A global shortage means imported olive oil is more costly than it’s been since the late 90s. Can local producers compete on price now?

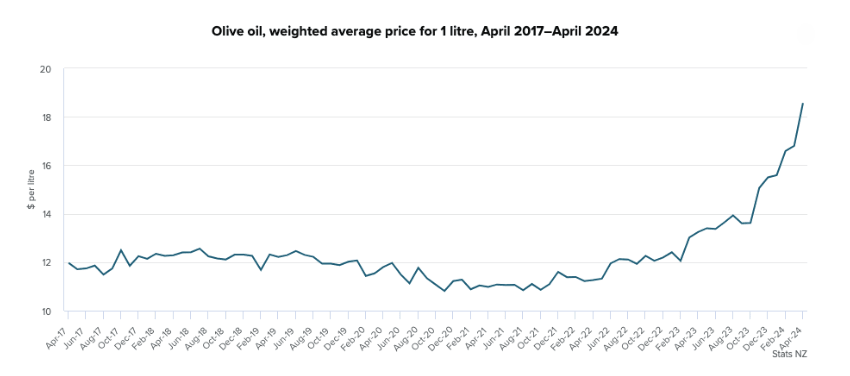

The past couple of years have seen olive oil prices spiking higher than a Mariah Carey top note. Heat waves and drought in the Mediterranean, particularly in Spain – the country responsible for producing 40% of the world’s olives – caused global olive oil prices to shoot up to levels not seen since the last peak in 1997.

A litre of Woolworths home-brand extra virgin olive oil (EVOO is the good stuff, FYI), made from 100% Spanish olives, now costs $18.70, compared to $12ish at the start of last year. It’s enough to have the tight-fisted among us crying hot tears into our stingily dressed salad.

But what about the olive oil we produce locally? Can New Zealand producers of EVOO come to the rescue, restoring the ability of consumers to take home a bottle at a price that won’t make your eyes water?

Since prices started skyrocketing midway through last year, New Zealand producers have seen a “huge increase” in demand for locally grown olive oil, according to Emma Glover, the executive officer of Olives New Zealand. “Next weekend, we’ve got our New Zealand olive oil awards, and a lot of the growers are going ‘Well actually, I’ve just about sold out of my oil already,’” Glover says. “We can’t keep up with demand at this point.”

Many oils from New Zealand’s largest olive oil producer, Hawke’s Bay-based The Village Press, have been out of stock at supermarkets and online for months, but its website says new season oils are back in stock from early October.

Despite high demand for olive oil produced locally, New Zealand producers have a small share of the market here. “We produce less than 10% of the extra virgin olive oil that is consumed in New Zealand,” Glover continues, adding that this figure has been stable over time. “We’re pretty boutique, small producers.”

What are the barriers preventing New Zealand producers from competing on price with imported oil? Chief among them is scale, says Ross Vintiner, who owns a medium-sized grove in Martinborough, producing Dali olive oil. “The problem with New Zealand is you’ve got a lot of small producers and very few large producers, and so you don’t get the economies of scale.” Large numbers of small growers face “very high costs around pruning and harvesting, and then they’ve got all the other compliance costs, like Food Safety”.

There’s also competition from our familiar rival, the Aussies. Australians produce “very high-quality olive oil at scale”, Vintiner continues. “There are some growers in Australia who have millions of trees … and their whole operation is mechanical. So their unit costs per litre of olive oil are way below what we could produce.” As a result, Aussie olive oil is increasingly elbowing out European oil (let alone local stuff) on supermarket shelves.

On top of this, workers are in short supply, and it’s hard to keep landowners interested in growing olives. Glover says higher and more immediate profits for crops like wine grapes and apples mean “some of our bigger groves in the last few years have been converted”.

So the chances of local producers being able to compete on price are low, even with the cost of European oils high by historical standards. But supermarket shoppers looking for rock bottom EVOO prices have never been the target market for local producers, and likely never will be; instead, they target the farmers-markets-and-Farro segment.

Which leaves consumers with a couple of choices. One is to shell out more for local olive oil, which even if it can’t compete on price, is fresher than imported stuff and among the highest quality globally (Vintiner’s Dali oil has twice won the New York international olive oil competition – what he calls the Olympics of olive oil.)

The other option, for the less discerning and/or flush consumer, is to switch to rice bran or sunflower oil while they wait for the price of imported olive oil to drop. “The good news for Spain is that this year they’ve had a good harvest,” Vintiner says. “So all predictions, by the futures market and everyone else, is that the price of extra virgin olive oil will actually drop.”

By Glover’s guess, that’ll be around the end of this summer in Aotearoa. “Theoretically we should … start seeing the oil coming through around February,” Glover says, but in the meantime, not much can be done about the high prices. “It is what it is for this year.”

Discussion about this post