’re near a bottom. You sell. You don’t buy back higher.

That’s how it goes. Selling is easy. Getting back in is impossible.

I’m not minimizing the pain or the fear, or saying that it’s going to get better tomorrow, but we will get through this. I don’t know if it takes a month, a year, or more, but eventually, the tariff/growth scare will have been nothing more than another reason to sell.

Okay, everything I just said is clean, sound, and old reliable things bloggers say during a stock market selloff. Keep calm, stay the course, etc. The truth is, I’m not that nervous. I acknowledge the risks, I know it can get worse, but I don’t think this is what ends the secular bull market. The Fed tried to bring the economy down, and they couldn’t. I don’t think tariffs are going to succeed where Powell failed.

This is an oversimplification, but I don’t feel like writing 7,000 words.

It’s never too late to get your financial affairs in order. If this selloff is the nudge you need to speak to an advisor, Ritholtz Wealth Management has CFPs all over the country standing by. We’d love to hear from you.

Discussion about this post