The IRA provides a 30% Investment Tax Credit (ITC) for solar installations, with an additional 10% bonus credit for systems incorporating 40% or more domestic content. Domestic content refers to products and product components manufactured in the U.S.A.

(Colorado Springs, Colorado – August 26, 2024) S-5!, a global leader in solar attachment solutions for metal roofs, proudly announces that after nearly 35 years of manufacturing in the U.S., its products can now contribute up to 37% towards the federal requirement for the domestic content percentage to obtain the bonus tax credit under the Inflation Reduction Act (IRA).

The IRA provides a 30% Investment Tax Credit (ITC) for solar installations, with an additional 10% bonus credit for systems incorporating 40% or more domestic content. Domestic content refers to products and product components manufactured in the U.S.A.

In May 2024, the IRS and Treasury issued Notice 2024-41, building upon last year’s guidelines for the domestic content bonus credit. This Notice introduces a New Elective Safe Harbor provision designed to simplify the process for qualifying clean energy projects for the domestic content bonus. It does this by providing for the classification of identified system products and components and assigning applicable cost percentages.

Utilizing this New Elective Safe Harbor method to determine the assigned domestic content of its products, S-5!’s clamps, brackets and PVKIT solar mounting solution can contribute a significant percentage, helping solar projects meet domestic content requirements and making it easier for customers to achieve the 40% threshold necessary to attain the bonus credit.

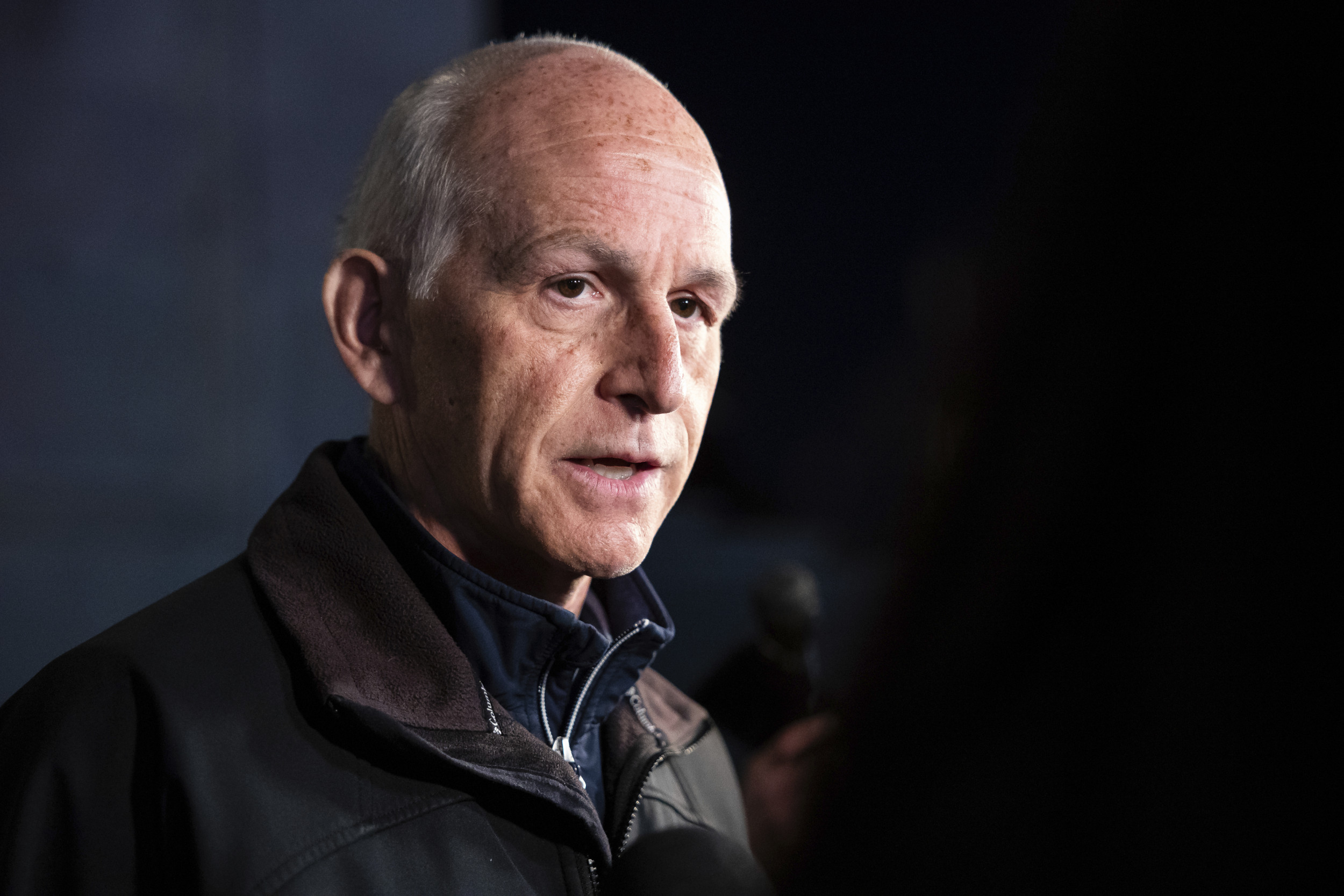

“S-5! is excited to be at the forefront of the made-in-the-U.S.A. movement as we have always understood the importance of manufacturing right here in our backyard,” said Rob Haddock, CEO and founder of S-5! “Our manufacturing has produced domestically made products and components since our inception in 1992. With these new clarifications from the Internal Revenue Service, our products are now aligned with their Table 1 chart, which quantifies the percentages of qualifying domestic products within the entire PV system. This alignment highlights the role of S-5! products in meeting these criteria. The numbers are compelling.”

The IRA incentives aim to bolster domestic manufacturing across the solar production supply chain, potentially offsetting price increases, reducing shipping and import costs, and boosting support for solar photovoltaics (PV) and other renewables in the United States

“Our long-standing commitment to domestic manufacturing can help our customers qualify for the domestic content bonus credit, which may result in significant savings on their solar projects, a quicker return on investment and a higher resulting internal rate of return,” said Haddock.

About S-5!

Founded by a veteran metal roof expert, S-5! has been the leading authority on metal roof attachment solutions since 1992. S-5!’s zero-penetration clamps and lifetime brackets attach virtually anything to most metal roof types, while maintaining roof integrity and warranties. Made in the U.S.A., S-5! solutions are engineered for a variety of roof-mounted applications and are now installed on more than 2.5 million metal roofs worldwide, including more than 7.3 gigawatts of rooftop solar, providing strength and longevity never before seen. For more information, visit www.S-5.com.

Discussion about this post