To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Get tips and answers to FAQs about Google Business Profiles and Google Reviews for financial advisors who join the Wealthtender community.

Given the prominent role of online search in the everyday lives of Americans, it’s important to establish your presence on Google since they control a majority of searches conducted online. Fortunately, setting up a Google Business Profile is an easy and free way to improve your firm’s visibility in search results.

Of course, financial advisors must consider regulatory restrictions prescribed by the Securities and Exchange Commission, FINRA, and state regulators, in order to compliantly maintain their firm’s Google Business Profile. Unfortunately, one of the most popular features of Google Business Profiles, Google Reviews, opens the door to considerable risk that could land advisors in regulatory hot water.

The Problem with Google Reviews

Google Reviews are popular and well-known among consumers. Financial advisors may already have unsolicited reviews written about them visible on their Google Business Profile. Assuming these are favorable reviews and unsolicited, that’s terrific, as advisors are gaining SEO (Search Engine Optimization) benefits and visibility among consumers visiting these sites.

However, because reviews on Google lack the required SEC disclosures to be considered advertisements (e.g., testimonials and endorsements advisors can promote to grow their business), advisors can’t direct prospects to check out their reviews on Google. Doing so opens the door to “entanglement” and/or “adoption”, terms defined by the Securities and Exchange Commission that trigger additional oversight and disclosure requirements.

↗️ Related Article: Kitces Podcast Sparks Debate on Google Reviews

This is one of the many reasons we launched Wealthtender as the industry’s first SEC-compliant online reviews platform, and designed Certified Advisor Reviews™ for compliance with the SEC Marketing Rule.

In this article, we specifically discuss ways financial advisors who join Wealthtender can turn their Google Reviews into compliant testimonials and strengthen their SEO in the process.

Importing Reviews from Google to Wealthtender

Wealthtender offers a tool that is popular with advisors in our community to import reviews from Google to Wealthtender. When reviews are imported to Wealthtender from Google, they go through the same compliance process as all other reviews, so disclosures can be added to satisfy requirements prescribed in the SEC Marketing Rule. By ensuring the required disclosures are prominently displayed with each review, advisors can compliantly promote reviews on their Wealthtender profile page.

Importing Google Reviews to Wealthtender also strengthens SEO for advisors. Once advisors have collected around 3 or 4 reviews on their Wealthtender profile, Google starts to display the gold stars earned by the advisor in search results. For example, in this Google search for advisor Emily Rassam, Google prominently features Emily’s Wealthtender profile with accompanying gold stars, sending positive signals to Google’s algorithm to help her rank higher in search results. These gold stars also attract the eyes of consumers who are more likely to set up an initial appointment with advisors like Emily, who have reviews, vs. those they may get referred to who don’t.

Another benefit of importing Google Reviews to Wealthtender is that consumers are often searching for advisors by their name, and not searching for the name of their business. Since Google Reviews are displayed within Google Business Profiles that generally only appear in search results when consumers search the name of a business, these reviews are often not seen by prospective clients. By importing Google Reviews to an advisor’s profile page on Wealthtender, the gold stars earned by the advisor will appear in search results when consumers search for the advisor by their name.

Learn how United Financial Planning Group grows its business with a testimonial marketing strategy powered by Wealthtender.

Exporting Reviews from Wealthtender to Google

On the flip side, Google doesn’t allow anyone to push reviews from third-party platforms into the Google Reviews platform (“Google Business Profiles”). Even if this were a possibility, doing so risks advisors landing in regulatory hot water, given the shortcomings of the Google platform that lacks the ‘clear and prominent’ disclosures required by the SEC. (This is one of the reasons why we launched Wealthtender. Most compliance officers never plan to permit advisors to request reviews on Google, unless Google updates their platform to accommodate SEC Marketing Rule requirements).

Accordingly, best practices for advisors to compliantly maximize the potential of their online reviews include:

- Collecting reviews on Wealthtender (to stand out with the ~500,000 consumers who visit wealthtender.com each year)

- Importing unsolicited reviews received on Google to Wealthtender so they become compliant testimonials (watch how-to video)

- Getting Wealthtender reviews indexed by search engines for SEO benefits (occurs automatically)

- Using widgets from Wealthtender to display reviews compliantly on advisor websites (learn how and view examples)

- Creating SEC-compliant social media posts using templates we offer (e.g., this LinkedIn post by an advisor)

- Incorporating client testimonials into advisor marketing funnel activities (read the UFPG case study)

The Twist: “Reviews from Around the Web” in Google Business Profiles

Of course, anything this complicated wouldn’t be as fun or interesting without a little twist.

Google knows that consumers benefit from reading online reviews about businesses, including online review platforms other than Google Reviews. And Google recognizes Wealthtender as a reputable online review platform for financial advisors. This is why gold stars appear in Google search results when advisors earn reviews displayed on their Wealthtender profile page. Sometimes, but not always, Google will also link to Wealthtender reviews within an advisory firm’s Google Business Profile.

Advisory firms that join Wealthtender with multiple advisors have profile pages on Wealthtender for their advisors and a firm profile page. When advisory firms collect reviews on their firm profile, these reviews get indexed in Google search results, just as individual advisor profile pages do. Sometimes, in addition, the reviews will appear in a section of the advisory firm’s Google Business Profile called “Reviews from the web.”

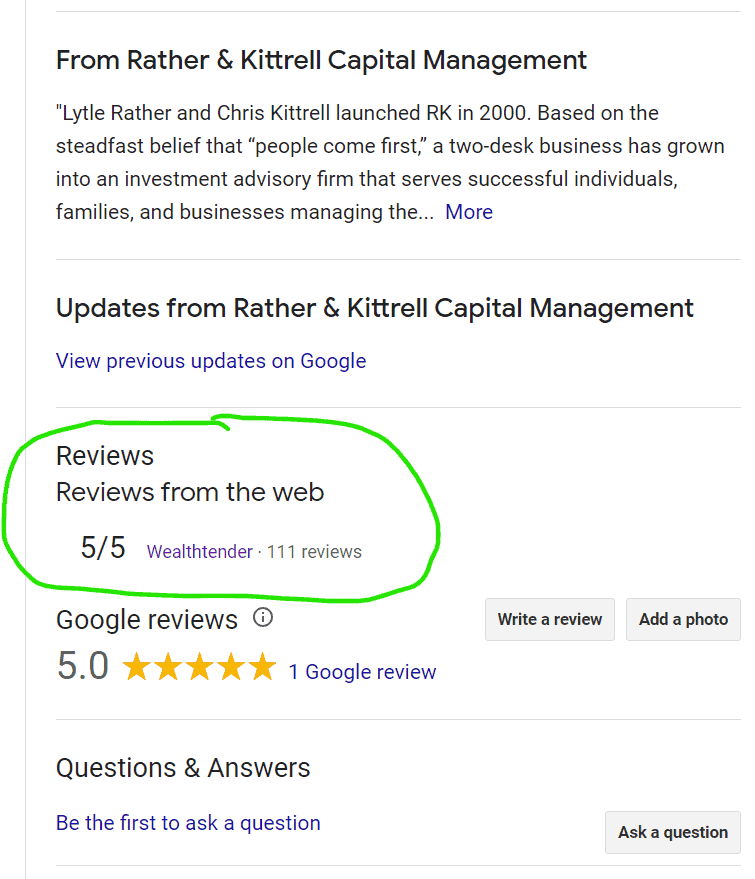

For example, at the time of this writing, you can search Google for “Rather & Kittrell” and see a section of their Google Business Profile that shows they have more than 100 reviews on Wealthtender with a link to their firm’s profile page on Wealthtender.

While we love sharing this example, it is the exception, not the norm. We often do not see a “Reviews from the web” section appear in Google Business Profiles, and we haven’t figured out the secret sauce for this section to appear on a consistent basis. As they say, “Google is going to do what Google wants to do”, so all we can do is follow their guidance to improve the odds of appearing prominently across their platform, but ultimately, we simply don’t have control to know when or why they will link to Wealthtender reviews.

Of course, we know that the reviews on an advisory firm’s Wealthtender profile do get indexed by Google and consistently appear within search results, they simply don’t often appear within this section of the Google Business Profile itself.

Note for Solo Advisors: Wealthtender offers an add-on benefit for solo advisors interested in the SEO benefits of an advisory firm profile that costs $10/month (or $100/year for annual subscriptions). Solo advisors can then utilize our Review Sync feature to automatically collect and display reviews on both their individual advisor and advisory firm profiles. The primary benefit of this add-on is gaining the visibility of indexing reviews to also appear in search results for the advisory firm, but as explained above, we can’t promise or expect that reviews will appear within the firm’s Google Business Profile itself.

A Creative and Compliant Way to Add Reviews to Google Business Profiles

We’re always thinking of ways to get creative (while remaining compliant, of course!). And there is one approach advisors can consider to compliantly make their testimonials accessible through their Google Business Profiles.

Specifically, the approach is analogous to creating a compliant social media post, like this example we shared earlier posted to LinkedIn. But instead of posting the graphic to LinkedIn, the graphic with the testimonial and required disclosures can be added as a “photo” to an advisor’s Google Business Profile. Of course, the typical photos added to Google Business Profiles are of a business storefront, pictures of staff, etc., but adding images featuring testimonials should work fine as well.

Next Steps

At Wealthtender, we’re dedicated to helping you get found online and convert more prospects into clients. Beyond our industry-first Certified Advisor Reviews™ designed for compliance with the SEC Marketing Rule, financial advisors and wealth management firms that join Wealthtender gain recognition for their areas of specialization and SEO benefits to rank higher in Google search results.

Whether you’re already part of our growing community of financial advisors and wealth management firms who have chosen Wealthtender as their digital marketing partner, or you prefer to grow on your own, we hope the information in this article helps you feel more confident about your approach to compliant testimonial marketing.

If you have questions this article did not answer, please email yourfriends@wealthtender.com or schedule a Zoom call. We look forward to hearing from you.

To learn more about Wealthtender and get started, please visit this page and choose the plan best for you.

About the Author

Brian Thorp

Brian is CEO and founder of Wealthtender and Editor-in-Chief. He and his wife live in Austin, Texas. With over 25 years in the financial services industry, Brian is applying his experience and passion at Wealthtender to help more people enjoy life with less money stress. Learn More about Brian

Discussion about this post